What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Investment Strategies are for two types.

Outlier Is the guy who bought Infosys/Apple/Amazon during IPO or the First few investors in Bitcoin. These are guys who did the right thing and got lucky by holding onto them forever. You cannot mimic this repeatedly. So we will stop talking about a strategy that we cannot mimic

General Common Strategies ;

Almost Every investment for faster wealth appreciation depends upon LEVERAGE!

Imagine just 30 Lakh Rupees can control an asset valued at 1 crore?

You see, at some point in our life, we are pressured by our parents, spouse, kids, or friends to stop paying rent and, use that same rent as EMI to own a home.

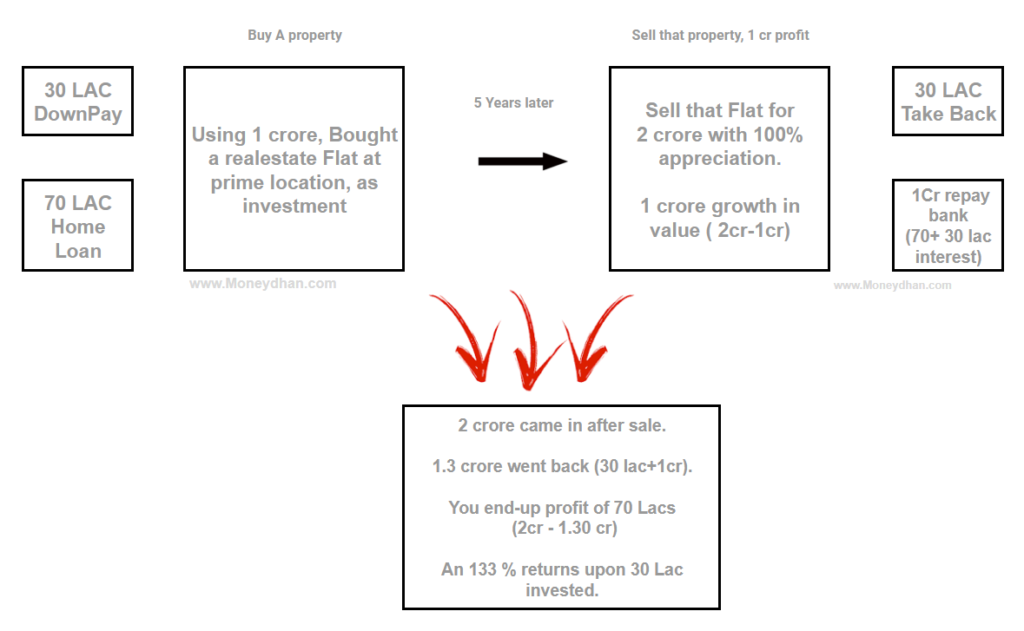

Did you ever look at buying a home using a bank loan as a form of leverage?

Probably Not. Then realize that You have volunteered to take upon leverage by taking a bank loan. By doing this action, in financial terms, You believed that your asset will out-run the interest cost paid to the bank. Let’s say, my property will earn 15–18% appreciation while I pay, just 10% interest to the bank.

And if Yes, you haven’t gone through the math behind this. That above “too much written” picture shows how a 1 crore house sold for 2 crores in 5 years can fetch you 133% using leverage. Assuming bank loan interest was at 10% upon 70 lac. (An approx math)

I guess by this we understand, how leverage is the basic ingredient for the general public to become rich -faster than the rest.

I understand that arranging 30 lac is still a great amount for many of us. No problem. Let me share it with you…

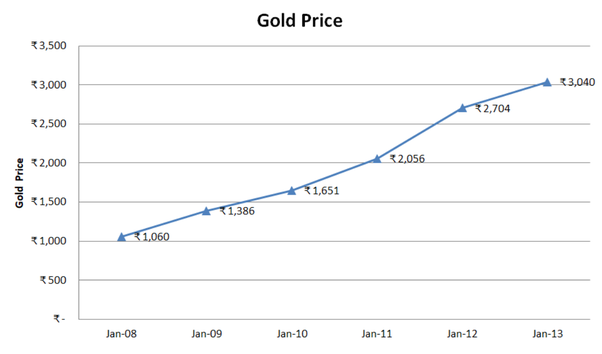

How I happen to use this leverage in my favor, during 2008 onset of Gold rally.

1 gram of gold from a value of 1000 rs shoot up to 3000 rs within 5 years(2008–2013)

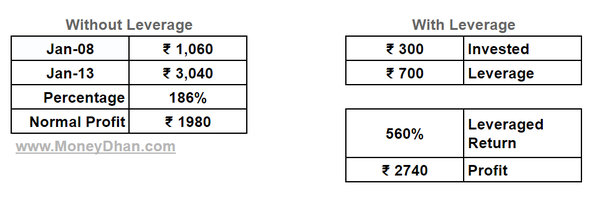

For every 1000 rs worth of gold, I kept 300 rs as a down payment. There is a product in a stock exchange known as “MCX-Gold Futures” for Indian citizens where you can buy gold at leverage.

Using this leverage,

In 5 years, My investment made 560 % returns while gold itself rallied just 186 %. (Check the chart above)

Please do keep in mind, what I bought was not 1 gram but;

1000 grams (1 kilo gold with a down payment of 3 lac per kilo).

Without Leverage. Buy 10 Lac worth gold using 10 lac rupees. Exit it after 5 years at 30 lacs value. Making a profit of 20 Lacs ( 30 minuses 10 invested)

With Leverage. Buy 10 Lac worth Gold using just 3 Lac as a downpayment margin. Exit after 5 years at 30 Lacs value. Making profit of 27 Lacs ( 30 minuses 3 lac down paid)

A pure advantage of extra 7 Lac! Thanks to the leverage

There were few kilos worth gold contracts which I kept accumulating with whatever profits i made. Leading to a snowball effect of huge wealth creation for a 22-year-old guy at that time.

The gold example using leverage is the trick that worked for me a decade back. Since then I have become smarter and been, looking for a similar approach.

How can you create Wealth next, using a similar approach?

Stocks are the answer. Large companies report their profits every 3 months. They grow consistently. Look at them as assets that appreciate reliably.

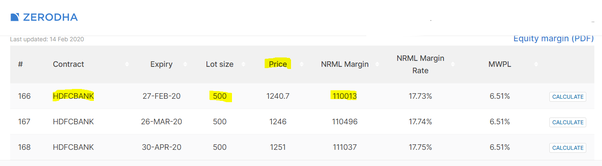

Leverage can be taken for those stocks which are available in the “futures and options segment”. To check the list of available stocks along with the needed down-payment (Known as margin) click on the below link.

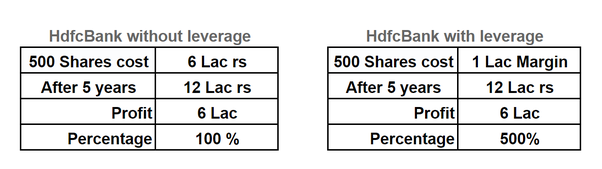

A Hdfcbank which is at 1240 per share. 500 Shares will cost 500x Rs1240 = 6,20,000 rs

Instead of this 6 lac, keep 1 lac a downpayment. Hold your asset for long term and ride the appreciation wave using leverage.

Basically you bought a 6 lac worth flat that doubles every 5 years!

Bear with me, and follow the math :-

Your 6 lac becomes 12 Lacs in 5 years. A profit of 6 lacs (12 minus 6 invested).

However, your investment was not 6 lac but just 1 lac. Which means….

Upon 1 lac invested, 6 lac profit in 5 years. (1 lac profit per year on average 100% CAGR) ; If HDFCBANK continues to double every 5 years as usual.

Sounds Excellent. What could be the other side of taking this leverage?

Well, What if HDFCBANK as a company goes bankrupt. You stand you loose 6 lac. While investment was just 1 lac. If you don’t pump further cash if HFCBANK falls, the stockbroker can sell that stocks on your behalf due to insufficient margin. You not only lose what you paid as a downpayment (1L) but more than that Max 6 lac when HDFCBANK goes to zero…

This is the Decision you need to take. Volunteering to take such leverage can speed up your wealth creation journey – provided you are right.

My gold adventure was due to my Dad’s business in the gold jewelry sector. I had a “know-how” advantage. Likewise, Some stocks like Hdfcbank mentioned here has evidence to back my claim where it doubles every 5 years. No matter when you buy.

Likewise, other stocks like Dabur, BajajFinance, Hindustan Unilever are few other assets that we buy on leverage and hold for super fast CAGR.

Conclusion investment strategy – Start Small

Pick an average small size ticket investment. Take affordable leverage. Stay committed to it for a few years. Along the way add more capital and use leverage to control more of that asset. Let the snowball effect kick in.

All the above mentioned is probably the accelerator part of the wealth creation. We haven’t spoken about, the clutch, gear, break, engine breakdown issues that need to be tackled. A financial engineer by education, I have mastered that skill and art required to minimize risk.

“When you avoid enough risk, what remains is just profit” – Charlie Munger

Am in the profession of Wealth creation as a service. Just like COD by Amazon, I believe in receiving a profit share of 10k once you (the investor) gain 1 lac in your own Demat account.

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.