What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

MONEYDHAN INVESTMENT ADVISORY

As SEBI registered investment advisors, we at www.moneydhan.com cannot make you exit or Invest without proper due diligence.

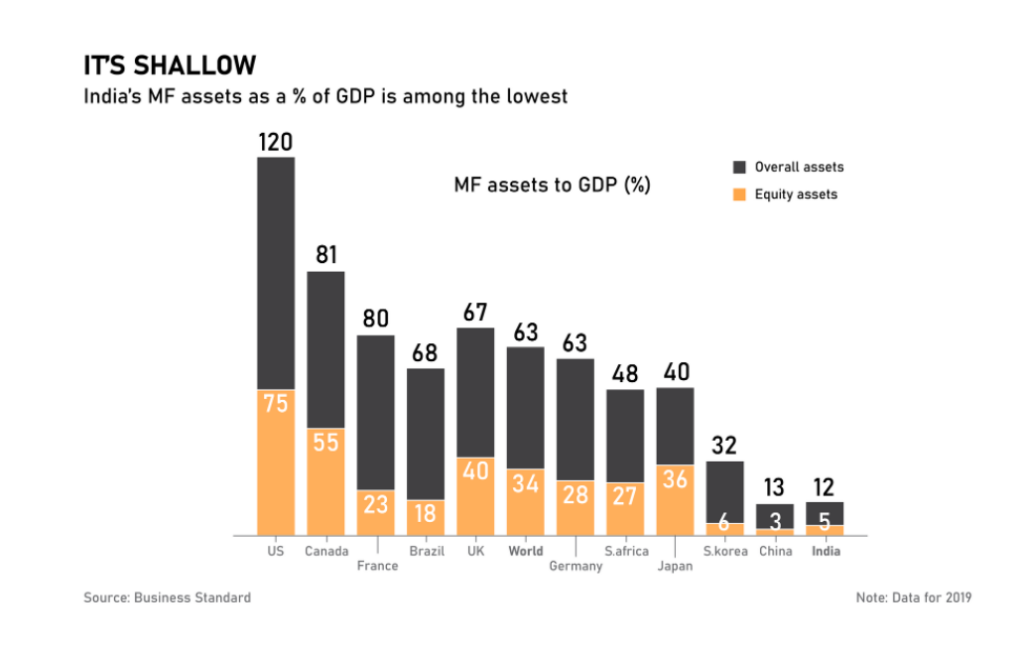

India is at the lowest among countries as MF assets wrt to GDP (2019 data)

So as a statement, we say this is the underpenetrated sector. Potentially multi-bagger opportunity we can expect for MF Stocks. Let’s recap what happened to past IPOs

81 times oversubscribed Listing gain was 20%

NOW

1) Reliance Nippon Asset Management Company:

3% return (since Nov 2017)

Max Drawdown : -52%

83 times oversubscribed Listing gain was 65%

NOW

12% (since Aug 2018) Max Drawdown: -25%

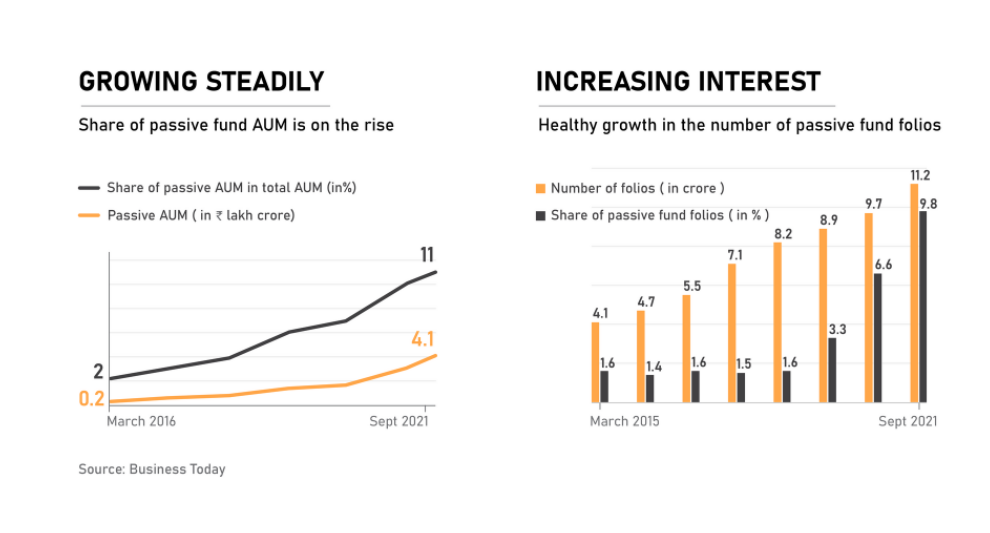

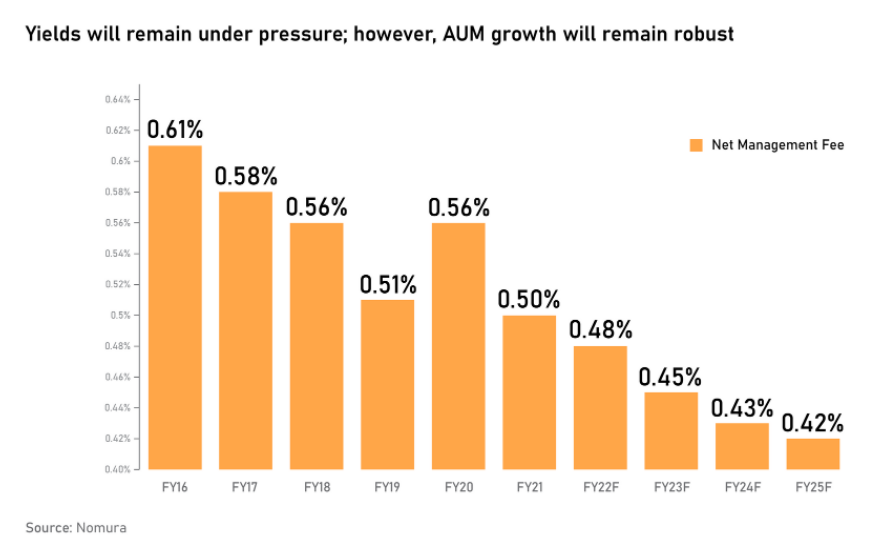

Customers show an inclination toward passive funds than actively managed funds. As passive funds are simply mirrored funds of indexes which removes the need for fund managers.

Investors got to know that directly paying 1% of AUM as a fee for fund managers eats a big chunk of their returns. New investors are with the supplement of information.

Currently, funds charge around 0.30% – 0.50%

So, there are enough chances that fees will increase more and more in the coming years. The investment industry is getting expensive by hiking the expense ratio.

However, without skin in the game. They receive the fee even if the customer doesn’t make a profit. The expense ratio ensures fixed cash flow for companies.

So, MoneyDhan asks, for 10% of the profit share

10 thousand for every 1 lakh profit

or,

1.25 lakh as maximum fees if you make

12 lakh profits whichever is lower, in the client’s favor.

Sujith ⚡ Investment Advisor SEBI MoneyDhan.com Investment Advisory

Twitter: @REALmoneydhan

Whatsapp: wtsAp http://wa.link/p3d57p

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.