What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

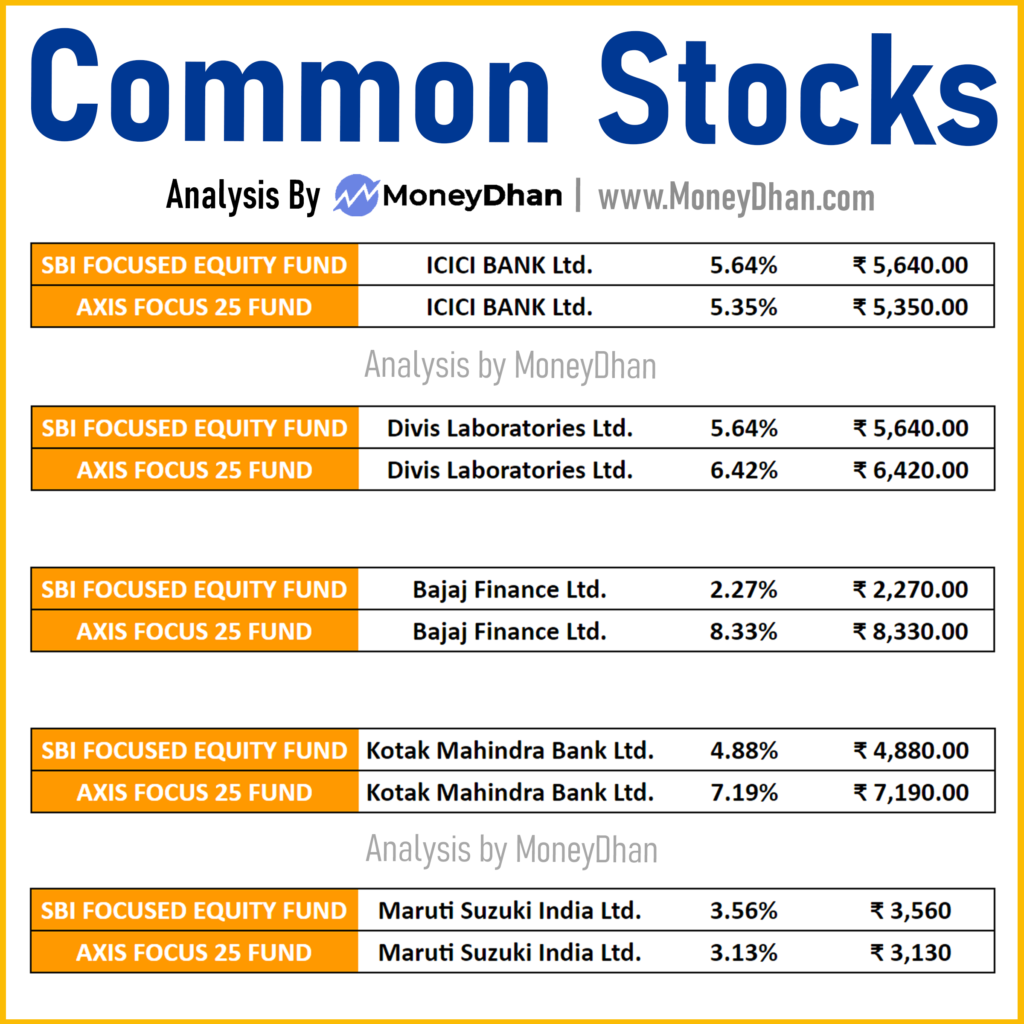

Every mutual fund manager has just few stocks to choose from. Therefore, most Mutual Fund houses will have similar stocks. The below ones are the common stocks.

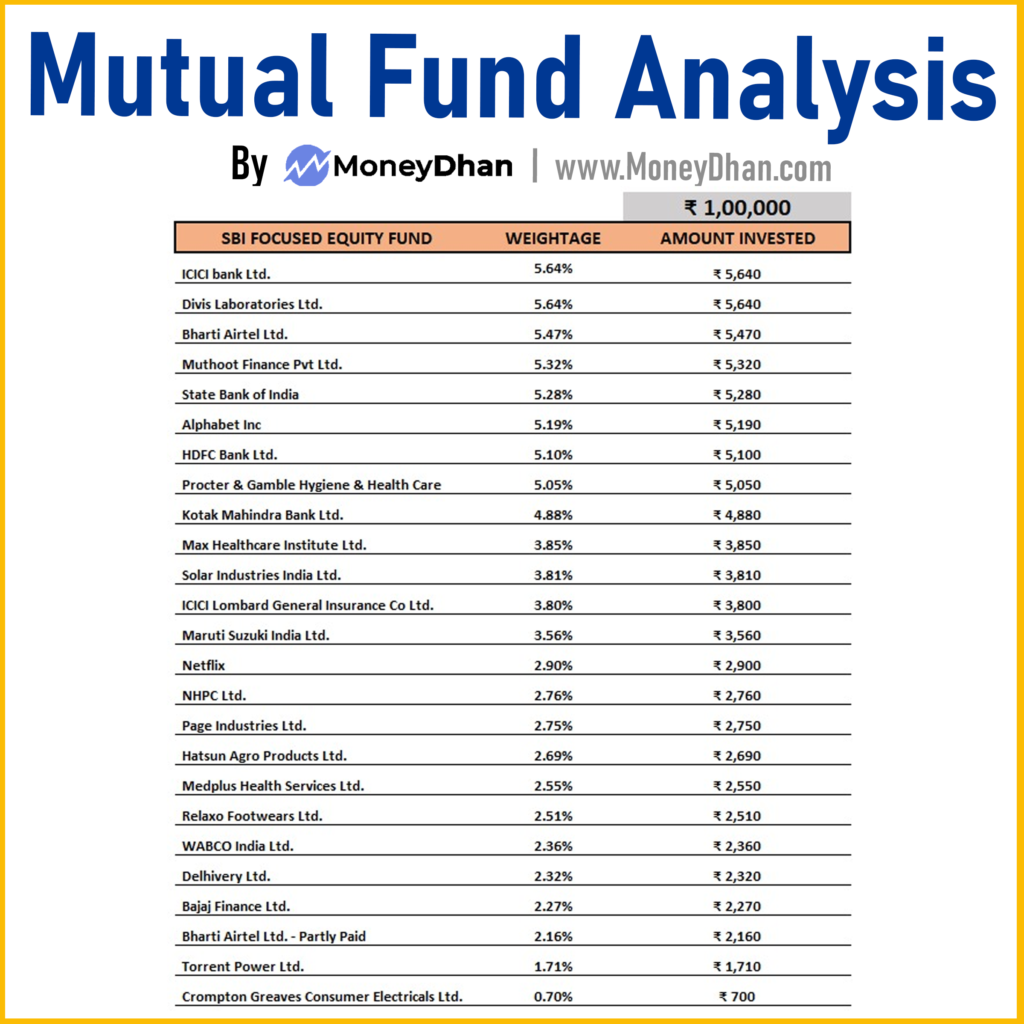

SBI Focused Equity fund has Equity Holding: 90.27% | F&O Holdings: 0.00%

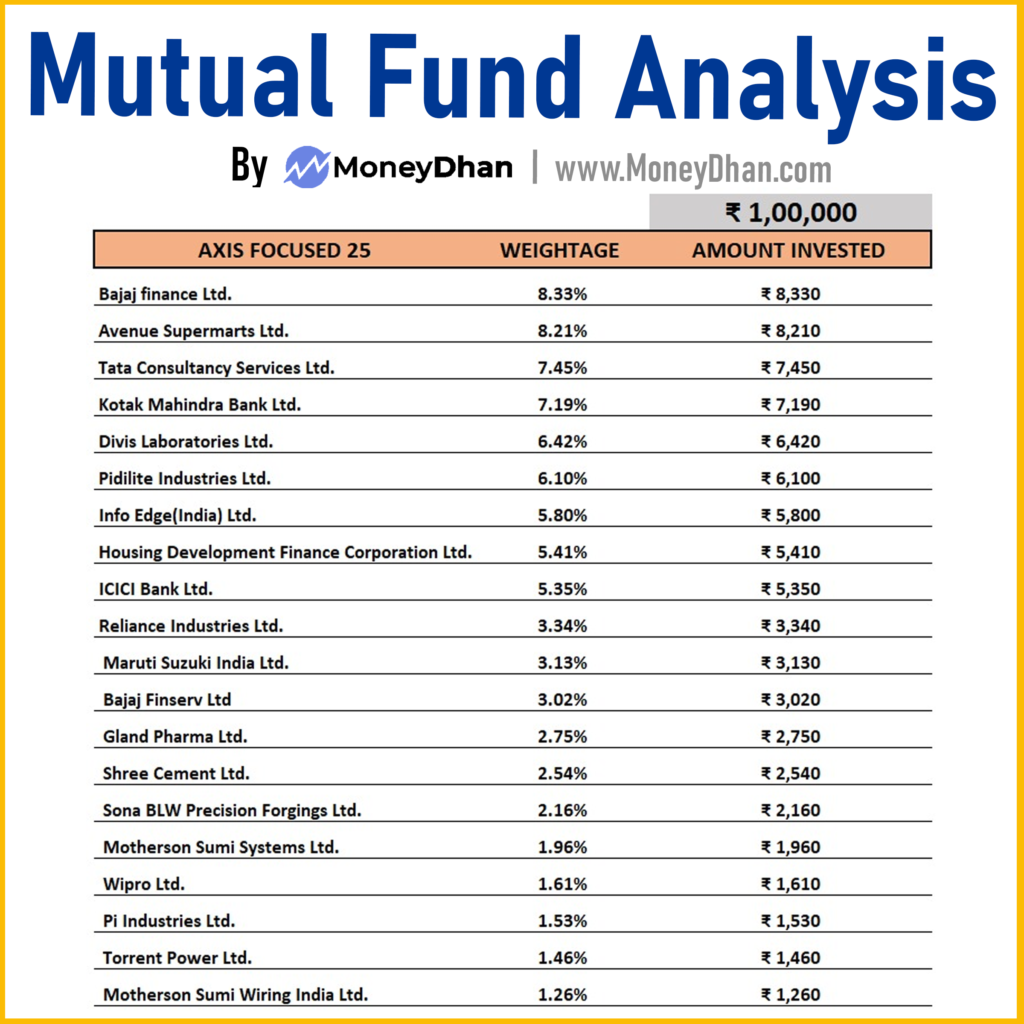

Axis Focused 25 fund has Equity Holding: 84.29% | F&O Holdings: 6.90%

Notice the F&O hedge component in the Axis-focused fund while the SBI Focused Equity fund is truly focused on just Large cap equity!

Data tells us that SBI fund also has more exposure to debt part than Axis focused 25 fund.

Debt Holdings SBI Focused Equity : 9.73% (Out of 1 lakh, 9,730 rs in Debt) Axis focused 25 : 8.27%. (Out of 1 lakh, 8,270 rs in Debt) Debt part helps the portfolio to lower the volatility during erratic market movements and brings in fixed income component.

Also Axis focused 25 uses 6.9% money in FnO holdings to hedge. This Hedge works both ways. It can generate extra income if market falls. But, it limits the potential to earn good return, when there is a sudden rally in underlying stocks, which are hedged.

Axis focused 25 comes with 1.85% expense ratio while as sbi focused with 1.65%. This simply means Rs.1850 per lac invested in axis focused 25 vanished and similarly Rs.1650 for sbi focused .

SBI focused has 90.27% equity which brings volatility. During a good bull run, this MF will beat the Axis Focused 25 equity fund hands down! Vice versa, SBI Mutual Fund will give bigger draw downs w.r.t Axis MF due to higher allocation to stocks.

From its data of fund size , Axis focused 25 with 16,700 Cr size 310 Cr per annum. No obligation on performance. SBI focused with 23,800 Cr size 390 Cr per annum. Again, No obligation on performance.

Given this data, I will invest in SBI Focused Equity, because they put 90,000 of my 1 lac in Equity. Also, Higher proportion in large cap companies. And they charge me 1650 rs per annum for the service which is less than Axis focused 25 fund.

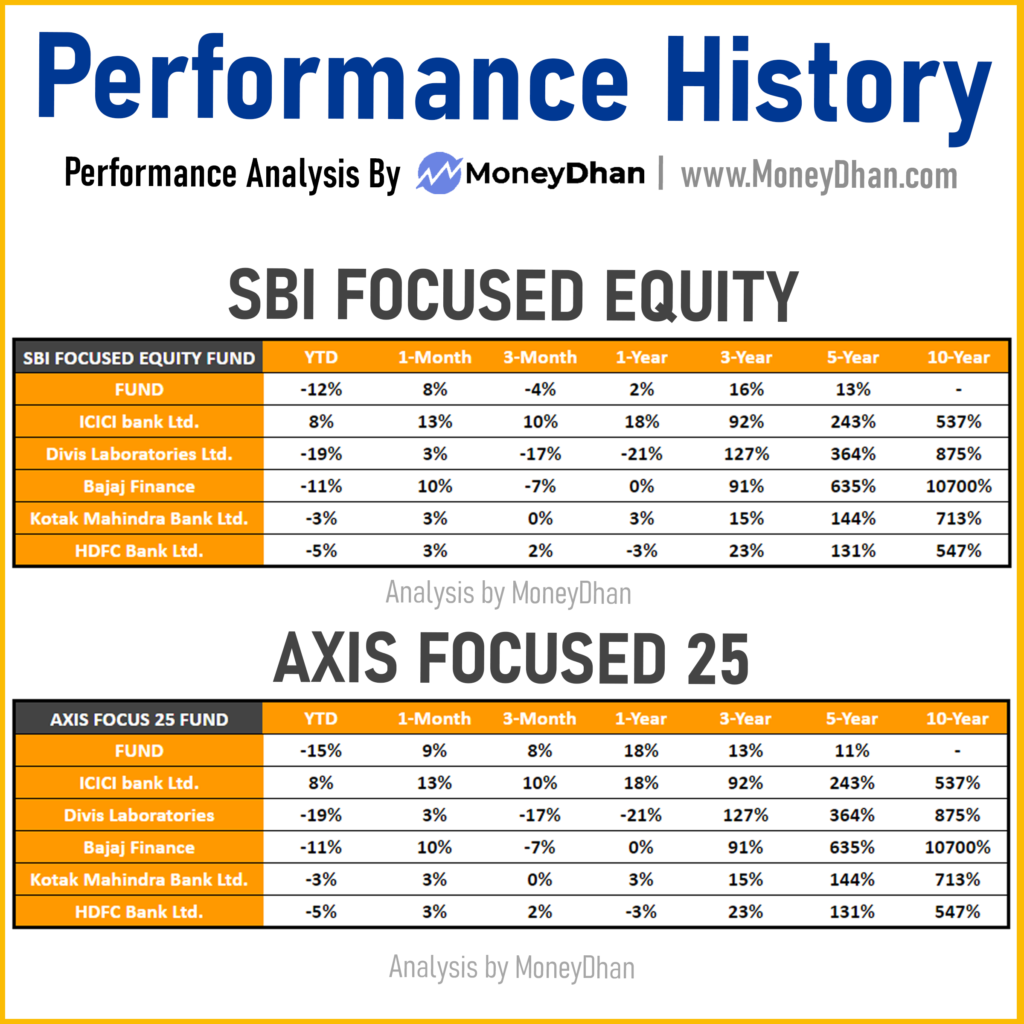

See below images, Both the funds cannot beat individual top holdings of their constituents.

Both are never going to beat direct equity. Especially their own top 3 holdings.

When we compare in last 1 year performance between both seems similar. However in long term SBI Focused Equity will definitely beat Axis Multi cap.

Sujith⚡ Investment Advisor SEBI

Whatsapp: http://wa.link/p3d57p

Twitter: @REALmoneydhan

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.