What Is Demat Equity Long Term

This is like your personalized mutual fund

Theory suggests that, Equity share’s investments should produce 100% returns within 5 years. A fair compensation for the risk you volunteered.

Inorder to achieve the mentioned return, Let us guide you regarding

✔ Which share to buy.

✔ How many shares to buy.

✔ When to exit.

Unlike MF, With us, everyone gets a personalised equity portfolio. Which is based on your age, financial scenario and risks.

A youngster and a retired personal received same portfolio in MF.

We personalise it for you.

Large Caps Leaders

HDFC, TCS, Reliance, HUL

Buying consistent & reliable monopolistic business is no-brainer. Sector leaders like Reliance, TCS, Hdfc, Asian paints etc… Anyone can buy them. But people Hire us to manage them.

Buy And Hold

No churning.

Just buy and hold...

We believe in No churning.

Just buy and hold those large Cap stock unless fundamentals deteriorate beyond recovery. It works like magic !

Tax Loss Harvesting

Save a portion of your tax liability with the help of tax loss harvesting

Our List Of

Preferred Stocks

Blue Chip stocks only. Preferably sector leaders. These giants do not participate in market rally nor do they crash.

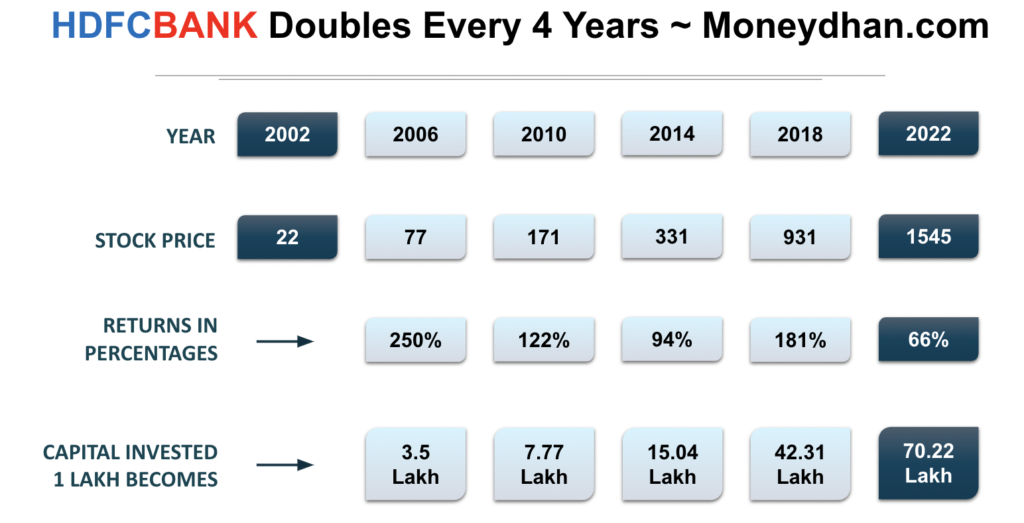

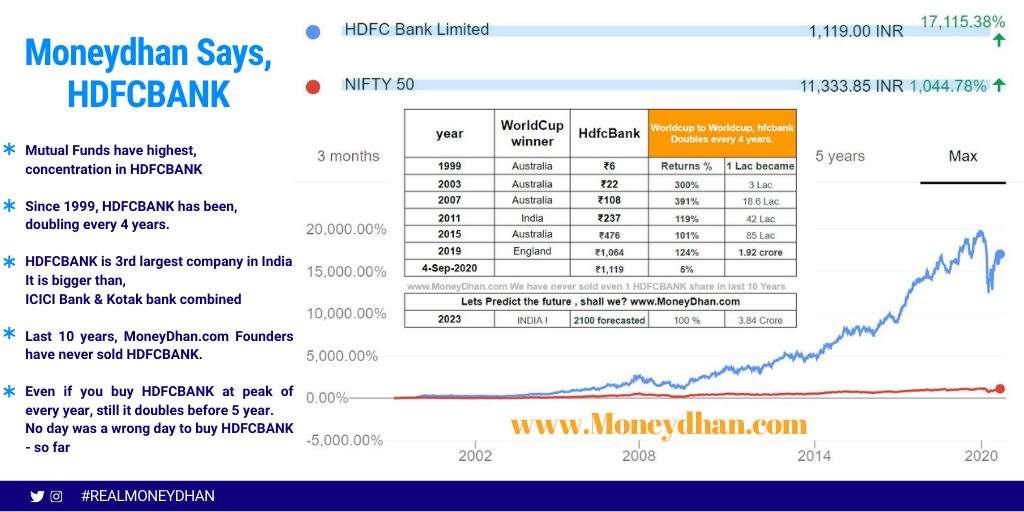

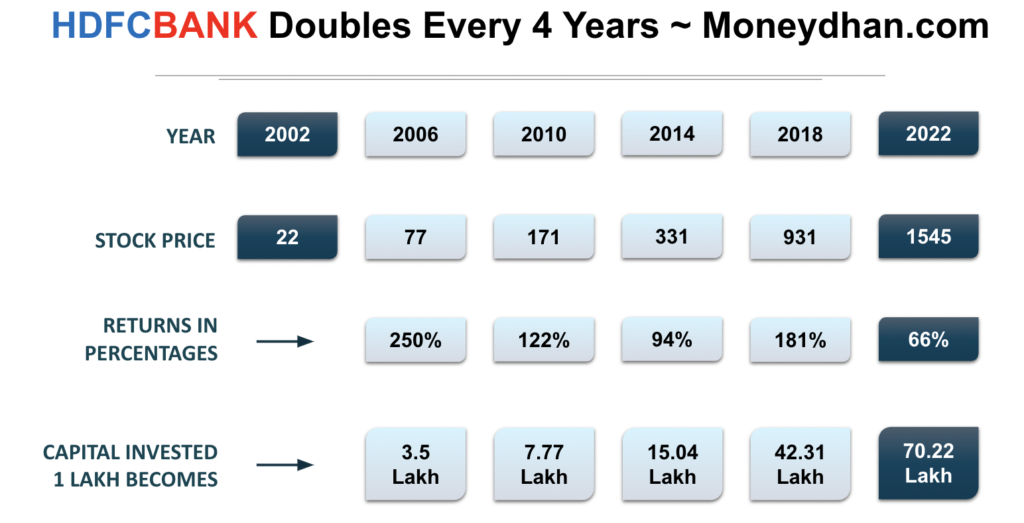

HDFC BANK

HDFCBANK stocks is the leader in banking sector and 4th largest company in india.

NESTLE

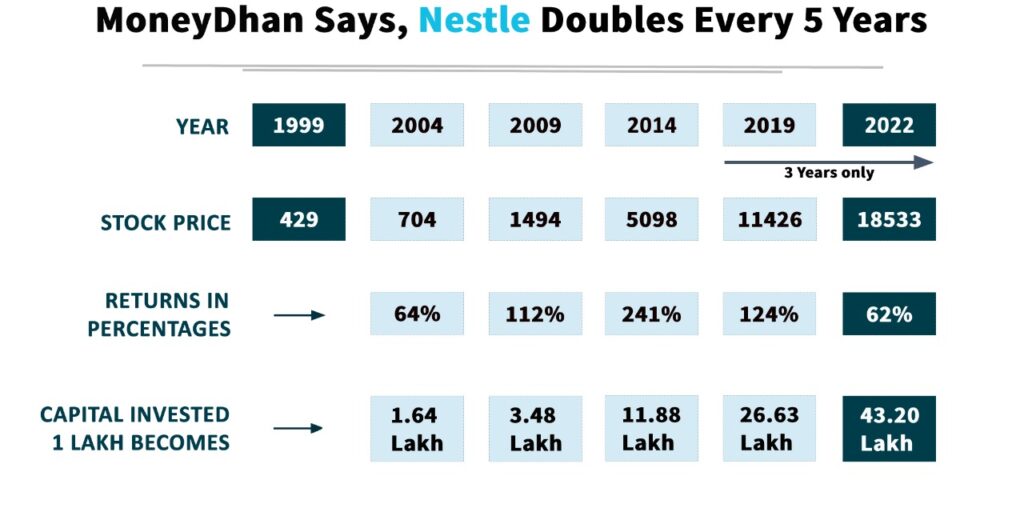

NESTLE is an FMCG that has navigated Maggie crisis and gave 100% returns in 5 years

Our Rules

If you are in stock market, You should get 100% within 5 years.

You should not trust anyone with your capital. The money should be in your own Demat account. It should be as good as in your lap.

Don’t pay unless you see results.

We have some ground Rules

MUTUAL FUND LARGE CAP TOP 10 HOLDINGS (Moneydhan.com)

No Data Found

Our Philosophy

The graph tells you the truth. Any mutual fund out there ends up investing your money into the above list of stocks. These companies control the fate of all your future financial goal achievements via Mutual Funds.

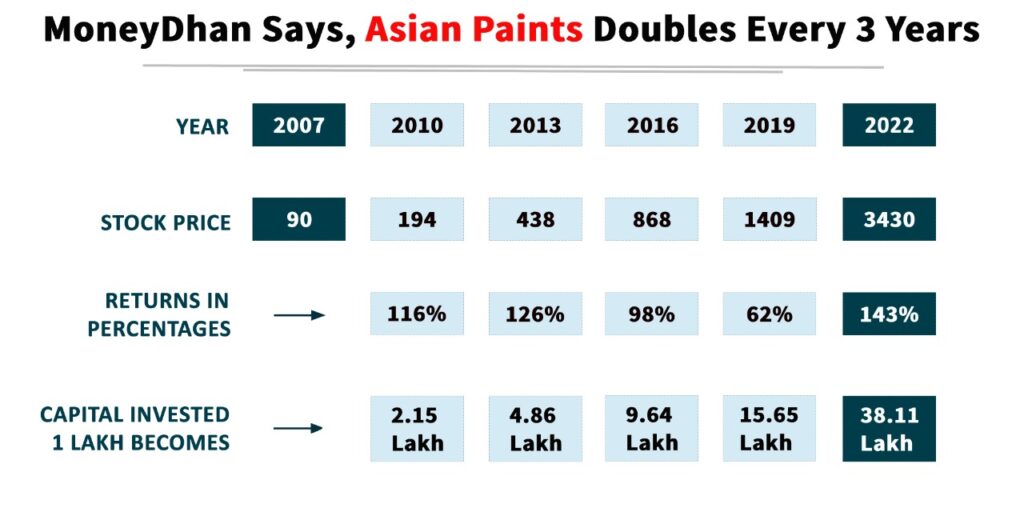

- We Believe in sticking to the best. The sector leader ( TCS not Infy / Asian Paints not Berger / HdfcBank not Icici or Kotak etc)

- We stick to large caps only. Since the intention is to buy and keep quiet for 4- 5 years minimum. The large caps are well capable of getting our expected results. Mid-Caps requires you to volunteer for higher risk. We are uncomfortable with that risk.

- You are not hiring us to buy these famous stocks. You hire us to manage them. Most investors are not aware of the CEO, Market Cap and Quarterly results of the company. So, investors will show reluctance to invest big amount in any of the above companies. You hire us for that conviction.

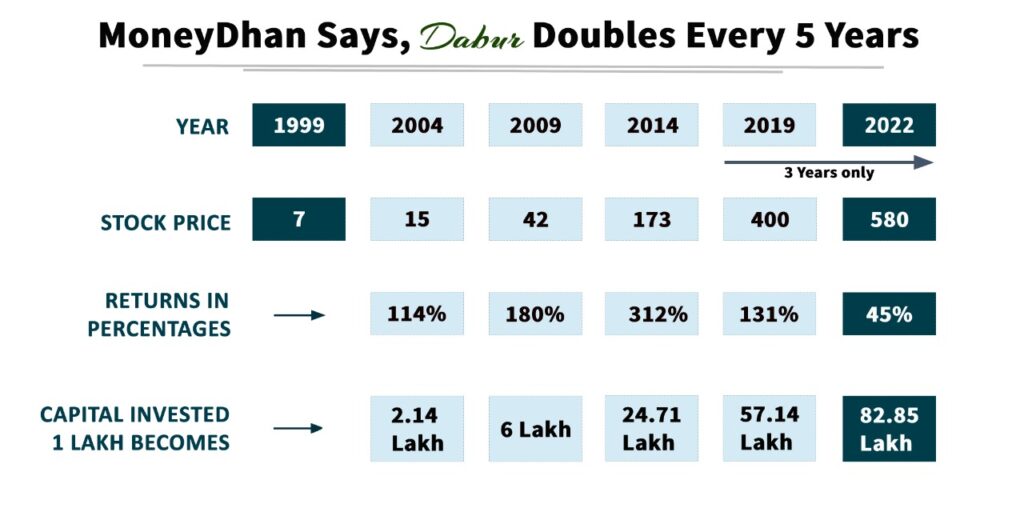

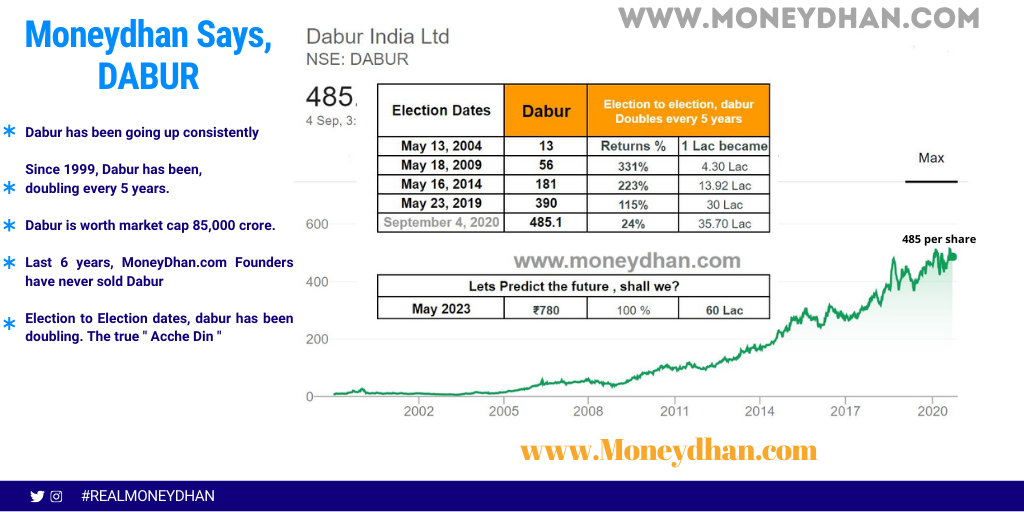

- Last 10 years our founder never sold HDFCBANK shares. Last 5 Years,never sold nestle (16% CAGR), Dabur (18% CAGR) or Asian paints(29% CAGR) ever. We believe in hiring the management of the company. Support them until the fundamentals ruin beyond any repair. Sticking with the best sector leaders steered us away from YesBank, DHFL, RCom etc. Our philosophy has kept us safe and grown our capital consistently.

- The Company where we invest in, needs to have atleast 20 years evidence.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

-

Stock #1

- Stock #2

- Stock #3

No Data Found

My Skill

Web Designer

50%

My Example Heading

My Other Example Heading

No Data Found

Previous image

Next image

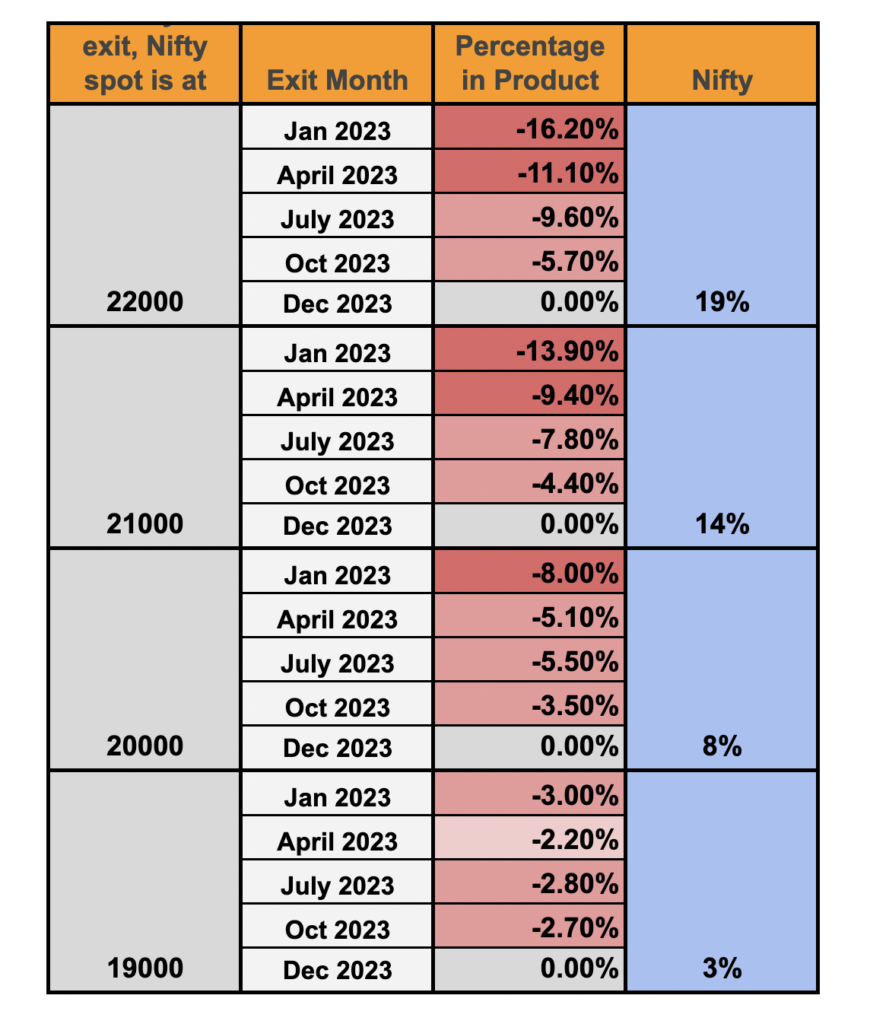

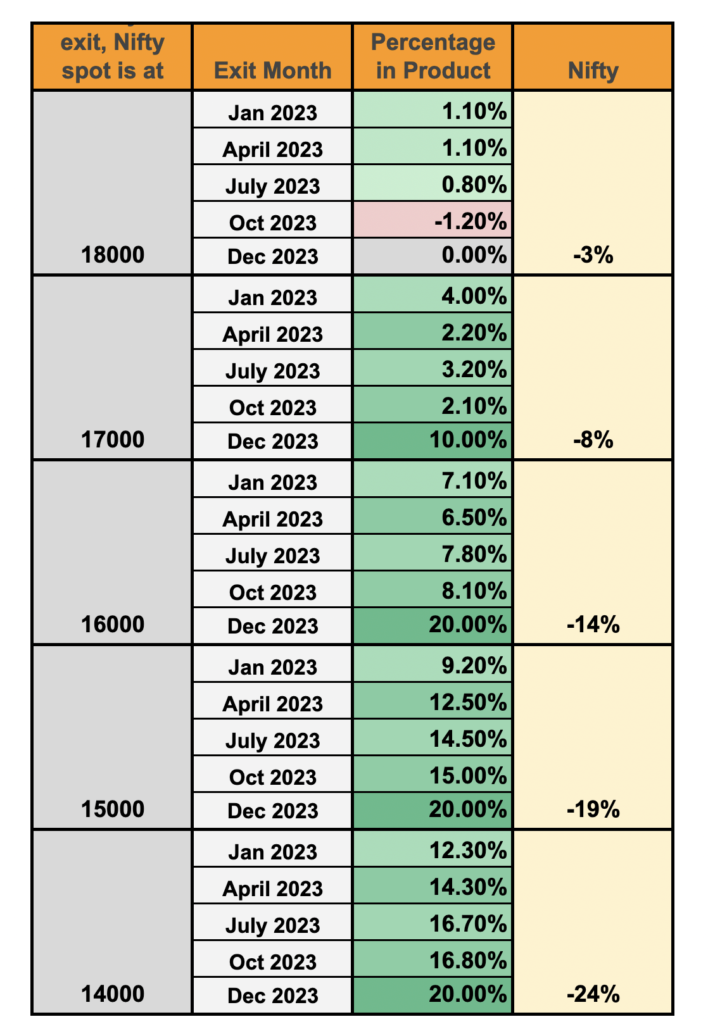

2X in 5 years

One investment for all market conditions. Works for everyone

By MoneyDhan

Mi. Amount

Rs 2,972

4Y CAGR

10.63%

All Time High in 3 Years

Nifty ETF lenge. SIP karenge. EVery 3 years all time high banata hain na.

By MoneyDhan

Mi. Amount

Rs 2,972

4Y CAGR

10.63%

Consistent performers

Stocks that beat sensex consistently over past decade. And ones which are expected to do so in near future.

By MoneyDhan

Mi. Amount

Rs 2,972

4Y CAGR

10.63%

Adani lega?

One investment for all market conditions. Works for everyone

By MoneyDhan

Mi. Amount

Rs 2,972

4Y CAGR

10.63%

Stand on the Shoulders of giant large caps

We pick the time tested and proven Large caps. When a firm has spent more than a decade as publicly traded stock. We will have more than enough data to do a proper due diligence and come up with a very marque list of shares where one can invest a great sum of wealth and still get a peace of mind while sleeping

Companies which are beyond 1 lakh crore market cap.

Companies which are publicly listed for more than a decade.

Companies which are generating profits.

Companies which are generating new all time high profit Y-o-Y.

Companies with clean management and clear communicating with its investors.

Companies that are doubling market value every 5 years or less.

No churning policy

Some stocks, when once bought, they seldom give any reason to book profits. We pick those companies which makes an all time high every 12-18 months. This means, we hold them until the company profile deteriorates.

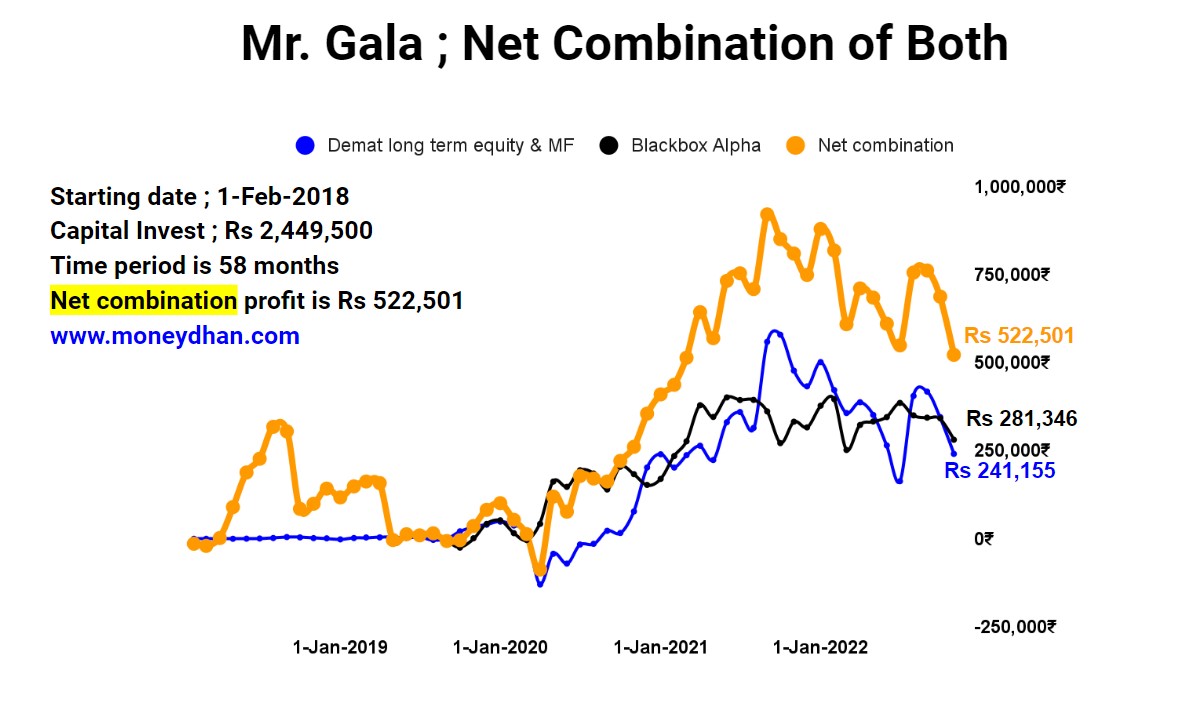

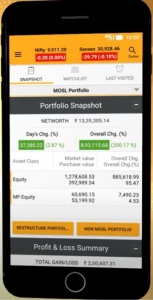

Our Track Record

Case Studies And Reviews

Real Numbers & clients. Only guy who tells you truth is your CA. Check these people’s capital Gains Report, which your CA asks for Income Tax Filing. Numbers cannot lie.

Frequently Asked

Questions

Who is MoneyDhan.com ?

MoneyDhan is a Sebi Registered Investment Advisor which guides you with Demat Account Management.

The intention is to use Stock Market as a source of income which could provide sufficient wealth appreciation inorder to meet future Financial Goals for every Indian citizen.

Is my Money Safe?

Yes. It is safe and secure from any kind of potential fraud or glitch of the system.

We do not accept any of your capital. You fund your own demat account, opened under a legal exchange governed stock broker. (Zerodha/Sharekha/motilal oswal etc). They hold your capital whereas moneydhan just advises you, on the action to be taken in your demat account.

How Do I Fund My Account?

At the account opening KYC stage, you would have submitted us with a bank proof. Payment from that bank account ONLY will be accepted.

Internet banking( RTGS), Online Payment gateway from Motilal’s app, UPI are various modes of transfer. We do not accept Cash.

Demat Account LT, Does It Suit Me?

- Any person who can volunteer for some risk.

- A cash saver of 5 thousand or above can fund his/her demat account.

- Someone who don’t need the capital back for 3 years at the least.

Not for those who will need the invested capital back within 3 years.

For short term, we utilize debt fund.

We will suggest you the best available asset that would create long term wealth for you.

How Do I Withdraw Money From My Account?

You can withdraw cash from your account at any time. All you have to do is initiate the withdrawal process from the ‘Payout’ tab on the mobile app or desktop. The money will be wired directly to your bank account. It may take the same 2 hours – 4 business days for the Amount to reflect.

What are the documents required?

Required documents

- Pan card (color copy)

- Adhaar card (both sides/color)

- Passport size pic (color)

- Your mother name

- Your place of birth

- A pic of cheque

- Email id

- Mobile number

- Married or single

Then, any one of the following

6 months bank statement upto July end

or

3 month pay slip

or

form 16

or last 3 year ITR acknowledgement

Who Executes My Order?

We seek permission via Registered email before every execution.

Using our master terminal, we execute the order, in your account.

Via mobile app from the broker, you can always verify the Trades, Profit or Loss, net balance lives.

How frequently you do transactions in equity?

Our preferred transaction is “Never Exit”

However if a company screams out a fundamental deterioration, we will migrate that capital to better opportunity (stock).

Can you use existing Demat Account?

We are SEBI Registered Authorized Personal. This means, we request you to open a new Demat Account under our franchise.

We do not take control of your existing Demat account. However, you can easily shift your Shares/MF holdings to new Demat account opened under our franchise.

Minimum Amount Required?

We are SEBI Registered Authorized Personal. This means, we request you to open a new Demat Account under our franchise.

We do not take control of your existing Demat account. However, you can easily shift your Shares/MF holdings to new Demat account opened under our franchise.

What Will Happen if Moneydhan Goes Down?

Your Demat is under CDSL where all the stocks/Mf holding is safely stored. Accessible to your direction as well, without our presence.

If we don’t exist, surely the Motilal Oswal team will be there to service your needs. Under no circumstances, you would have an issue with your holdings or payouts.

Who Executes Order In My Account?

We are Authorized Personal for your Demat account. This means, we have access to your Demat account from our master terminal.

We execute your trade order. But we require your permission as email first. For every Single transaction, we need this permission. That is the compliance part.

Using mobile App from the broker, you can always verify the Trades, Profit or Loss, net balance lives.

What Is Your Fee Structure?

We request 10 thousand from you. After you gain 1 Lakh profit.