What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

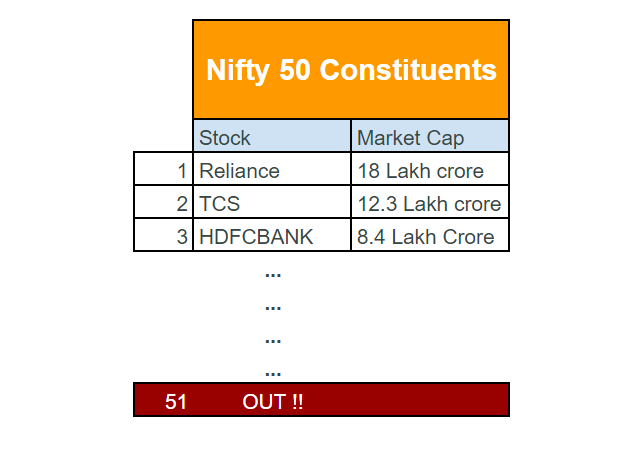

Even if reliance or TCS goes to zero, nifty won’t go to zero. Reliance industries is worth 18 lakh crore today August 2022 & TCS is worth 12 lakh crore, HDFC bank is 8.4 lakh crore.

They are India’s top 3 stocks. Like them, India’s top 50 stocks put into a single basket forms nifty index.

But nifty always pushes out the low performing lagging company and replaces it with those who are going up. Thus if reliance or TCs starts to fall, soon enough, they will be out of nifty. Replaced by other large companies. Thus nifty will never go to zero.

On the contrary,

People usually book “profits” in stocks that gave them good returns by going up. Cash from the exited stock gets transferred to companies which are “under performing”.

Like people who exited HDFC BANK to buy YESBANK when it was falling. These people do exactly opposite to what nifty index does. Nifty gives more money to growing stock and kills bad ones.

Also ironically, in real world, same human will give bonus to his best performing employee (won’t book profits by firing him). Duh! In share market people fire the good companies and buy the bad ones. They cook up good reasons like value buy/ profit booking etc.

Then eventually they underperform nifty index. Right? Nifty had satyam, rcom, yes bank, DHFL type companies at top once. As they lost their ground in business, nifty kicked it out of the list. This is why we as sebi registered investment advisors recommend you to buy nifty index.

Reason number 2

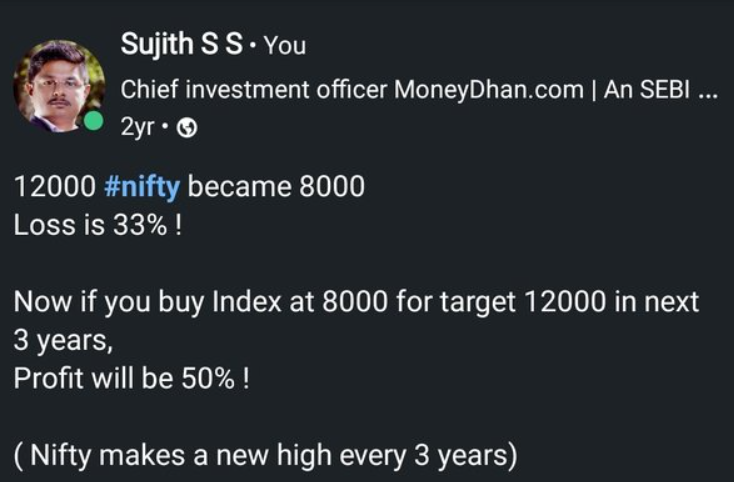

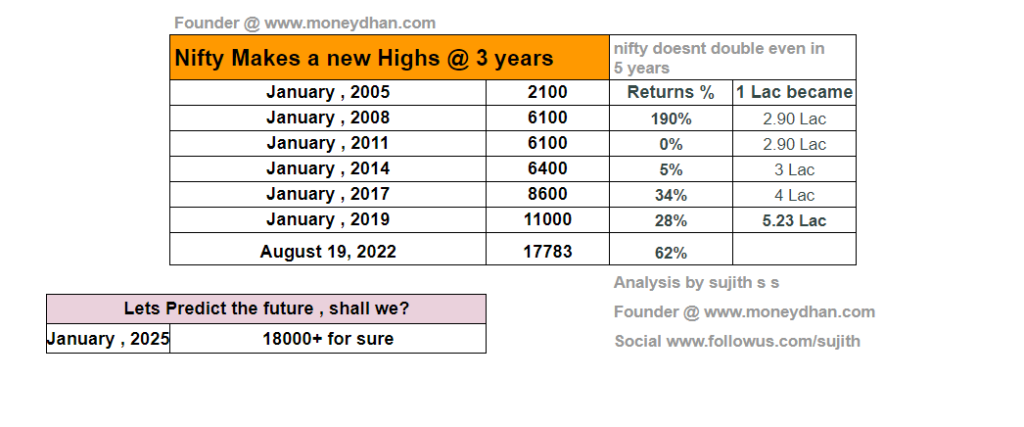

As an investment advisor, We want to protect our imagine, in case we are wrong. Did you know this, 𝗡𝗶𝗳𝘁𝘆 𝗺𝗮𝗸𝗲𝘀 𝗮 𝗻𝗲𝘄 𝗵𝗶𝗴𝗵 𝗲𝘃𝗲𝗿𝘆 𝟯 𝘆𝗲𝗮𝗿𝘀.

Which means, even if we are wrong today, you will thank me for advising nifty in next 3 years. 😉

The above image can be verified from simple google search. Nifty makes a new high every 3 years.

Imagine, You are working in a company. You will get hike only if you meet quarterly targets, set by the company you work for. Yes?

If quarterly targets are met by employee (you), company will show profit in balance sheet. If company shows profit, share prices will reflect it with a rally. If share prices rally, nifty index goes up. At grass root level, we all are working for nifty index to go up. If your company is not amongst NIFTY 50, still its client could be listed in NIFTY 50.

Keep adding Nifty index ETF Or associated stocks with high beta correlation with nifty. Think of those who kept adding Nifty at 9000 till 8000 levels in march 2020 (2 years back during covid crash). At that time, we were shouting even in linkedin to buy with target of 12200 (peak of year 2020). That was a cool 50% return.

The below image(black) is from 2 years back. When we were posting to buy nifty for target 12000. Logic was, nifty makes a new high every 3 years.

It was our luck that within 6 months nifty made a new high and continued to go up till 18600 in October 2021.

Since oct 2021, at the time of writing this answer is June 2022. NIFTY level is 15200. So by now you know why we always recommend a newbie person to buy nifty when, he/she cannot commit time to full time research nor, has the willingness to hire experts like us at their service. Now coming to the second part of the question. We SEBI registered investment advisor/Financial planners do not buy Nifty ourselves. That is true. Sounds ironical right? Let me explain, The reason we do no buy nifty because, we want to double of money in 5 years. We don’t want to just see all time high for our money in 3 years.

We have time, resources, skills to beat nifty. This is our full time work. If you can commit full time to market study, reading and research, then you too will sharpen your investment for faster wealth growth. Yes?

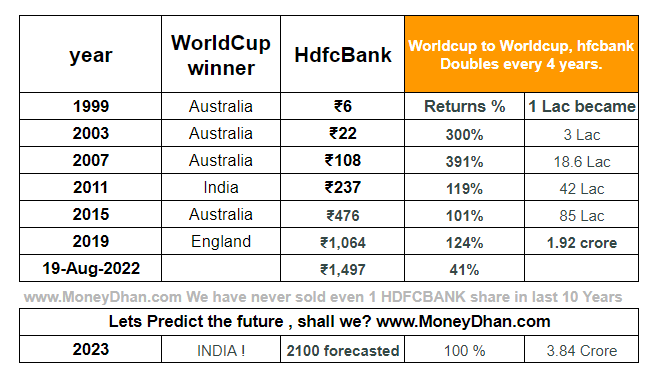

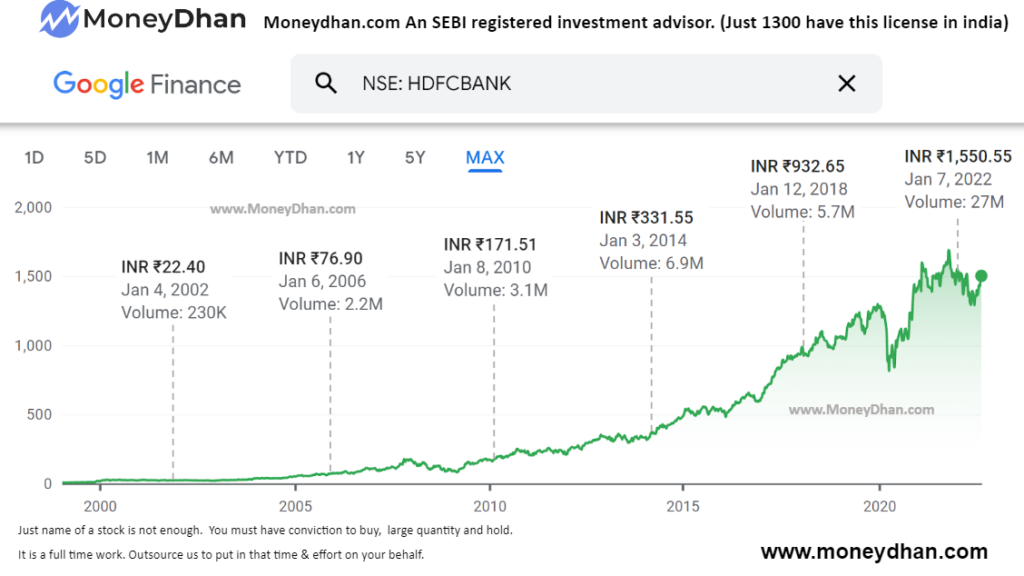

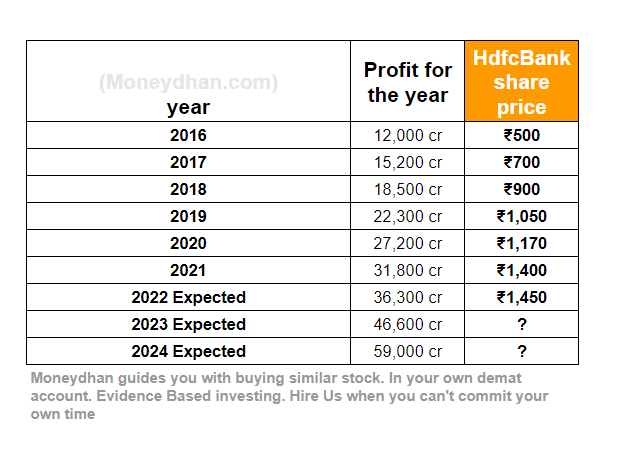

So, HDFC bank doubles every 4 years. Worldcup occurs every 4 years. We buy this stocks like crazy and never ever exit this. You can verify this from google charts too.

The challenge is not in buying this HDFC bank stock. Anyone with commonsense will buy this stock for 5 lakh rupees. But can we buy HDFC bank for 30 lakhs ? You will loose sleep over it. You do not know the ceo name, its balance sheet or future growth prospects. We are professionals who commit time to read everything on it. We do not fear investing large sums in such stocks.

As an advisor i am not in the business of stock recommendation. The names are very popular. Everyone knows these stocks. I am in the business of, “managing your fear.“

I have confidence to buy 50 lakh in HDFC bank stock. You will stop at 5 lakh. That lack of conviction and confidence cannot be transferred.

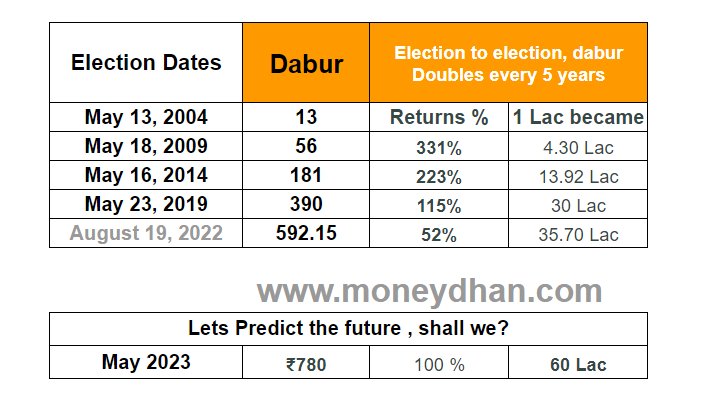

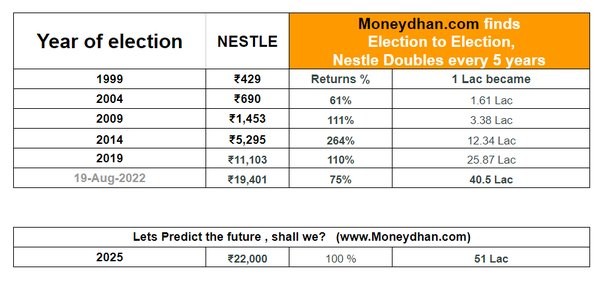

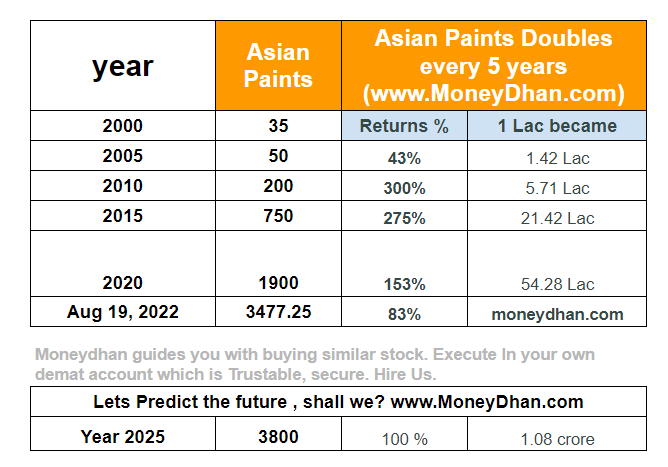

Let’s check other stocks that follow similar pattern?

So, when we are asked for an advise for free….We recommend nifty. It is safe. It is a basket of best 50 stocks. You will not abuse me for recommending nifty.

Just few bad factors could make these stocks loose their growth and turn a looser in our portfolio.

But since we are full time in market. My ears are on the ground. We will get the hint before hand, we will exit that stock before it is too late.

A newbie cannot make such moves on time. I hope you got the answer.

This is Why do so many financial advisors tell their clients to invest in index funds when they themselves don’t invest in them?

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.