MoneyDhan is a Sebi Registered Investment Advisor which guides you with Demat Account Management.

The intention is to use Stock Market as a source of income which could provide sufficient wealth appreciation inorder to meet future Financial Goals for every Indian citizen.

Yes. We proudly say that we are associated with SEBI. We are among the 1334 RIA at present in India.

Our registration number is Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual). You will be able to verify from SEBI portal

We are based in Ernakulum, Kerala. MoneyDhan has a pan India presence.

Our Registered Office is in Kerala however our team members are spread across major cities like Pune, Mumbai, Bangalore,Visakhapatnam, Rajkot etc

We will schedule a call with our team to discuss your priorities. Once onboarded, you will receive the advice through email and WhatsApp. So location is not a constraint.

Yes. We are SEBI registered Investment Advisor licensed to provide financial advice to you.

Unlike a Mutual Distributor, Bank RM, LIC Agent or a CA who is barred from stock or MF related investment advisory activities.

You are not trusting Moneydhan. We are Sebi Registered Authorized Personal.

We cannot touch your money in Demat Account.

Payout happens to your Pre-provided bank account only.

If you feel uncomfortable, Click on “Request Payout” button in your demat mobile App and pull out the capital.

Your Demat is under CDSL where all the stocks/Mf holding is safely stored. Accessible to your direction as well, without our presence.

If we don’t exist, surely the broker team will be there to service your needs. Under no circumstances, you would have an issue with your holdings or payouts.

Yes we are

Sujith completed his Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Meanwhile he accumulated multiple certificates including Investment Advisor XB, FRM (USGARP) making him an authority in finance field

| Sr. No. | Type of Investor / Trader | Definition Investor / Trader | Type of Products | Risk Tolerance Capacity |

|---|---|---|---|---|

| 1 | Conservative (Low Risk Category Client) | An investor who has low ability to accept risk. A conservative investor is someone who wants his money to grow but does not want to risk his principle investment. | FD, Gold, PPF, NSC, Savings bank | Low Risk |

| 2 | Moderate (Moderate Risk Category Client) | An investor values reducing risks and enhancing returns equally. This investor is willing to accept short to long term fluctuation risks to seek higher returns & capital gain. A Moderate investor endures a short-term loss of principal and aware that capital may fall under original investment capital, during economy downturn. Group 1 / Moderate Risk Category services are offered. | Equity, Mutual Funds, Real Estate, small / Large Cap stocks, High income Bonds | Medium Risk |

| 3 | Aggressive (High Risk Category Client) | An investor who seek for "high risk high return" investment, able to accept short to long term fluctuation to earn very high returns. Services under Group 2 / High Risk Category Services are recommended however client may also opt for services under Group 1 / Moderate Risk Category Services. | Derivatives Currency, Futures and Options | High Risk |

When you have a regular source of income, we can go for financial planning. It is all about allocating your work as per your risk appetite and goals. Once enough corpus is accumulated in this way , wealth creation will start. We will guide you with financial planning and wealth creation.

NIFTY makes a new high every 3 years. Last 8 years it has made positive returns.

Moneydhan abides by the rule of fiduciary. We take your interest into consideration before we give advice. We also ask you to fill the risk profile during onboarding to know the level of risk one wants to take.

Yes. It is safe and secure from any kind of potential fraud or glitch of the system.

We do not accept any of your capital. You fund your own demat account, opened under a legal exchange governed stock broker. (Zerodha/Sharekhan/motilal oswal etc.)

They hold your capital whereas Moneydhan just advises you, on the action to be taken in your demat account. Execution is done by you. If you connect with us , we can provide you with implementation of services free of cost where a broker will execute your trades on your behalf after your consent.

You can view the portfolio from your demat account. We are only advice givers.

Any amount is welcome. We have a single client with 25 cr also we commit equal time for our 18-year friend who invests 2000 rupees per month.

Our preference is 5 lakh plus where we can introduce our derivatives strategies into your Demat account. But that is not mandatory.

yes.

There is no stipulation that you should do one time Lump-sum or a give us a monthly commitment.

On any day , any amount can be transferred for investment purpose. Just fund your demat account. Drop us an whatsapp message and we will email you our advice for investment allocation. We keep maintaing your risk profile and other details that guide us in guiding you in an on-going basis.

Yes. It is risk. It has to be.

If you are seeking risk free investment; SBI Bank Fixed Deposit and wait 12 years for your 100% return on capital without risk.

Here we are trying to generate 100% return much faster. This reward demands some risk to be volunteered. Inorder to reach faster, you need to accelerate and volunteer a risk na.

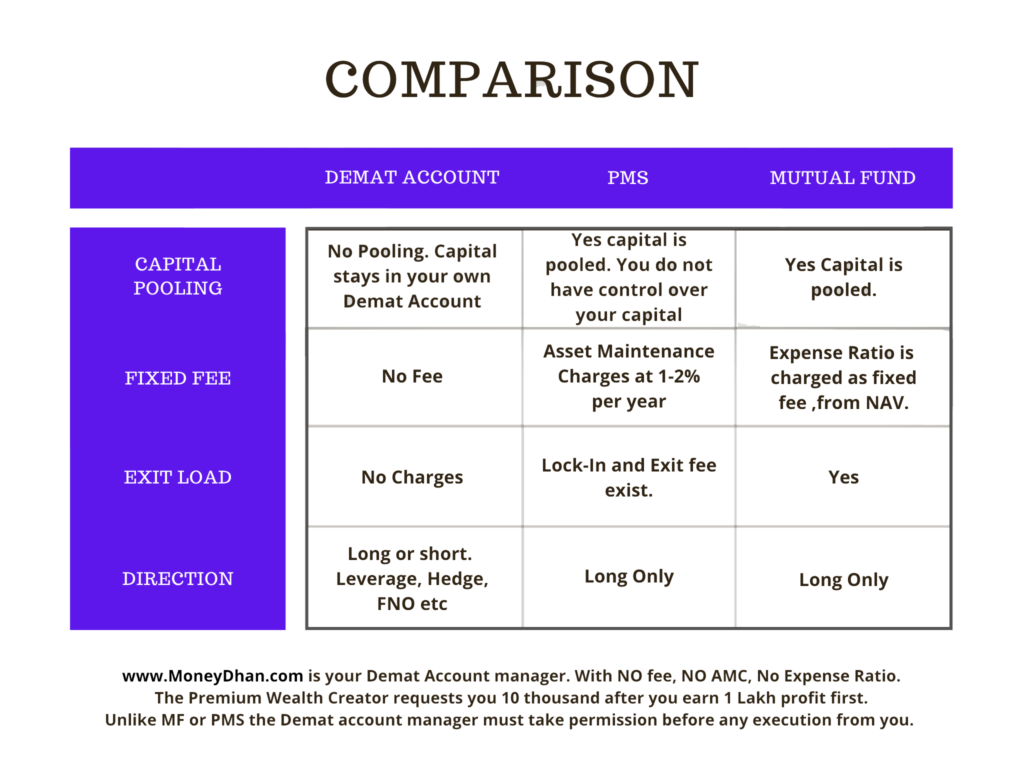

We receive this question a lot. There are 3 ways to look at it.

Scenario 1. We agree to sharing loss.

This means, we will not charge 10% profit but we will do 50% sharing in loss and profit. (Thats our confidence on ourselves)

Scenario 2. We are Lesser of the available Devils

Present option is to invest a 10 lakh in Equity Mutual Fund and pay expense ratio of 10 thousand per year Fixed. If MF gives you 15% or (-10%), This is your present option.We earn 10 thousand after making 1 lakh for you.

Whereas, we earn 10 thousand after you make 1 lakh first. If you paid 50k in 5 years. You made 5 lakh in 5 years !

Scenario 3. Our numbers Beat others

If you are able to beat our track records. You don’t need to hire us. We step in, when your capital gains are negative even after multiple years in market.

Yes. It is safe and secure from any kind of potential fraud or glitch of the system.

We do not accept any of your capital. You fund your own demat account, opened under a legal exchange governed stock broker. (Zerodha/Sharekha/motilal oswal etc). They hold your capital whereas moneydhan just advises you, on the action to be taken in your demat account.

Technically the demat account is owned by you. We cannot restrict you from squaring off or adding new position.

However, we believe too many cooks ruins the dish. You shouldn’t hire a driver if you intend to drive yourself.

Money will be present in your demat account. We do not touch your money. You have complete control on the money which is there in the demat account. We give advice on how you should invest/structure your portfolio.

Your money is looked after by a team of qualified investment managers with experience and real profits earned in their own prop accounts.

Our experts have developed an investment system that uses actuarial math based algorithms and industry experience to pick the best investable assets for you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money works as hard as you do.

Yes.

You can do sip of any amount.

Also, you can fund irregularly,whenever you feel you can spare extra amount for investing.

Its very simple. We provide you with the link to become our esteemed client. You need to fill the risk profile which will help us plan your investments. Next is to understand the type of products that we offer according to the risk profile. You also need to authenticate your KYC details (pan card, Aadhar) . We will have a mutual agreement document that we you can eSign using your AADHAR authentication.

We will send the onboarding email once all the agreement is signed by you and our principal officer. Voila! You got onboard.

It hardly takes max of 10 minutes for onboarding. Fee charges and details will be given in the agreement. You can glance at the fees section in FAQ also

| Mode | Asset under Advisory (AUA) | Applicable Fee (Annual) | Accepted Mode |

|---|---|---|---|

| 1 | Below Rs. 1 Crore | 1. Fixed Fee- 1% of AUA | Yes |

| 2 | Rs. 1 Crore and above | Annual Fee-2.5% of AUA (Payable in breakup of 4 equal Quarterly installments each paid at the beginning of quarter.) | N/A |

Terms:

1. Fixed Fee is payable at the beginning of annual period.

2. Invoice would be generated on due dates, which is to be cleared within 15 days of invoice date.

3. Illustration(s)

We understand your financial needs and what is that you are expecting in the coming years.

According to your needs, we will structure your financial portfolio.

No. You can “square off” all the standing position. Instruct your stock broker to move all the funds back to your pre-defined bank account. Usually takes 2 days.

We cannot touch your capital as Investment Advisors.

Please talk to your demat account stockbroker.

Your Pay-in and Pay-out of money happens only between your Pre-determined bank account.

While opening a demat account, they request your bank details, cancelled cheque as proof.

You can withdraw cash from your account at any time. All you have to do is initiate the withdrawal process from the ‘Payout’ tab on the mobile app or desktop. The money will be wired directly to your bank account. It may take the same 2 hours – 4 business days for the Amount to reflect.

We as Investment Advisors don’t deal with demat accounts. We are only investment advisors. But usually, we get a lot of questions. So let us ease the job for you by answering on a high level.

Once all documents are verified, it takes 20 minutes.

Verification takes 1-2 days

Yes.

HUF, Pvt Ltd, LLP, Trust etc all types of account is possible.

Yes. A modification Document PDF is sent to you. Download it. Print it. Fill it. Scan and upload it.

In two days , it gets approved and updated. Based upon the proof provided.

Yes. As long as your Pan Card matches. Its possible.

The direct MF stays Direct. If the source MF was Regular, it stays Regular.

At the account opening KYC stage, you would have submitted us with a bank proof. Payment from that bank account ONLY will be accepted.

Internet banking ( RTGS), Online Payment gateway from Motilal’s app, UPI are various modes of transfer. We do not accept Cash.

Yes.

As long as your Pan card matches, You can transfer pre-existing shares or Mutual Funds into your new Demat Account opened under us.

Mutual Funds stays as it is. (Regular stays regular & Direct stays direct)

This transferring is a manual process.

Is Online. An OTP to your Adhaar linked mobile is enough.

CDSL charges 200 rs per year. A one-time 1000 rupees. Up-Front for 5 Years.

Yes.

Even if you don’t give us a nominee, your legal heir receives the asset

Yes.

Using a Family Declaration document, Single person can get information about multiple accounts within family.

Yes. Using Delivery Instruction Slips to your current Broker, Request them to transfer those shares to your own demat account, in Motilal Oswal

NIFTY makes a new high every 3 years . Last 8 years it has made positive returns.

When you have a regular source of income, we can go for financial planning. It is all about allocating your work as per your risk appetite and goals. Once enough corpus is accumulated in this way , wealth creation will start. We will guide you with financial planning and wealth creation.

| Sr. No. | Type of Investor / Trader | Definition Investor / Trader | Type of Products | Risk Tolerance Capacity |

|---|---|---|---|---|

| 1 | Conservative (Low Risk Category Client) | An investor who has low ability to accept risk. A conservative investor is someone who wants his money to grow but does not want to risk his principle investment. | FD, Gold, PPF, NSC, Savings bank | Low Risk |

| 2 | Moderate (Moderate Risk Category Client) | An investor values reducing risks and enhancing returns equally. This investor is willing to accept short to long term fluctuation risks to seek higher returns & capital gain. A Moderate investor endures a short-term loss of principal and aware that capital may fall under original investment capital, during economy downturn. Group 1 / Moderate Risk Category services are offered. | Equity, Mutual Funds, Real Estate, small / Large Cap stocks, High income Bonds | Medium Risk |

| 3 | Aggressive (High Risk Category Client) | An investor who seek for "high risk high return" investment, able to accept short to long term fluctuation to earn very high returns. Services under Group 2 / High Risk Category Services are recommended however client may also opt for services under Group 1 / Moderate Risk Category Services. | Derivatives Currency, Futures and Options | High Risk |

Yes. It is safe and secure from any kind of potential fraud or glitch of the system.

We do not accept any of your capital. You fund your own demat account, opened under a legal exchange governed stock broker. (Zerodha/Sharekhan/motilal oswal etc )

They hold your capital whereas Moneydhan just advises you, on the action to be taken in your demat account. Execution is done by you. If you connect with us , we can provide you with implementation of services free of cost where a broker will execute your trades on your behalf after your consent.

You can view the portfolio from your demat account. We are only advice givers.

We will schedule a call with our team to discuss your priorities. Once onboarded, you will receive the advice through email and WhatsApp. So location is not a constraint.

Moneydhan abides by the rule of fiduciary. We take your interest into consideration before we give advice. We also ask you to fill the risk profile during onboarding to know the level of risk one wants to take.

| Mode | Asset under Advisory (AUA) | Applicable Fee (Annual) | Accepted Mode |

|---|---|---|---|

| 1 | Below Rs. 1 Crore | 1. Fixed Fee- 1% of AUA 2. Annual Fee- 10% of portfolio appreciation Subject to a maximum total fee of 2.5% of AUA | Yes |

| 2 | Rs. 1 Crore and above | Annual Fee-2.5% of AUA (Payable in breakup of 4 equal Quarterly installments each paid at the beginning of quarter.) | N/A |

Terms:

1. Fixed Fee is payable at the beginning of annual period.

2. Invoice would be generated on due dates, which is to be cleared within 15 days of invoice date.

3. Illustration(s)

For AUA- Below Rs 1 Crore

| Particulars | Scenario 1 | Scenario 2 | Scenario 3 |

|---|---|---|---|

| 1. Beginning AUA | 50,00,000 | 50,00,000 | 50,00,000 |

| 2. Appreciation during the year | 15,00,000 | 5,00,000 | -5,00,000 |

| 3.Fixed Fee (1% of AUA) - Payable at the time of beginning of agreement | 50,000 | 50,000 | 50,000 |

| 4. Annual Fee as per calculation (10% of appreciation) | 1,50,000 | 50,000 | Nil |

| 5. Annual Fee to be charged- subject to maximum total fee of 2.5% of AUA | 75,000 | 50,000 | Nil |

| 6. Total Fees Charged | 1,25,000 | 1,00,000 | 50,000 |

For AUA- Above Rs 1 CroreAUA* 2,5/100 i.e. if AUA is Rs. 10,00,00,000 the fees would be Rs. 25,00,000/- (Rs. 6,25,000/- payable quarterly at the beginning of each quarter)

Yes. We proudly say that we are associated with SEBI. We are among the 1334 RIA at present in India.

Our registration number is Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual). You will be able to verify from SEBI portal

Yes we are

Sujith completed his Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Meanwhile he accumulated multiple certificates including Investment Advisor XB, FRM (USGARP) making him an authority in finance field

Need to add Seshadri sir qualification

Money will be present in your demat account. We do not touch your money. You have complete control on the money which is there in the demat account. We give advice on how you should invest/structure your portfolio.

We understand your financial needs and what is that you are expecting in the coming years.

According to your needs, we will structure your financial portfolio.

MoneyDhan is a Sebi Registered Investment Advisor which guides you with Demat Account Management.

The intention is to use Stock Market as a source of income which could provide sufficient wealth appreciation inorder to meet future Financial Goals for every Indian citizen.

Yes. It is safe and secure from any kind of potential fraud or glitch of the system.

We do not accept any of your capital. You fund your own demat account, opened under a legal exchange governed stock broker. (Zerodha/Sharekha/motilal oswal etc). They hold your capital whereas moneydhan just advises you, on the action to be taken in your demat account.

We are based in Ernakulum, Kerala. MoneyDhan has a pan India presence.

Our Registered Office is in Kerala however our team members are spread across major cities like Pune, Mumbai, Bangalore, Rajkot etc

Your money is looked after by a team of qualified investment managers with experience and real profits earned in their own prop accounts.

Our experts have developed an investment system that uses actuarial math based algorithms and industry experience to pick the best investable assets for you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money works as hard as you do.

Yes. We are SEBI registered Investment Advisor licensed to provide financial advice to you.

Unlike a Mutual Distributor, Bank RM, LIC Agent or a CA who is barred from stock or MF related investment advisory activities.

Technically the demat account is owned by you. We cannot restrict you from squaring off or adding new position.

However, we believe too many cooks ruins the dish. You shouldn’t hire a driver if you intend to drive yourself.

Any amount is welcome. We have a single client with 25 cr also we commit equal time for our 18 year friend who invests 2000 rupees per month.

Our preference is 5 lakh plus where we can introduce our derivatives strategies into your Demat account. But that is not mandatory.

No. You can “square off” all the standing position. Instruct your stock broker to move all the funds back to your pre-defined bank account. Usually takes 2 days.

Yes.

Indian all electronic investments done via stock broker or any other Mutual fund platform has a dashboard that keeps you updated real-time with what’s going on with your capital.

yes.

There is no stipulation that you should do one time Lump-sum or a give us a monthly commitment.

On any day , any amount can be transferred for investment purpose. Just fund your demat account. Drop us an whatsapp message and we will email you our advice for investment allocation. We keep maintaing your risk profile and other details that guide us in guiding you in an on-going basis.

Yes. It is risk. It has to be.

If you are seeking risk free investment; SBI Bank Fixed Deposit and wait 12 years for your 100% return on capital without risk.

Here we are trying to generate 100% return much faster. This reward demands some risk to be volunteered. Inorder to reach faster, you need to accelerate and volunteer a risk na.

You are not trusting Moneydhan. We are Sebi Registered Authorized Personal under MotilalOSwal.

You are trusting MotilalOswal and Stock Exchange.

We cannot touch your money in Demat Account.

Payout happens to your Pre-provided bank account only.

If you feel uncomfortable, Click on “Request Payout” button in your mobile App and pull out the capital.

We receive this question alot. There are 3 ways to look at it.

Scenario 1. We agree to sharing loss.

This means, we will not charge 10% profit but we will do 50% sharing in loss and profit. (Thats our confidence on ourselves)

a) We buy Debt Fund. Earns 6%. We receive 3 %. Well we didn’t speak of which asset.

b) We generate 12% return in a year. Nifty gave 12%CAGR for 10 years. We get 6% as half profit share. You end up with debt return again.

c) We generate 15% or above every year. In that case, with a track record like us, our minimum will be 1 crore capital. This wont help the small investor with 5 lakh.

Scenario 2. We are Lesser of the available Devils

Present option is to invest a 10 lakh in Equity Mutual Fund and pay expense ratio of 10 thousand per year Fixed. If MF gives you 15% or (-10%), the Asset Manager still earns your 1% of capital every year. This is your present option.We earn 10 thousand after making 1 lakh for you.

Whereas, we earn 10 thousand after you make 1 lakh first. If you paid 50k in 5 years. You made 5 lakh in 5 years !

Scenario 3. Our numbers Beat others

If you are able to beat our track records. You don’t need to hire us. We step in, when your capital gains are negative even after multiple years in market.

We cannot touch your capital.

Only authority we get is to execute trade order in your Demat account, on Your behalf.

Yet,we cannot execute any order without your permission as email.

Your Pay-in and Pay-out of money happens only between your Pre-determined bank account.

While opening a demat account, we request you bank details, cancelled cheque as proof

10 % of profit share. We usually target 1 lac profit so as to request 10k ( 10 % ).

Once all documents are verified, it takes 20 minutes.

Verification takes 1-2 days

Yes.

HUF, Pvt Ltd, LLP, Trust etc all types of account is possible.

Yes. A modification Document PDF is sent to you. Download it. Print it. Fill it. Scan and upload it.

In two days , it gets approved and updated. Based upon the proof provided.

Yes. As long as your Pan Card matches. Its possible.

The direct MF stays Direct. If the source MF was Regular, it stays Regular.

At the account opening KYC stage, you would have submitted us with a bank proof. Payment from that bank account ONLY will be accepted.

Internet banking( RTGS), Online Payment gateway from Motilal’s app, UPI are various modes of transfer. We do not accept Cash.

Your Demat is under CDSL where all the stocks/Mf holding is safely stored. Accessible to your direction as well, without our presence.

If we don’t exist, surely the Motilal Oswal team will be there to service your needs. Under no circumstances, you would have an issue with your holdings or payouts.

You can withdraw cash from your account at any time. All you have to do is initiate the withdrawal process from the ‘Payout’ tab on the mobile app or desktop. The money will be wired directly to your bank account. It may take the same 2 hours – 4 business days for the Amount to reflect.

We seek permission via Registered email before every execution.

Using our master terminal, we execute the order, in your account.

Via mobile app from the broker, you can always verify the Trades, Profit or Loss, net balance lives.

Yes.

You can do sip of any amount.

Also, you can fund irregularly,whenever you feel you can spare extra amount for investing.

Yes.

As long as your Pan card matches, You can transfer pre-existing shares or Mutual Funds into your new Demat Account opened under us.

Mutual Funds stays as it is. (Regular stays regular & Direct stays direct)

This transferring is a manual process.

Is Online. An OTP to your Adhaar linked mobile is enough.

CDSL charges 200 rs per year. A one-time 1000 rupees. Up-Front for 5 Years.

All other account opening charge is borne out of pocket by us.

Yes.

Even if you don’t give us a nominee, your legal heir receives the asset

Yes.

Using a Family Declaration document, Single person can get information about multiple accounts within family.

Yes. Using Delivery Instruction Slips to your current Broker, Request them to transfer those shares to your own demat account, in Motilal Oswal

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.