Derivatives(Futures & Options) Strategy with focus on just 10% returns per annum.

This choice of product, is not available with PMS or Mutual Funds.

Provides additional cash flow.

Does not need separate cash in your demat account.

F&O can go short, Buy protection against downside , write calls etc.

This makes money, when market falls

Product aims for return of 10% or above, per year. Also, Intention is to limit DrawDown(max risk) under 10% of capital.

This is not Intra-Day trading. F&O positions are kept until expiry without churning.

Sell Deep OTM nifty call against the equity portfolio as hedge.

OR Shorting Nifty future and selling ATM Put as “covered Put” to gain in down trend. Covered Put gives limited profits with no downside risk.

An income generating strategy from OTM Put sell. Also, Writing Puts is used to to Purchase Stocks at lower levels. Deep OTM Put strikes are chosen. Detailed Explanation by Investopedia.

Hedge strategy used to earn limited profit. Safe from Blackswan event.

After determining the probability of a price “Not” coming, we go for credit writing spread.

Very well explained by Zerodha Varsity

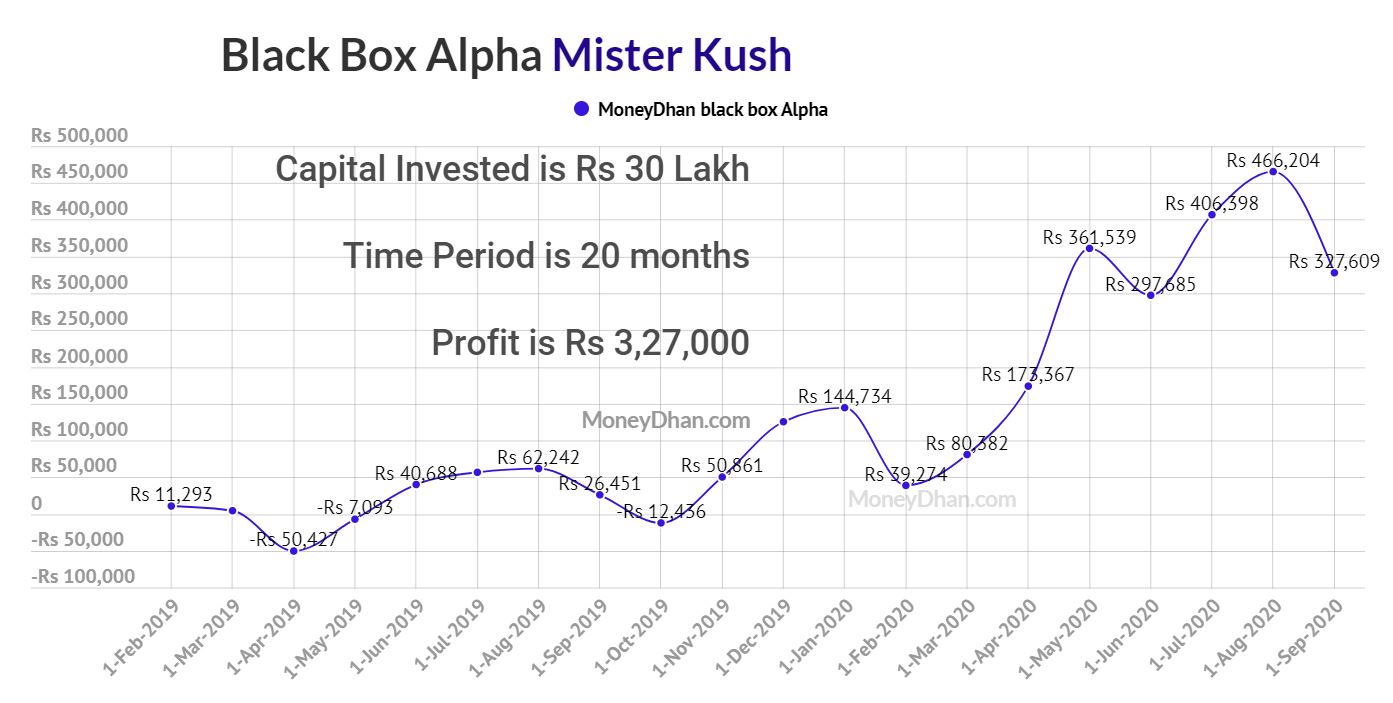

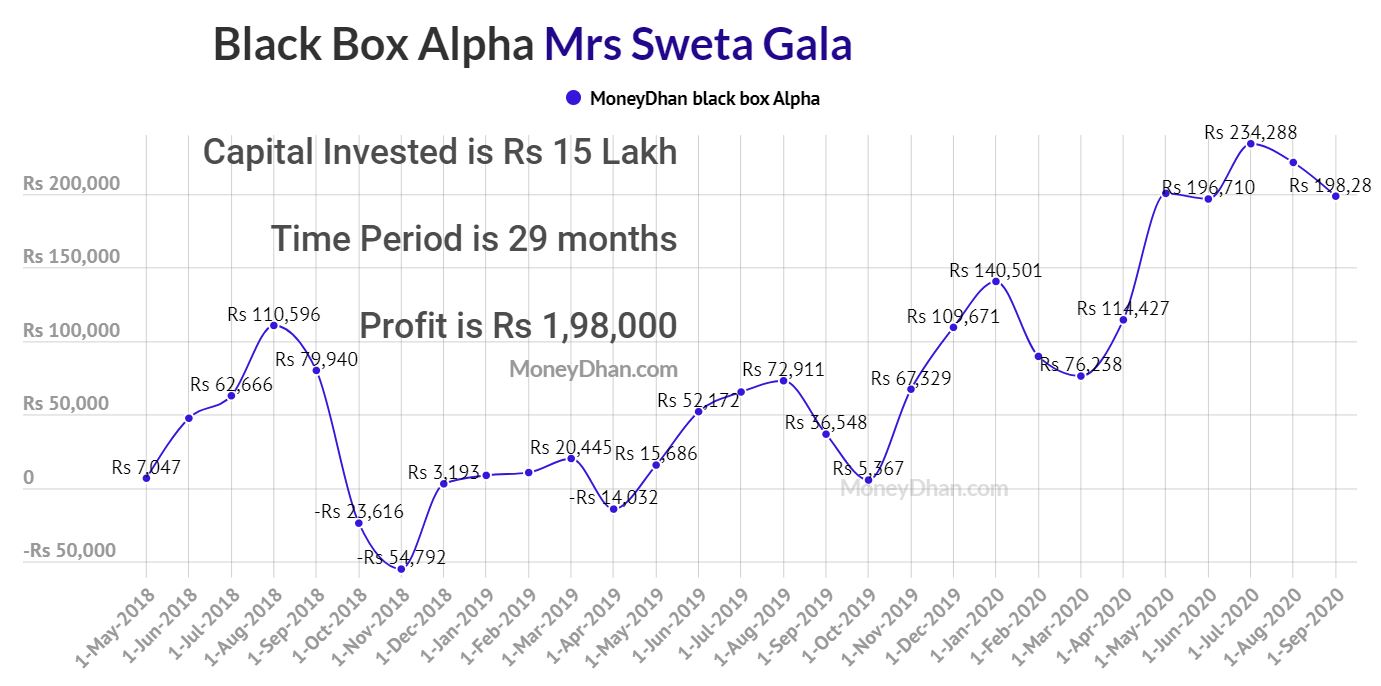

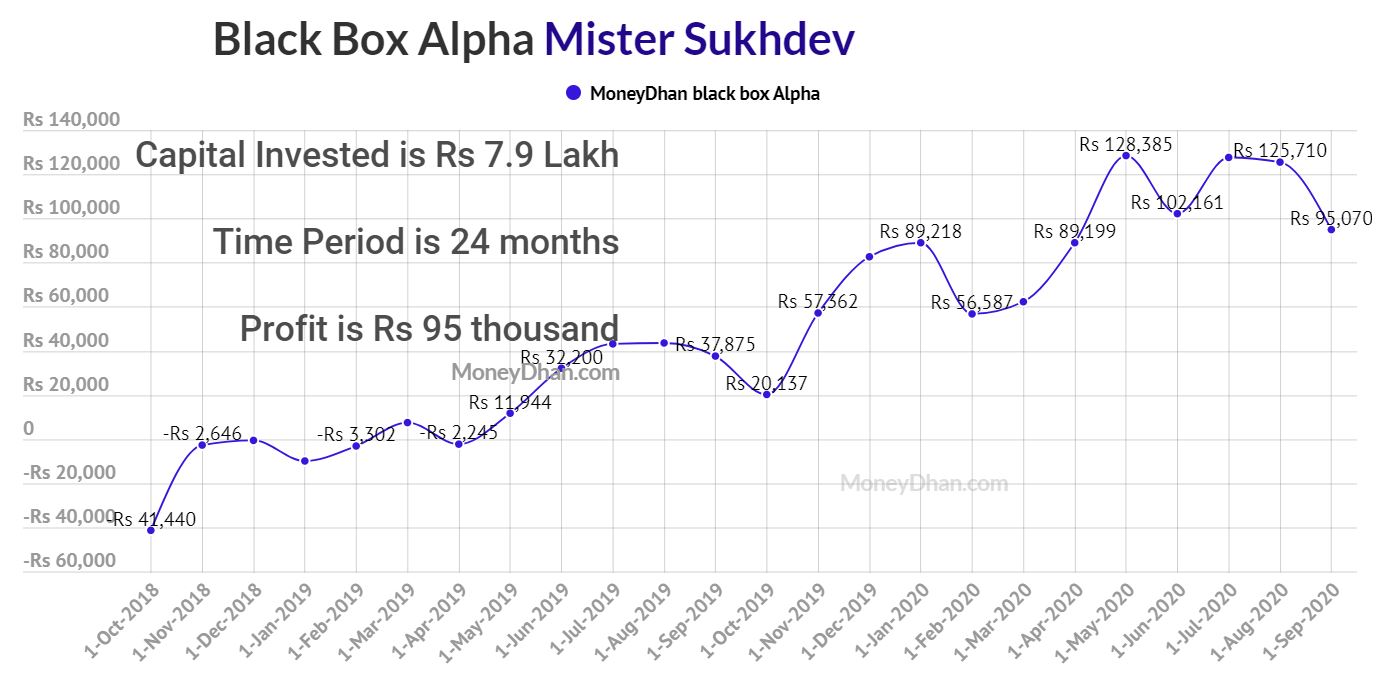

Real Numbers & clients. Only guy who tells you truth is your CA. Check these people’s capital Gains Report, which your CA asks for Income Tax Filing. Numbers cannot lie.

MoneyDhan is a Sebi Registered Investment Advisor which guides you with Demat Account Management.

The intention is to use Stock Market as a source of income which could provide sufficient wealth appreciation inorder to meet future Financial Goals for every Indian citizen.

Yes. It is safe and secure from any kind of potential fraud or glitch of the system.

We do not accept any of your capital. You fund your own demat account, opened under a legal exchange governed stock broker. (Zerodha/Sharekha/motilal oswal etc). They hold your capital whereas moneydhan just advises you, on the action to be taken in your demat account.

Not for those who will need the invested capital back within 3 years.

For short term, we utilize debt fund.

We will suggest you the best available asset that would create long term wealth for you.

You can withdraw cash from your account at any time. All you have to do is initiate the withdrawal process from the ‘Payout’ tab on the mobile app or desktop. The money will be wired directly to your bank account. It may take the same 2 hours – 4 business days for the Amount to reflect.

Required documents

Then, any one of the following

6 months bank statement upto July end

or

3 month pay slip

or

form 16

or last 3 year ITR acknowledgement

We seek permission via Registered email before every execution.

Using our master terminal, we execute the order, in your account.

Via mobile app from the broker, you can always verify the Trades, Profit or Loss, net balance lives.

Our preferred transaction is “Never Exit”

However if a company screams out a fundamental deterioration, we will migrate that capital to better opportunity (stock).

We are SEBI Registered Authorized Personal. This means, we request you to open a new Demat Account under our franchise.

We do not take control of your existing Demat account. However, you can easily shift your Shares/MF holdings to new Demat account opened under our franchise.

We are SEBI Registered Authorized Personal. This means, we request you to open a new Demat Account under our franchise.

We do not take control of your existing Demat account. However, you can easily shift your Shares/MF holdings to new Demat account opened under our franchise.

We are Authorized Personal for your Demat account. This means, we have access to your Demat account from our master terminal.

We execute your trade order. But we require your permission as email first. For every Single transaction, we need this permission. That is the compliance part.

Using mobile App from the broker, you can always verify the Trades, Profit or Loss, net balance lives.

We request 10 thousand from you. After you gain 1 Lakh profit.

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.