WIPRO

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

A rich Guy before making any investment looks at few needs

A tea seller sells his tea for Rs 10. While cost of making that tea could be just Rs 5. Here he doubled his capital at every transaction.

The catch is, he will hit a upper ceiling someday. He cannot sell tea worth 1 crore even in a month. He is not scalable.

Same holds true for other business like selling cloths/Garments. Good profit margin. Not scalable.

Again, An restaurant. Awesome profit margin, Not scalable

You see, when you put your own efforts , your reach is limited at some point. You will be forced to hire new people to support that business. This reduces the profit margin because now , your cost of production increased.

Ambani has reliance Retail though. They have circumvented this issue by hiring manager, keeping a procedure of checks and balances. But, their profit margin has shrinked to barey 10% over all.

Scalability is a big limiter. Smaller the business, bigger is your profit margin. As you scale up, Profit percentage shrinks down substantially.

Since its an daunting task to set up a business and grow it large yourself. Many Rich investors tag along with the already successful companies they know.

Think of it as sitting with this class topper all the time. You tend to mimic his approach towards studies and benefit with his company for sure.

how fast to double money is considered fair?

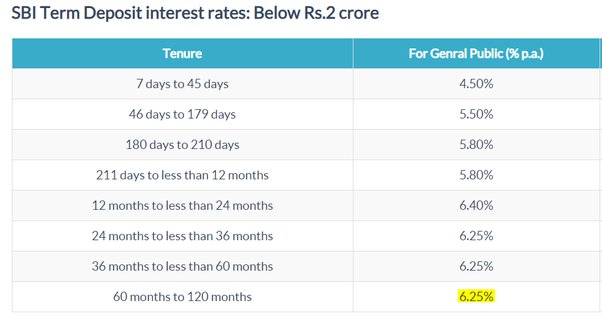

In india , Assured/guaranteed returns come via Bank Fixed Deposit. Check current Interest Rates:-

Using rule 72 ;

In 11.52 years (72/6.25), you will double you capital in India. zero risk. Zero time commitment, You can go for a vacation and be back to take double of your initial capital. It could be even 2000 crore into 4000 crore. Scalability is not an issue.

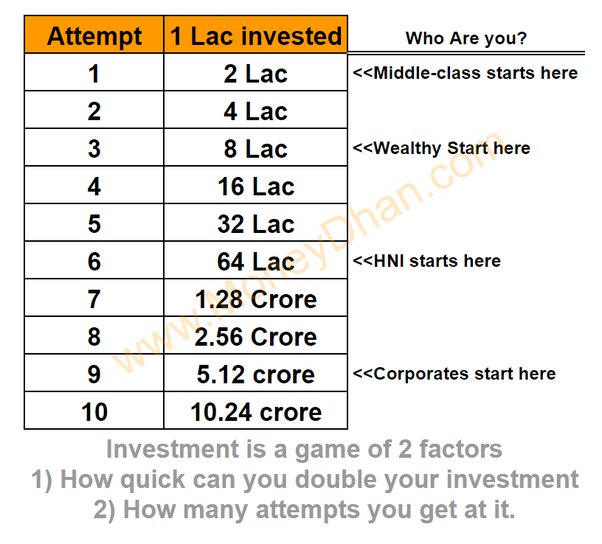

Lets assume, A human being starts to earns at age 20 & stays alive till 80. He/She can have probably 5 attempts with bank FD. (check the first image above)

Rich people want to double faster and get more attempts with any strategy they adopt. Their initial entry will be high too.

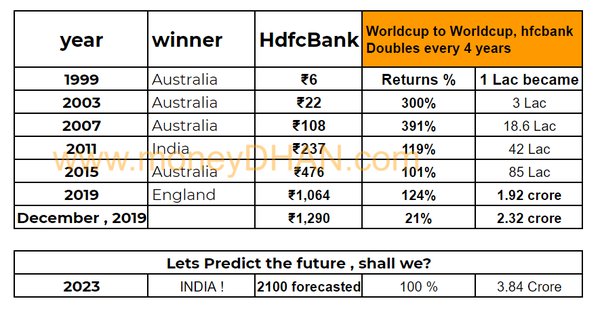

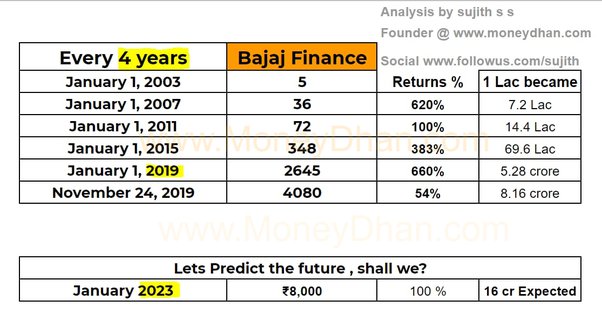

I believe,You got the point. Some business’s keep growing with a pattern of doubling at a fair time frame w.r.t risk free FD.

In 40 years, A person gets to do 10 attempts of doubling assuming, capital doubles every 4 years.

In 10 attempts, even a small 1 lac becomes 10.24 crore.

You ain’t gonna stop at just 1 lac, we both know that. You will earn salary and keep using these investment avenues to double capital ASAP with fair risk exposure.

This is how your “that” rich uncle made money. They bought some asset back in year 1990 and held onto it till 2020 (30 years). It was never an over night journey to richness.

Replace this Stock which is an asset, with any other asset like – real estate at a prime location, hefty quantity of gold , or some rare art.

Rich people stay rich by constantly doubling their networth as soon as possible.

Ofcourse they understand the importance of scalability & liquidity as well. You should be able to sell that real estate before you get stuck in a down turn market. That’s liquidity risk.

If you are reading me till here, Don’t be in competition with that uncle or cousin who is already rich. Maybe they started earlier than you or, they got few more doubling opportunities than you.

Chart your own path. Its always possible. It just asks for the right amount of patience. Getting rich is a choice. Not a fluke.

Remember a 10 lac per year salary forever is a bad choice, against one time 1 crore.

Because, if you can even manage to get 10% interest upon 1 crore every year, that is 10 Lac regular income per year, forever and…. 1 crore stays as capital.

Am in the business of handling your wealth and getting you rich. I ask 10,000 rs for every 1 Lac that your earn. Just like amazon’s COD.

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.