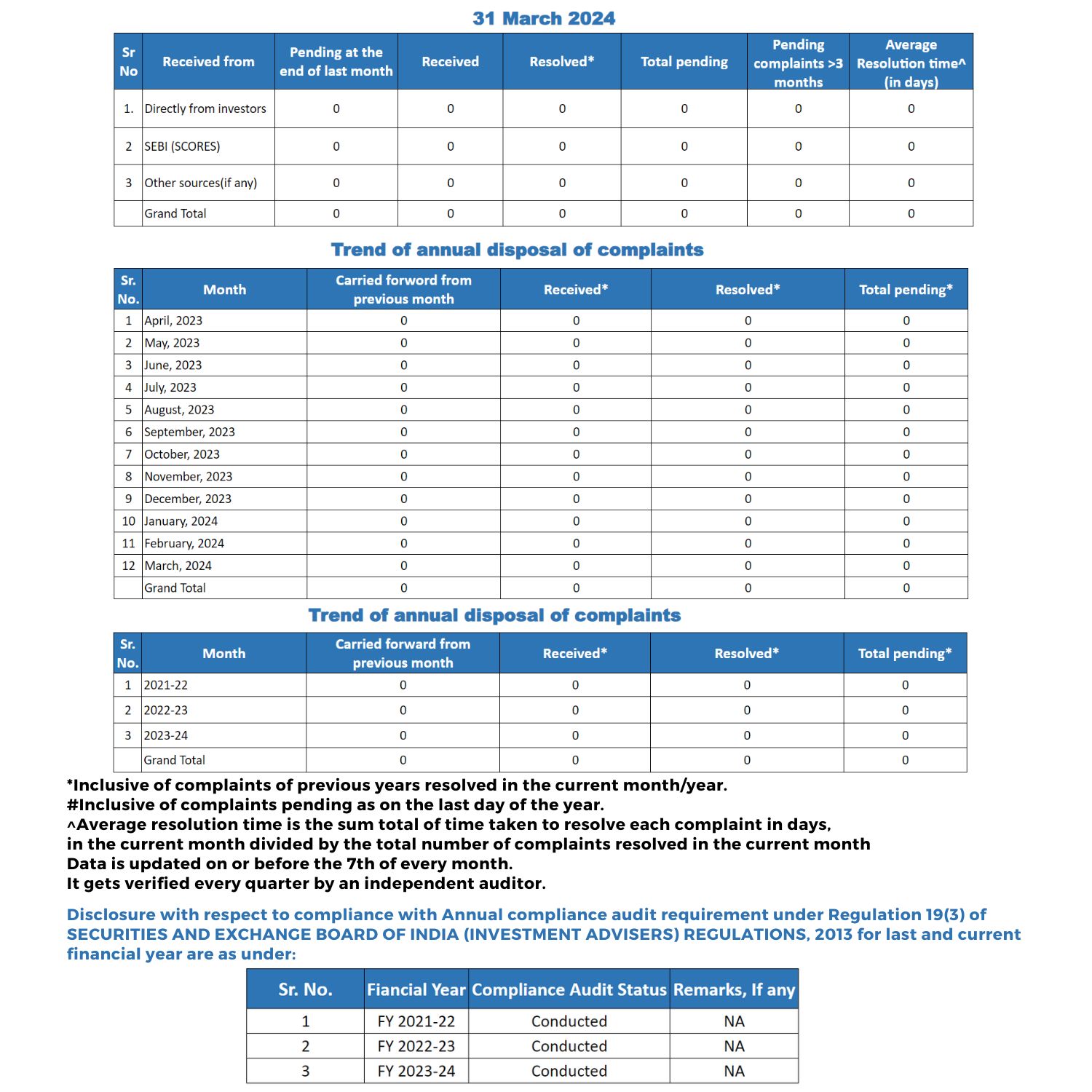

High ROI

Fixed Loss

Nifty Index Direction

Nifty Percentage UP move

Created On

Maturity Date

Maximum Return

Maximum Loss

Minimum Capital

Our Fees

Just one time trade, Executed in your own broker’s Demat account.

It takes just 5 minutes to enter the strategy, guided by us via Email.

We provide Follow up on bi-weekly basis.

Once strategy is entered, you can go on a vacation.

The broker will do the ” auto-exit” on last day in your absence.

The money gets credited back from your broker to bank account the next day.

Premium Module

₹1,000.00

1 Lakh Rupees

Ends on Date 29th March 2023. Can exit anytime in-between. No Lock-in

18 Thousand Rupees

7 Thousand Rupees

(+) 18 %

(-) 7 %

Premium Module

₹1,000.00

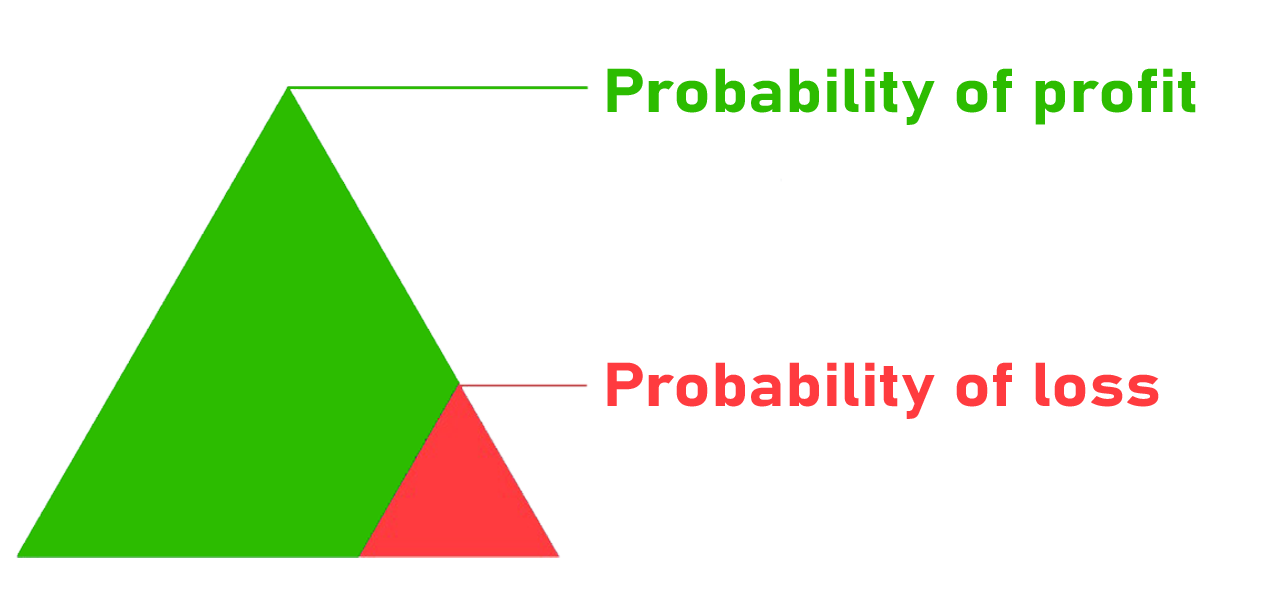

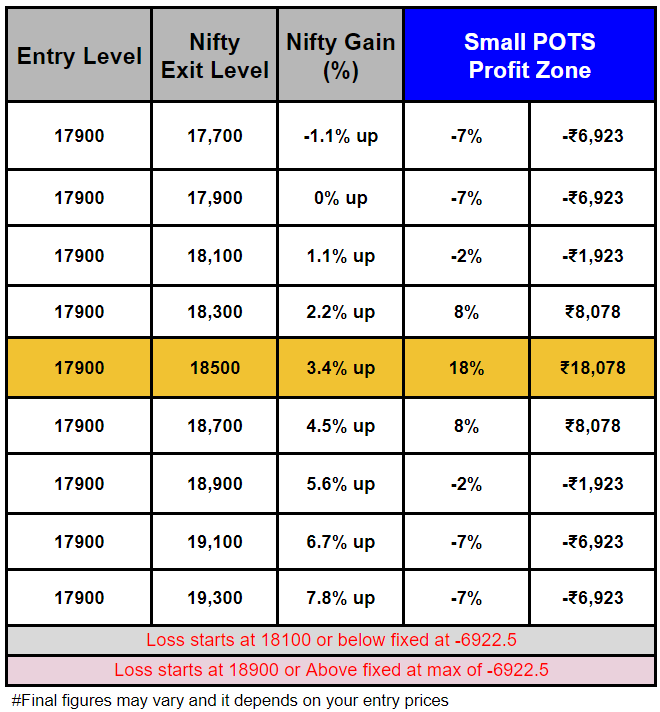

If Nifty closes at 18500;

on date 29th March 2023;

If Nifty closes above 18900;

on date 29th March 2023

If Nifty closes below 18100;

on date 29th March 2023

Once the entry is taken,

We can send you an excel of pre-defined payment chart.

There can be no un-known risk that could change the outcome.

Maximum Loss is pre-defined.

The options contract expires automatically on the pre-defined date.

Contract Outcome is guaranteed by National Stock Exchange.

You can test this with just 1 lakh capital and scale it to crores !

Premium Module

₹1,000.00

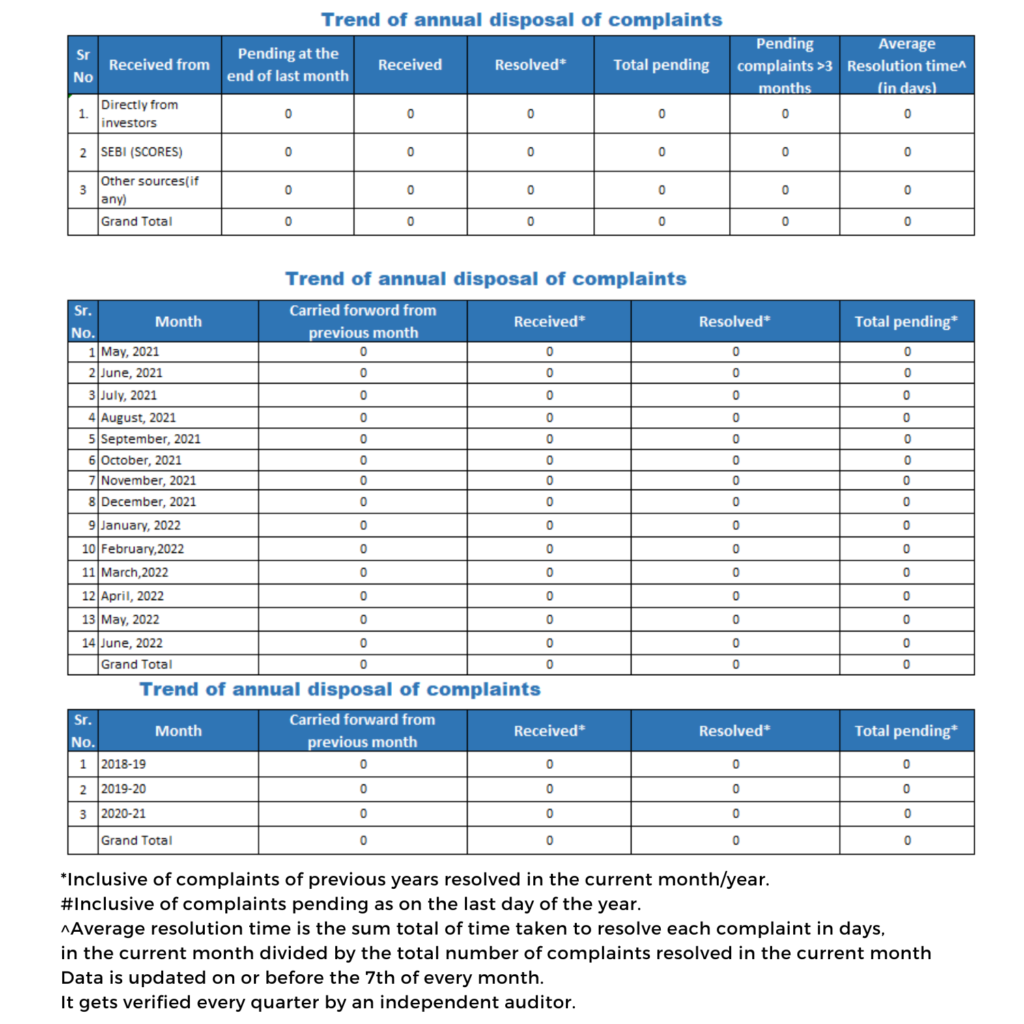

Profit Zone

Premium Module

₹1,000.00

Leverage is taken to enhance return.

When Nifty moves up by x%, Return will be 3X Plus.

Due to hedging strategy used here, The maximum risk is locked.

In-order to gain fixed Loss advantage, we have maximum profit fixed too.

Unlimited profit is not possible here.

Nifty must end up in a particular zone to get profit.

We have used quantitative analysis to give you high probability zone, for positive outcomes.

There are 2 simple steps to make an investment

Step 1: Complete your KYC here if not already done

You will have to submit your Know Your Customer details like PAN, Address proof details.We will verify them within 12 hrs. Once verified, you will be able to make your investment. This is paperless, you do not have to take any print of signature.

Step 2: Make payment to invest.

You can pay for your investment via UPI, Netbanking or bank transfer. Once verified by KYC team, we will send you the link via email for payment.

Asset used:

Nifty Index Options

Minimum Capital Required :

1 Lakh Rupees is required

Entry Load :

NIl

Exit Load :

NIL

Max Profit capped :

Yes. Max Profit is capped.

Max Loss capped :

Yes. Max Loss is also capped.

Lock- in :

NO Lock-in.

Pre-Mature exit is based on pro-rata

Fees :

1,000 Rs + Gst

As an Investment Advisor, it is our responsibility to show the power you hold with your Demat Account.

Nifty gave a negative close of -25% in Year 2011.

Since 2012, Nifty has always given a positive calendar return. It is akin to someone who is running a marathon for past 10 years. A negative calendar close is around the corner.

Mutual Funds cannot use leverage strategies to earn profits, in a down market. They are barred from doing so by Regulator SEBI. But an individual investor like you, can do short sell to gain when market falls.

Even if the fund manager is aware of recession or imminent fall, they will not Buy Put options or liquidate stocks.

Remember: If a stock falls from rupees 100 to rupees 50, The loss in percentage is 50%.

Same stock if goes from 50 to 100, The return is 100%. Needs Double effort to break even.

Nifty Beater crosses this Limitations of Mutual Funds

A Equity long only strategy with minimum investment of 50 Lakhs. The PMS managers advocate to hold or add more capital to average in a falling market. They are not allowed by regulator to short sell or take leverage on the upside.

A stock broker is someone who could help you with short selling strategies. However they seek constant activity from you, for their brokerages. Here Nifty Beater executes just one trade for one year. Brokers are not your friends.

Every theme based stock portfolio will witness losses when nifty goes down. Non of the products with smallcase can generate profit when nifty falls.

Last 7 years, Nifty never gave a negative close. But Thats a record meant to be broken soon.

Yes. You can exit at any time. You are in full control of your demat account.

Be informed that, the outcome depends on exit price, provided to us by Exchange via your stock broker. The intended result comes if position

Yes. You are in full control of your demat account.

Lockin means, if there any minimum commitment of time required before you can ask the capital back. Many Mutual funds charge ” Exit load at 1%” to discourage you from withdrawing money within 1 year.

We at moneydhan, An SEBI registered Investment advisory do not have any Lock-In nor exit load whatsoever. No strings attached. You can enter or exit at anytime.

But the desired result comes if you hold till contract expiry at NSE. ( December 2023)

As a Sebi Registered Investment Advisor, we can only provide you with guidance about execution via email.

You get the trade executed, by following our instructions, with your broker.

You own the Demat account, opened with your Stock broker using Your pan, adhaar etc.

An Demat is an electronic vault where you hold all your electronic assets. Its 100% safe and under your legal custody.

When Nifty Falls, the put options will increase in value, offsetting the losses in Nifty long exposure. This can help to protect the investor’s capital and reduce the impact of short-term market volatility on their investment goals.

In the context of the Nifty Beater product from Moneydhan.com, put options can be used as part of an overall risk management strategy to help protect against market downturns and preserve capital. While purchasing put options does come with a cost, it may be worth considering for investors who are concerned about downside risk in their portfolio.The cost envisioned here is affordable and negligible.

Yes. Using NRO account

Option 1) Email us on moneydhanadvisor@gmail.com with your name, requirement and phone number. We will reach out to you and assist you for onboarding.

Option 2) Fill your details in contact us in Moneydhan.com website . We will reach out to you and assist you for onboarding.

Option 3) Click on HireUS on NiftyBeater. It will redirect to onboarding platform where you need to fill in below details as per SEBI mandate

i) Fill your risk profile.

ii) Understand the suitability assessment and risk profile analysis according to your risk apetite.

iii) eKYC i.e You also need to authenticate your KYC details (pan card, Aadhar)

iv) eSign of Agreement using AADHAR otp. It hardly takes max of 10 minutes for onboarding. Thats it! Sit happily . Our relationship manager will assist you with your financial planning within 48 hours.

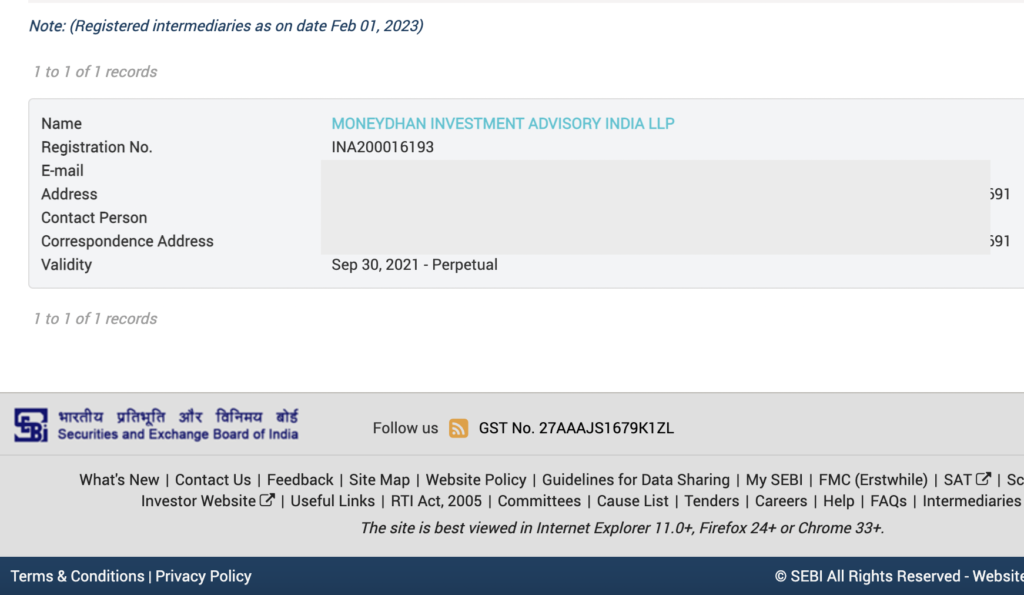

Yes. We proudly say that we are associated with SEBI. We are among the 1334 RIA at present in India.

Our registration number is Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual). You will be able to verify from SEBI portal.

We do onboarding. Only after you fill the risk profile and we understand your risk apetite then only we proceed with portfolio planning and proceed with investment advice.

5000rs/- Plus GST per 5 lakh capital deployed by you.

If you are exiting the Mutual Fund and buying bond, it is a personal choice. Buying bond will get you average 7% returns per year for sure. Nifty Beater will not give any return if market falls. Buying bond seems like a good option.

Liquidity is the major factor. We can enter and exit in Nifty related products easily, in comparison to individual stocks whre we might not get other side party for execution.

No. This performance does not include the tax calculation.

Every individual has there own post profit tax. We can provide you CA guidance to find your Tax implication, if requested.

Derivatives income will be taxed as Business Income.

Thus the tax is paid after your expenses incurred.

Side note:You can use the fee paid to us as expense as well.

For NRIs, options trading is considered as a non-speculative business activity, and the profits or losses from options trading are treated as business income. The tax rate applicable to business income in India is 40%, plus applicable surcharge and cess.

Individual,

Non Individuals like Partnership Firm,Corporates,

Hindu Undivided Family (HUF),

Trust,

NRI – NRO

Yes. IF you fear a fall in nifty price is possible. You can use NIFTY beater which will give you nifty exposure worth 9 lakh, with downside protection.

The risk starts once nifty crashes beyond 18%.

When nifty Falls till 12000 (At present 18300 at the time of writing this), Fall is 35% for your NiftyBees/ETF.

The Nifty beater loss will be 30% (loosing less is also beating)

We are SEBI Licensed Investment Advisory. Bearing Registration Number INA200016193

F&O income will be considered a non-speculative business Income.

Taxed as per your income slab.

Premium Module

₹1,000.00

Premium Module

₹1,000.00

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.