What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

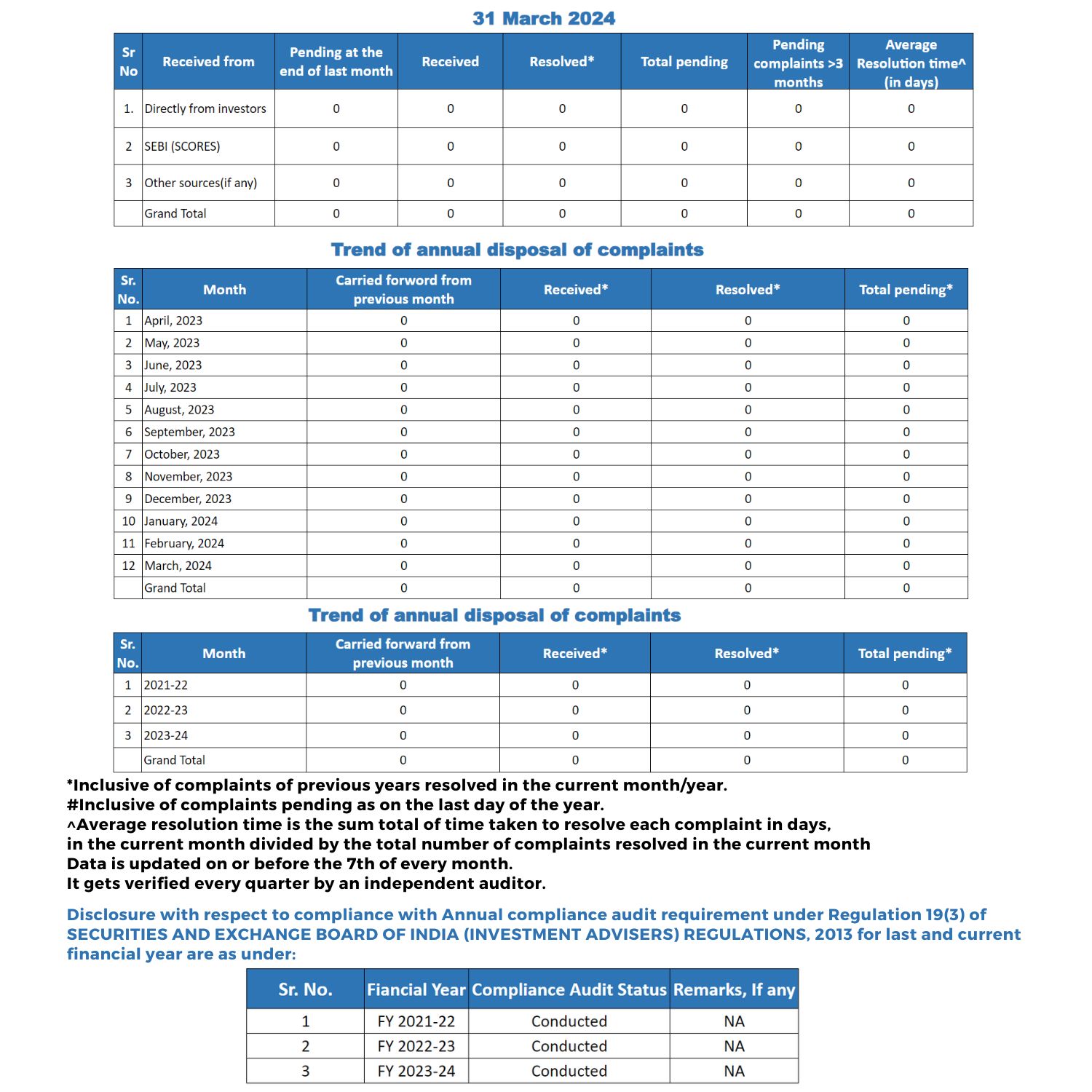

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one of the largest drivers of export revenue for the country.

The industry currently contributes about 7.7% of GDP and is expected to contribute about 10% by 2025.

The whole world looks toward India as IT Hub. Well, the prime reason for India having an edge in the IT sector is due to the availability of highly skilled, english speaking and less costly, manpower.

The below image will highlight some key insights about Information Technology industry in India.

The pandemic has highlighted the importance of having a proper IT infrastructure to ensure the efficient continuation of businesses and accelerated the push towards digitalization across the globe.

Did you know, IT companies are known to carry negligible to no debt on their balance sheets.

As no major capital expenditure (CAPEX) is required; focus is on providing services based on man-hour and skills. This enables companies to generate high profitability and return ratios for investors.

Especially in times of currency depreciation and market crash, it’s a golden opportunity for investors to clean their portfolios and replace them with ever consistent, IT stocks. These are mostly blue-chip IT stocks which are performing well and have impressive past records to verify.

The IT companies in India like TCS, and Infosys have a major portion of their earnings from foreign markets and this means that these companies earn in foreign currencies.

With the depreciation of the rupee, these export-oriented companies earn more due to the currency conversion. This is one of the main reasons for the demand for IT stocks.

The need for technology has gone up multi-fold and we have a sector that is basically catered to by the Indian IT services companies. This is one sector where Indian companies have almost no global competition.

Many Prominent market analyst strongly believes that a very large part of the portfolio should be dedicated to IT services because risk rewards are fairly good in this sector.

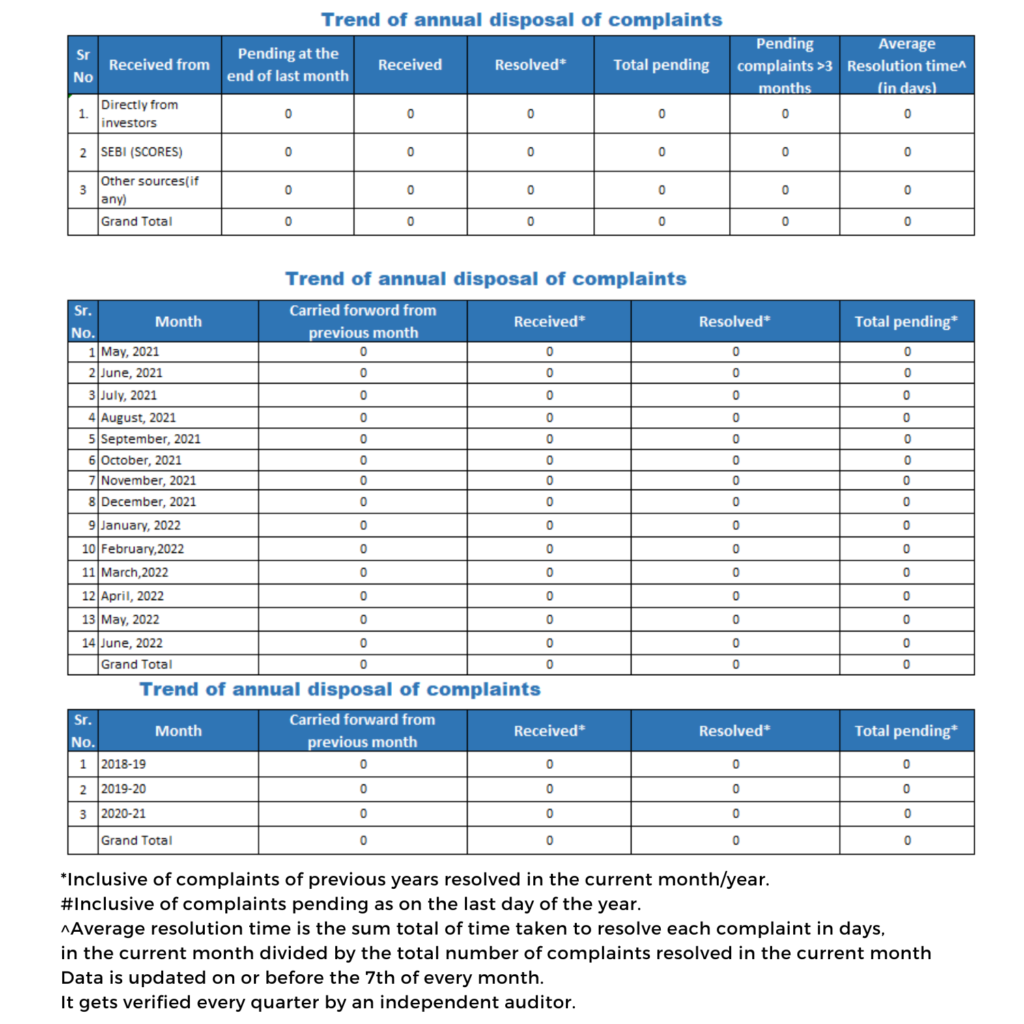

Now let us understand our argument with the help of 2 blue-chip companies – TCS and Infosys, the dominators of the IT sector.

Looking at the below image the past history suggests that; These companies break their All-time highs in approximately 2 to 3 years, even during worst draw down phase.

◾ TCS stock price is: 3141 ◾ All time high was 4043

🔷 If TCS makes an all time high in next 15 months, you stand to earn (+28%)

◾Infosys: 1474 ◾ All time high was 1953

🔷 If Infosys makes an all time high in next 26 months, you stand to earn (+32%)

It is been 9 months since all time highs were made in TCS and Infosys both. We are aware that, statistically these two companies take 21 month (TCS) & 35 months (INFY) to make an all time high.

Now I can sense your brain is all fired up with this awesome info.

Things are not easier as it sounds especially in stock markets. Once you invest considerable amount into these stocks, how would you react to bad news like the following?

The rupee is losing its value day by day, inflation has crossed the RBI-mentioned monetary margins.

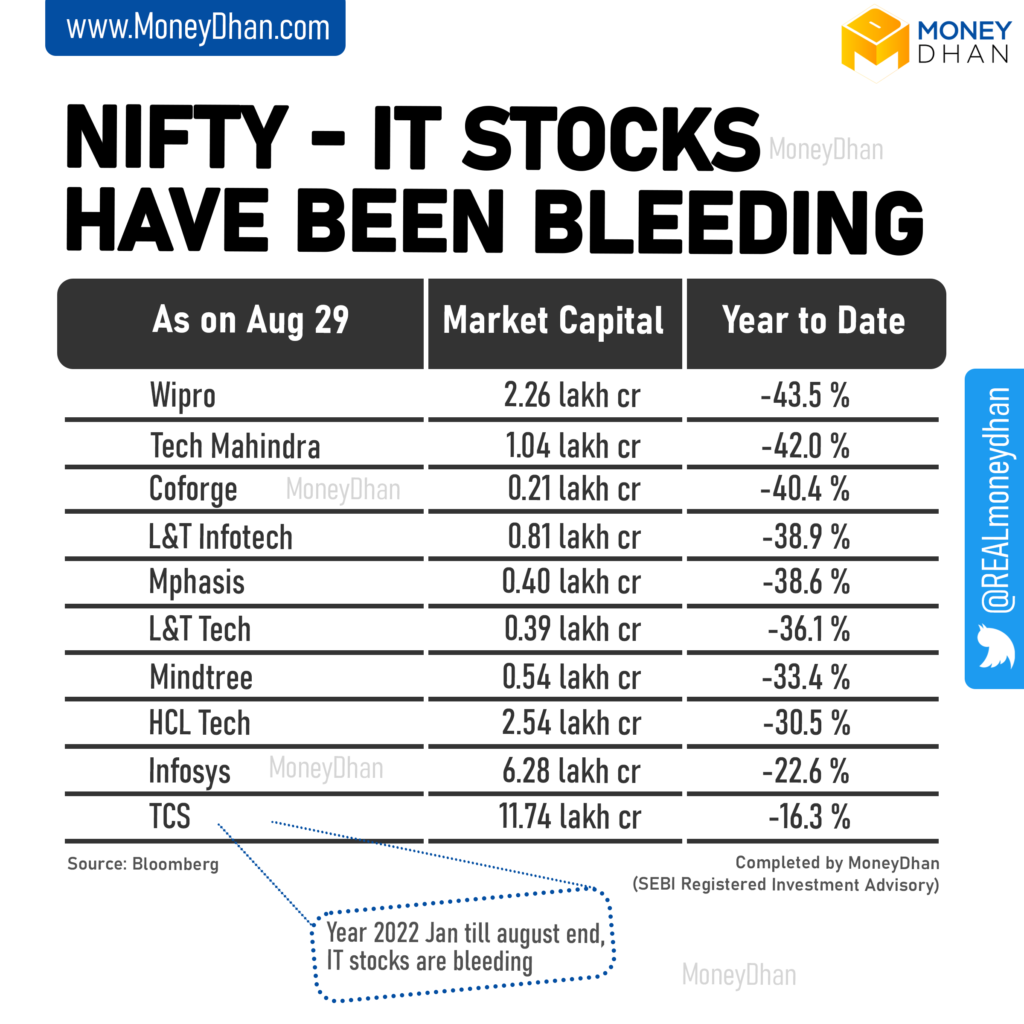

Of course, the IT Sector will definitely get affected like other stocks. They have already dipped considerably since all time high of January.

Cross-currency headwinds and spiked inflation that results in salary increases for IT companies might possibly exaggerate the difficulties for Information technology Industry. The head-wind affects particularly in terms on operating margins.

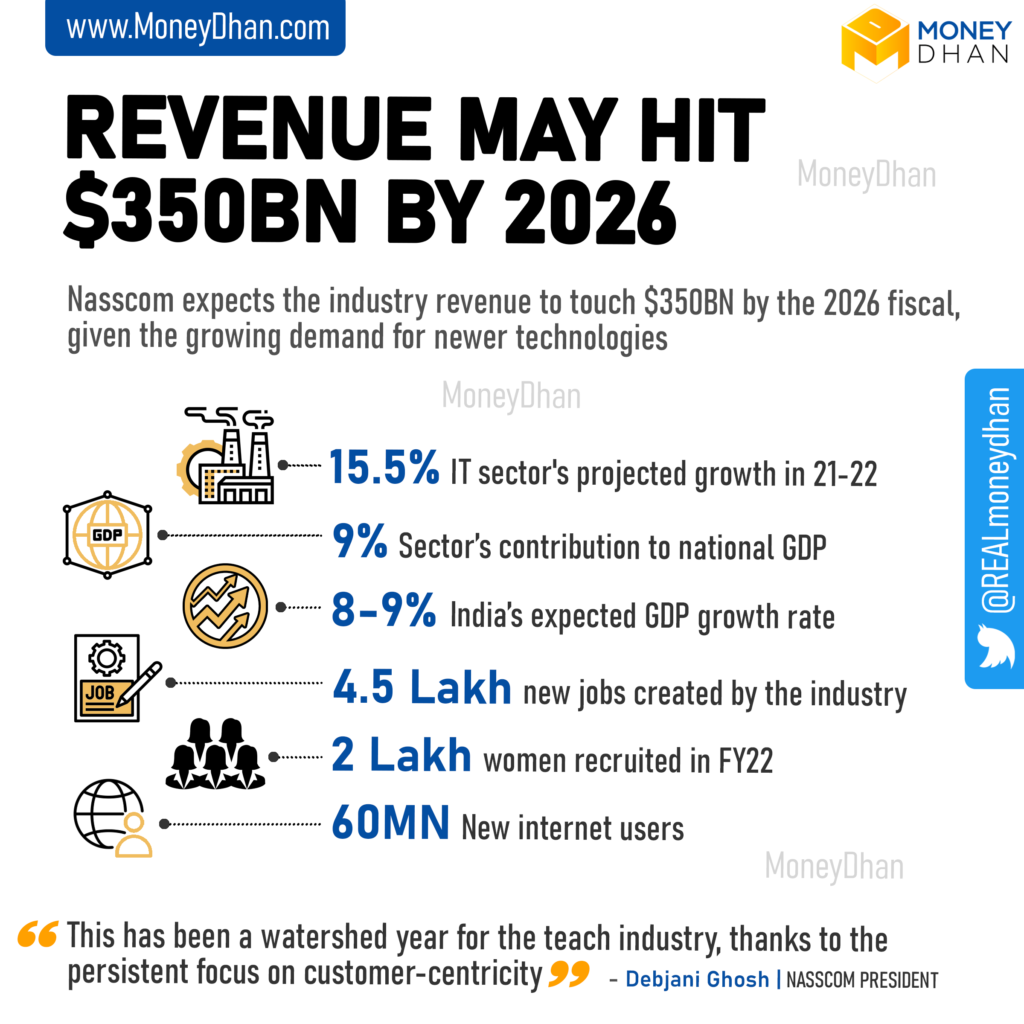

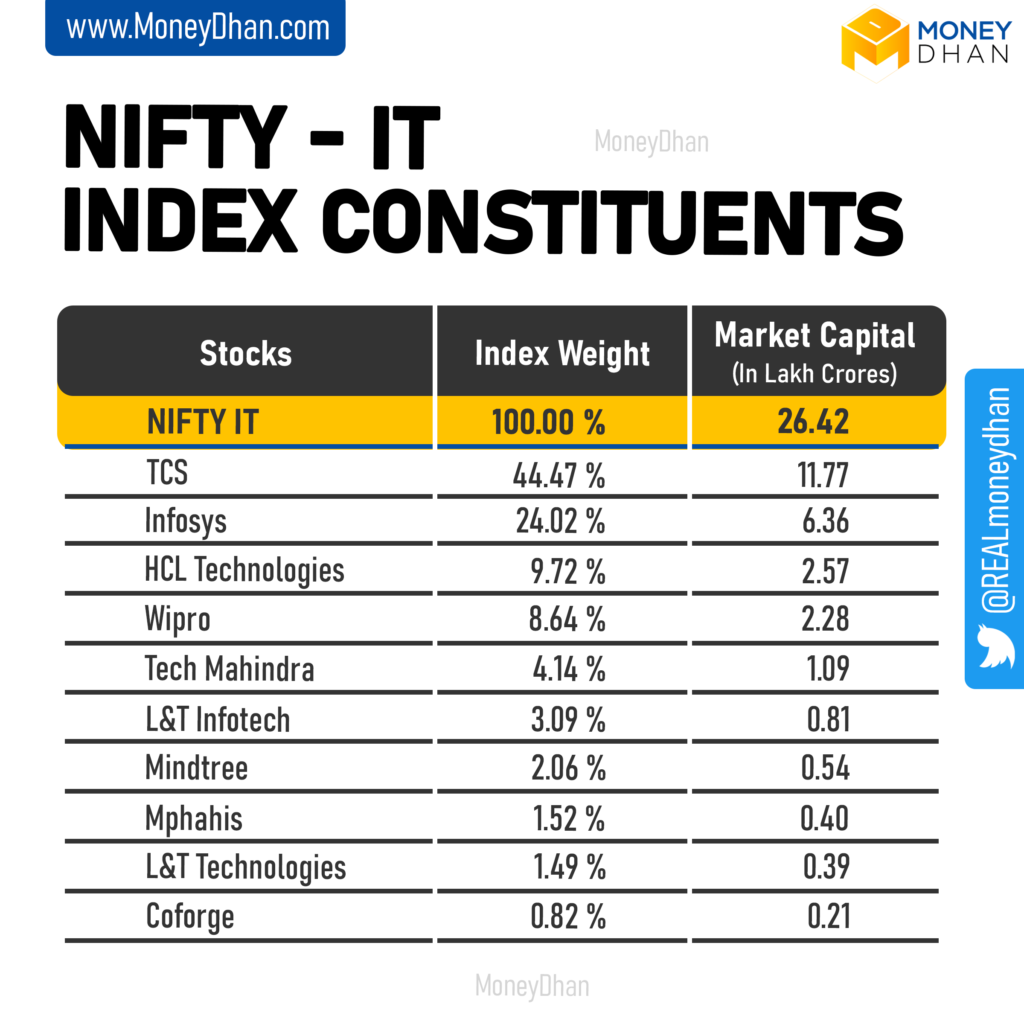

Since we are talking about IT stocks under pressure let us zoom out and understand the Information Technology Index itself. Nifty IT index.

Below is the

Notice how TCS and Infosys combine to dominate at 73% of the index weightage? This means for every 100 points up move in Nifty IT index, 73 point is contributed from these two stocks.

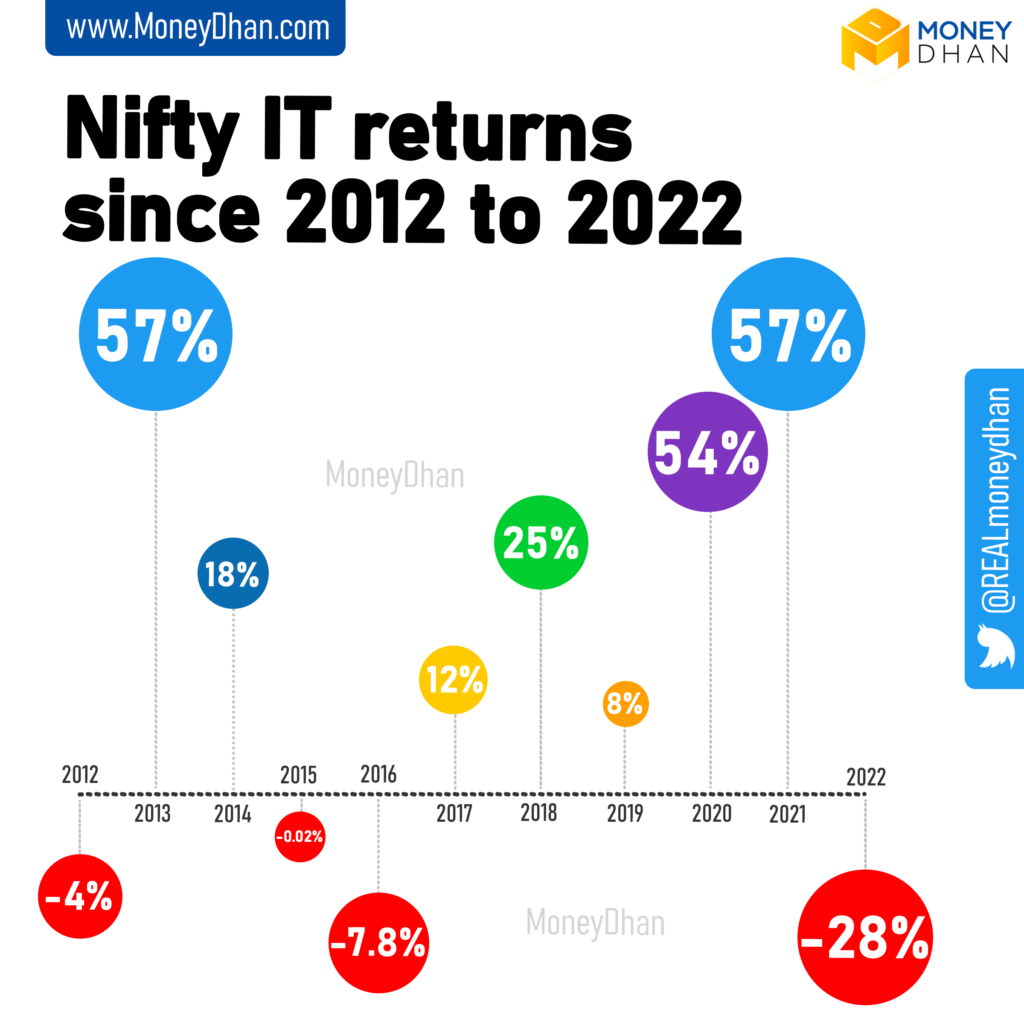

Now did you know, since 2012, this is the worst year for Nifty IT index so far? Nifty IT index is 28% down for the year 2022.

It did fall hugely during march 2020 covid lock down. However it made a year end close with 54% positive returns.

What if Nifty IT index closes 2022 year positive? (This is September 2022 now, 3 months remains for year end).

Above given images of the nifty chart depict nifty IT returns in the years from 2012 to 2022 and in every year it has given positive returns, except for 2016 it went little downhill but gained momentum again and gave a positive result for consecutive 4 years.

For year 2022, what does the negative return of 28.33% say?

The shocks to the downside is almost done. Henceforth you will have low volatility and a very decent return.

This year has been a painful one for short time investors in IT index. But for long-term investors, guys who will hold these for more than 3 years, it’s not a big deal as the returns are definitely going to rise in the future. For long term, this is a blessing in disguise. If someone had “chicken out” in march 2020 when everything fell in stock market, this 2022 fall is your second chance.

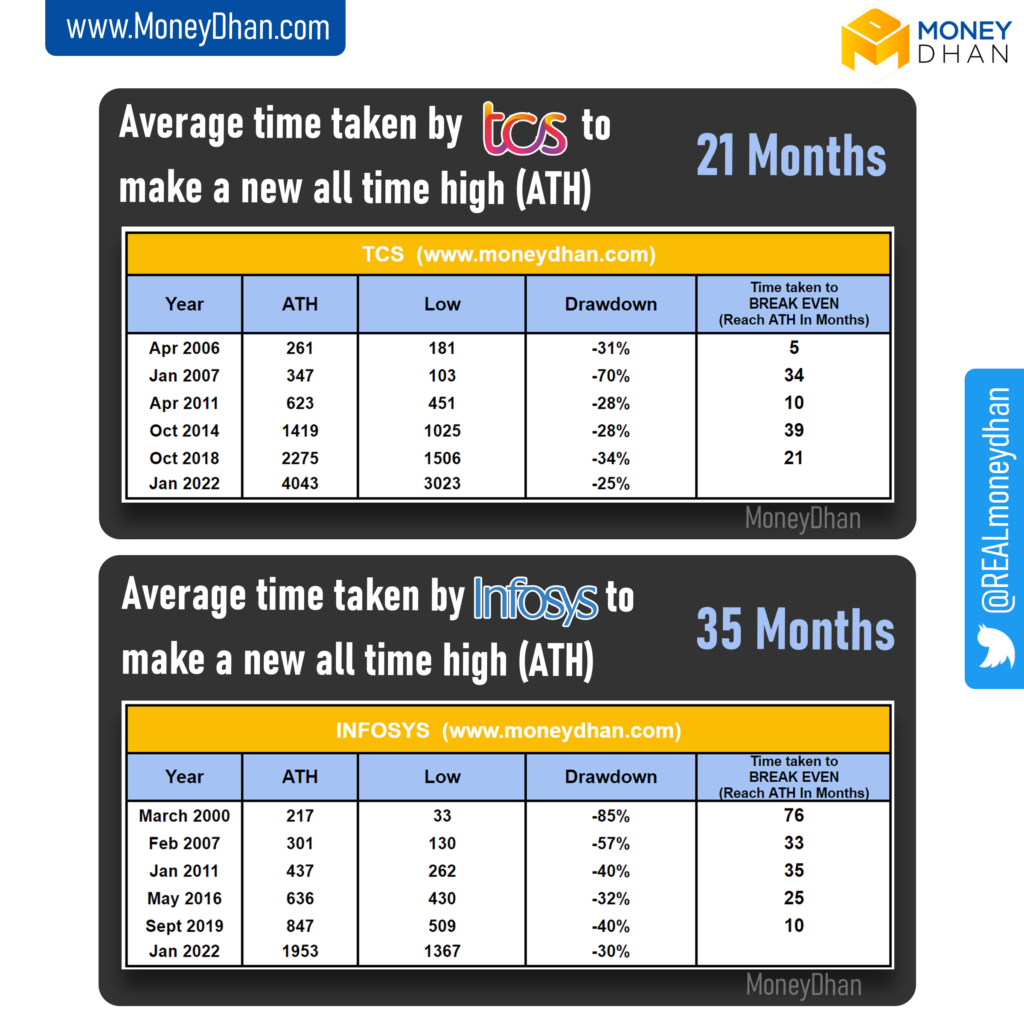

Falling share prices indicate a lower valuation for the company. This is confirmed by the stock market by examining its Price to Earning (PE) ratio.

To provide a reality check, we obtain the PE ratio from the company’s actual earnings and price.

PE will decline if earnings do not support its increasing pricing.

That is what occurred in the past two years for the IT industry; A board market rally raised IT equities before results could support them. and once the market made a correction, the PE ratio considerably dropped to overcompensate for the unnecessary increase in valuation.

Now that we have an exact price, we can shop. As we stated at the blog’s beginning, “Revenue may hit $350 Bn.” By then, we shall ride the IT industry’s fact-based swing.

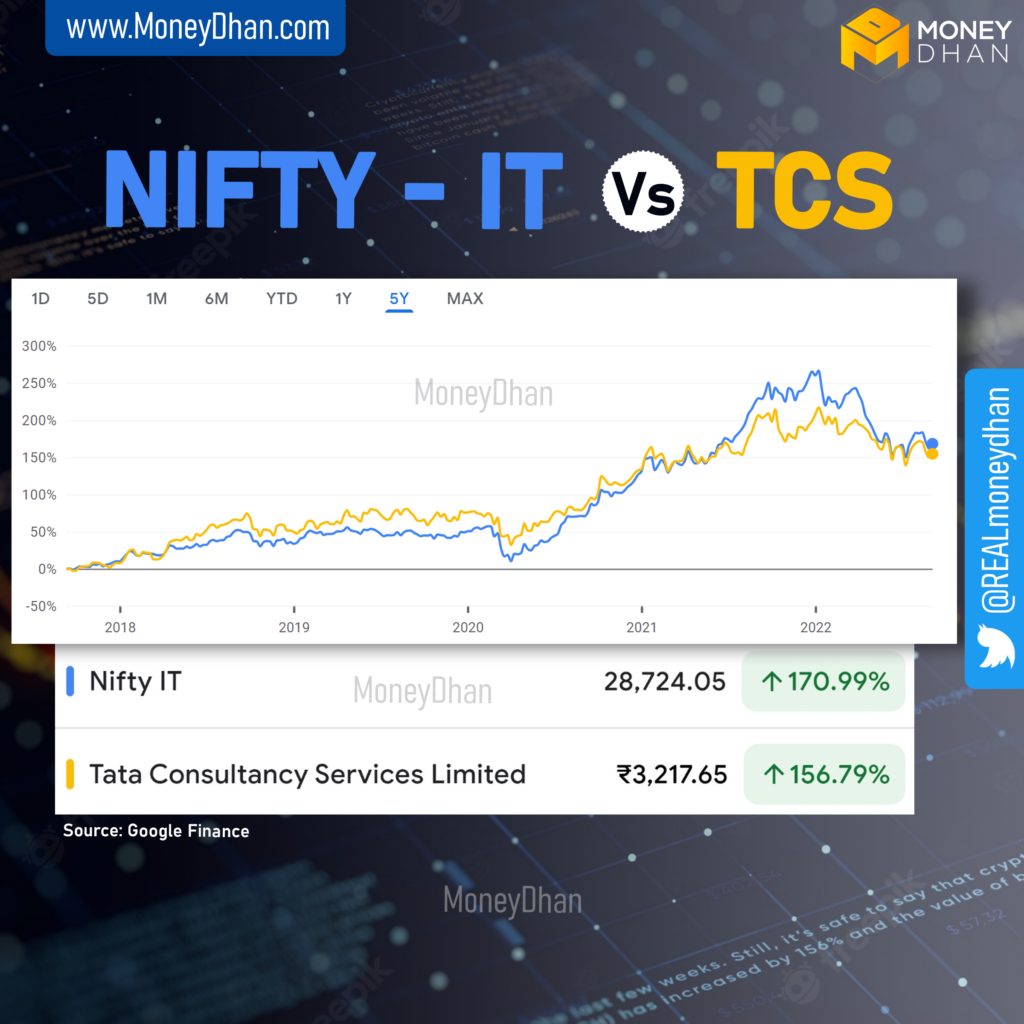

So we at moneydhan.com always go with the Elephant in the room: TCS.

Check the below image.

TCS is a 11.74 lakh crore company while Infosys is just 6.28 lakh crore company (half of TCS).

TCS has dropped by just 16% this year. Lowest amongst all its peers. Its funny how just 1.26% percentage movement in TCS, is equal to an “unicorn start-up” valuation. (8000 crore market value = 1 unicorn start up)

TCS drop of -16.3% tells us that, it resists drawdown. Also this means, in upcoming better it is poised to shine like a bright star.

The conclusion we can draw from this is that IT stocks are worth buying but the present environment needs to be analyzed in every aspect before taking any bigger steps.

The challenge is not in buying this TCS or INFOSYS stock. Anyone with common sense will buy this stock for 5 lakh rupees. But can we buy TCS for 30 lakhs ? You will loose sleep over it.

You do not know the CEO name, its balance sheet or future growth prospects. We (moneydhan investment advisory) are professionals who commit time to read everything on it. We do not fear investing large sums in such stocks.

As an SEBI registered investment advisor, we are not in the business of stock recommendation. The names are very popular. Everyone knows these stocks. We are in the business of, managing your fear.

We have confidence to buy 50 lakh in TCS stock. You will stop at 5 lakh. That lack of conviction and confidence cannot be transferred.

Every stock will have a bad phase. Satyam was equivalent to today’s infosys , in year 2006. It went down.

Bad news affects stocks. They do go down at times.

But since we are full time in market. Our ears are on the ground. We will get the hint before hand, we will exit that stock before it is too late.

A newbie cannot make such moves on time. Right?

Since 2020 our world is accompanied by uncertainty so a hawkish glance over the market every time is needed to make good gains.

→ CEO https://wordpress-964111-3368265.cloudwaysapps.com Investment Advisory

→ Whatsapp us http://wa.link/p3d57p

→ SEBI-RIA INA200016193

→ Free to hire us

→ Guidance in Building Equity Portfolio + Short term 𝐅&O

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

Did you know this, Nifty Index can never go to zero. Even if reliance or TCS goes to zero, nifty won’t go to zero. Reliance

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.