What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Mirae Bluechip fund invests in following sectors.

Banks, Pharma and IT sector consumes 40% of your invested capital. Performance of the MF depends on these 3 sectors.

Where Is the money invested?

What is the cost for 1 lac, by availing service of this Mutual Fund?

Even if the name is bluechip, this MF is parking 45% of your capital in bluechips.

Its accumulating some midcap (34%) & Small cap+ miscellaneous (18%)

The Asset Management company earns rs 147 Crore per annum fixed. No obligation towards performance. Means, even if they under-perform, they get rs 147cr to advertise “Mutual Fund Sahi Hain”; every year.

What are the top two holdings?

How did the MF perform in last 5 years against these two stocks?

Take any time frame, Mirae BlueChip has under performed HDFCBANk or Icici Bank.

Does this mirae bluechip emerging fund beat its benchmark?

YES, This MF is beating Nifty index ! And thus receives 5 star rating by outperforming the blue chip market (nifty)

Do notice, the mid cap and small caps it hold. They are taking extra risk to beat nifty. And being successful

should one buy this Mutual fund?

YES. Most of us are not sophisticated enough to keep track of top holdings or , switch stocks in direct equity.

This Mutual Fund portfolio is what you want to hold when india grows towards 5 trillion dollar economy.

Can i beat this MF on my own?

Go with top 4–5 holdings. Accumulate those stocks in your own direct equity- demat account. ( A bank account is for holding cash, A demat account is for holding electronic assets)

For any clarifications click on my profile

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

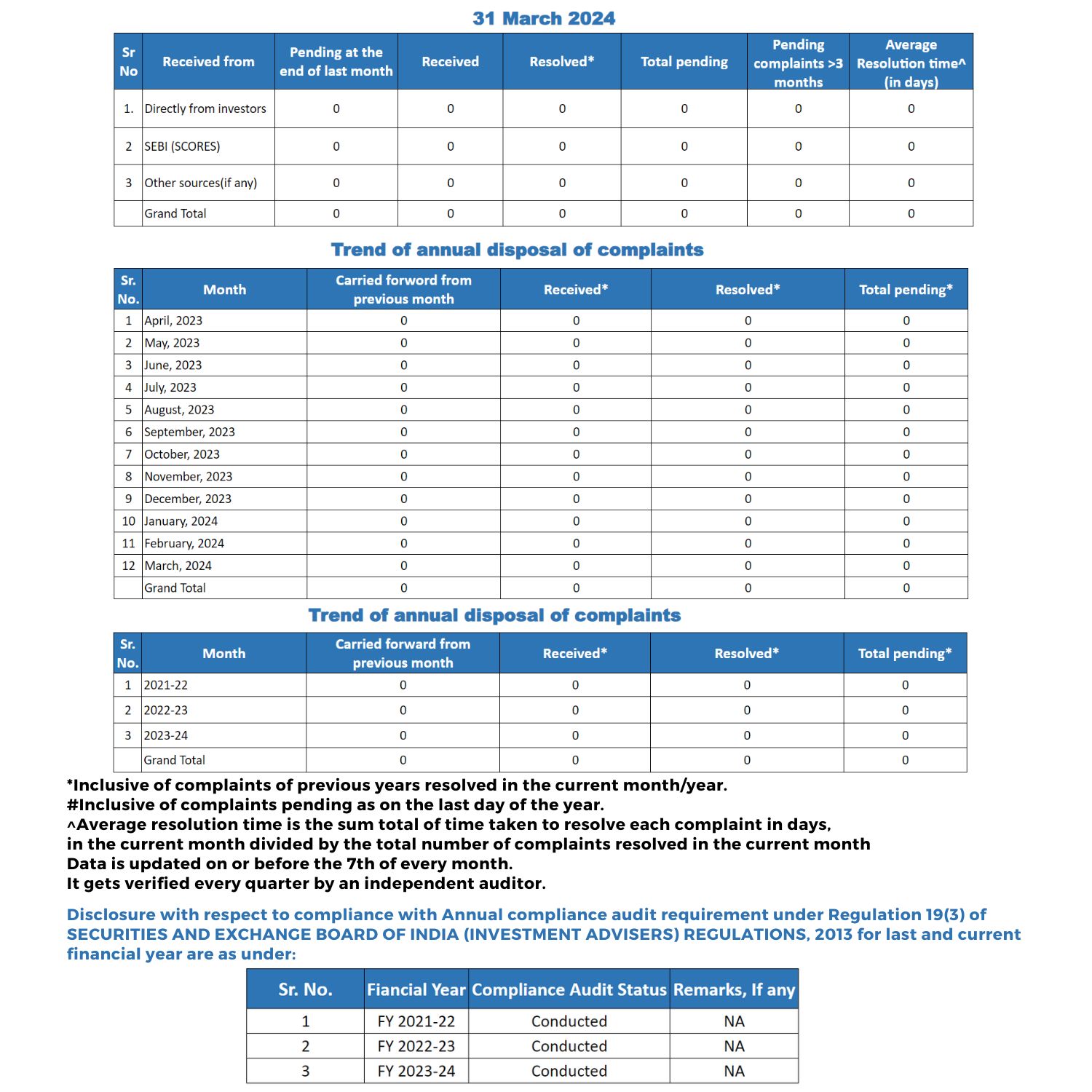

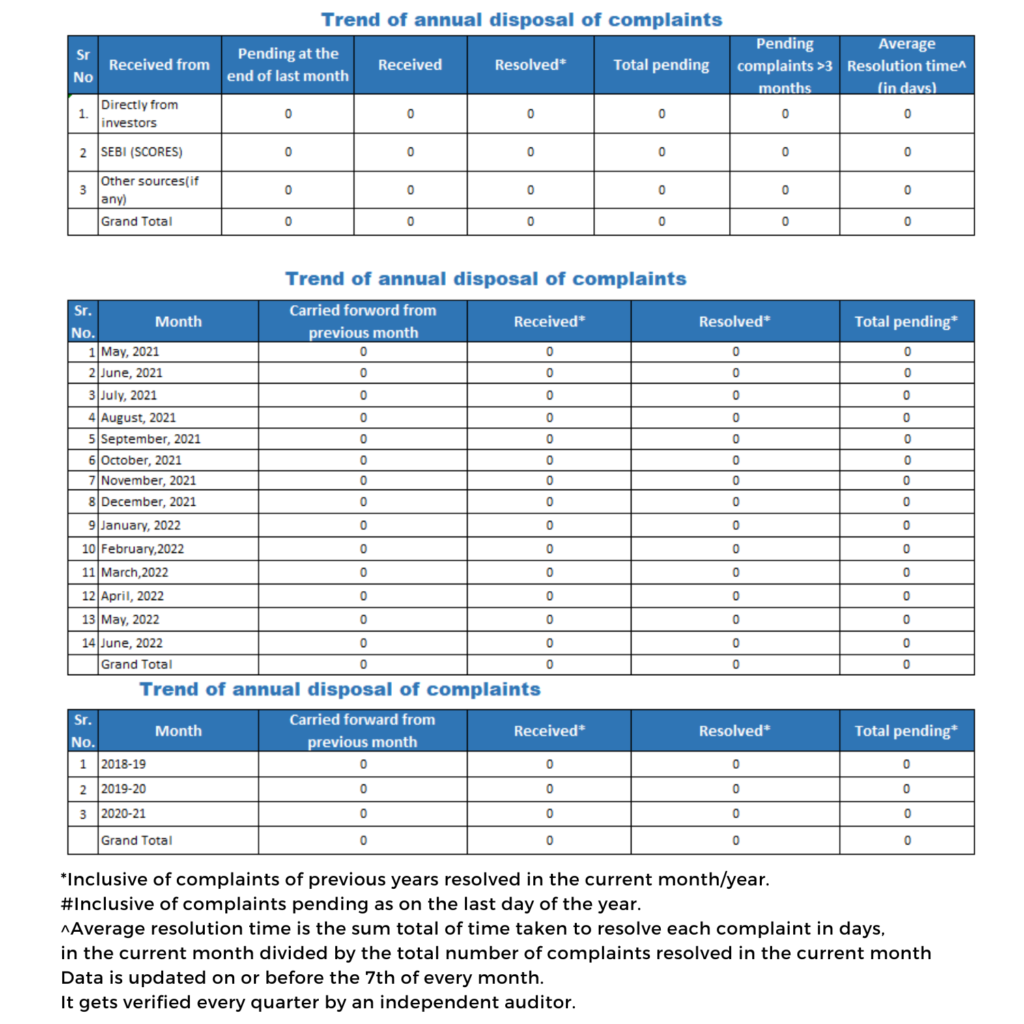

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.