What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high.

I am going to put my neck out and say the following,

“Next year before December 2023, Wipro should be 100% up.

The stock is trading at 380 today and, It* should *cross 760 by December 2023″

Do note, i used the word “SHOULD”. I am not saying it “will”. The word should indicates high percentage of probability here. Its not 100% Sure, but the odds are very very much in favour of my prediction.

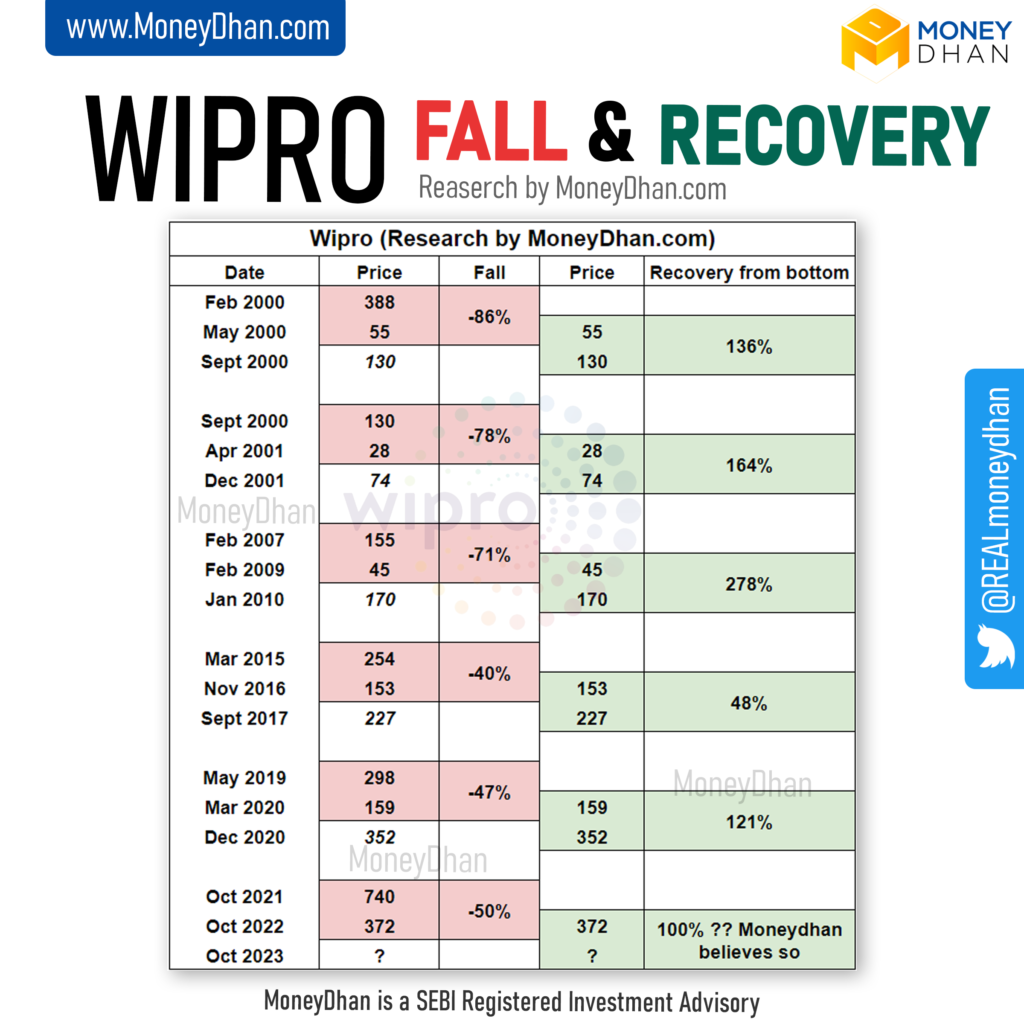

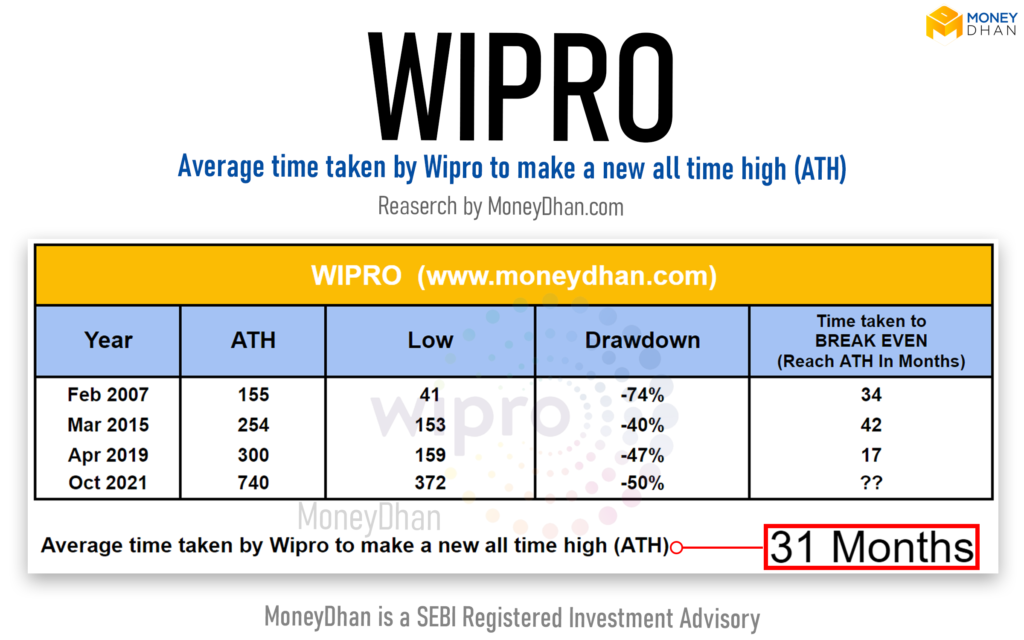

Check out the below infographic, we made

Between year 2000 and 2020, In the past 20 years, Wipro fell more than 40% from its peak not 1,2 or 3 but 5 times.

All these 5 times, we have witnessed a resurrection rally of more than 100% in the next 1 year.

Now October 2022, when I am writing this article, Wipro is 50% down from its all time high.Don’t you see the opportunity were this pattern could repeat again?

I know, your mind is stuck at one word. “Why?” What is the logic behind this pattern repeating. Why wipro share gave 100% again and again?

A business is as healthy as its profits. And Wipro here is a consistent growth oriented , profit making behemoth of an Information Technology company.

At our Investment Advisory firm MoneyDhan we have a quote hanging on office wall,

“We believe that although stock prices often react to emotion over the short term, they generally trade toward fair value over the long term. Therefore, if we are good at identifying mispriced businesses, the market will agree with us…eventually.”

Just like in 2015 and 2020, Wipro fell more than 40% first, and gave a stellar return later,October 2022 is presenting another chance.

A popular forward all around whatsapp is the following sentence about wipro,

10 thousand rupees invested in wipro , in year 1980 is worth 650 crore today!

But as warren buffet says,

For the nerd in you, I am going to post the numerical data here

1981 1:1 Bonus 200 Rs. 100

1985 1:1 Bonus 400 Rs. 100

1986 Stock split to FV Rs.104,000 Rs. 10

1987 1:1 Bonus 8,000 Rs. 10

1989 1:1 Bonus 16,000 Rs. 10

1992 1:1 Bonus 32,000 Rs. 10

1995 1:1 Bonus 64,000 Rs. 10

1997 2:1 Bonus 1,92,000 Rs. 10

1999 Stock split to FV Rs.2 9,60,000 Rs. 2

2004 2:1 Bonus 28,80,000 Rs. 2

2005 1:1 Bonus 57,60,000 Rs. 2

2010 2:3 Bonus 96,00,000 Rs. 2

2017 1:1 Bonus 1,92,00,000 Rs. 2

The current stock price of Wipro is about Rs356 per share, as of October 2022

Rs.356 × 1,92,00,000 = Rs. 6835200,000.00 i.e. about 683 crores .

But then you cannot predict future profit based on past growth. Warren Buffet is a person whom his competitors, friends and peers follow. He is a force to recon, in the world of investing. We should take heed to his words.

All we want is decent profit in next 1 year.Once you meet that goal, go and do your own due diligence and then decide, what to do at that point of time.

Firstly,The below image(black) is from 2 years back. When we were posting to buy nifty for target 12000. Logic was, nifty makes a new high every 3 years.

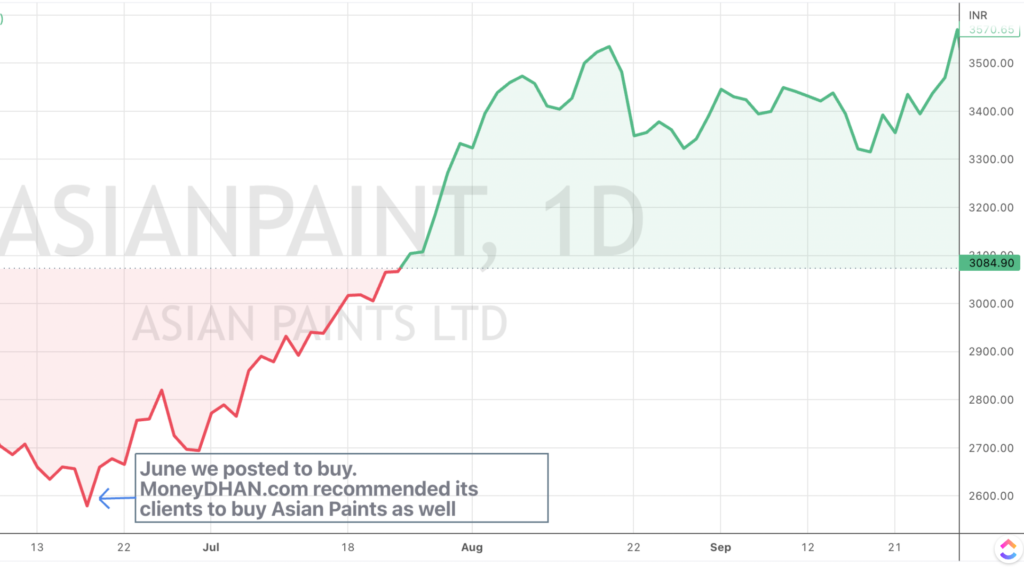

The above is linkedin post made in june 2022 with respect to Asian Paints. What happened next is easy to verify from simple google search for asian paints chart. I have done that for you below.

The above Asian paints chart was nice right?

Why don’t i show you, How Wipro chart is looking this year upto October 2022.

Digging a deep red zone for now. But hey, the fundamentals for Wipro are strong. The Russia induced fear of recession and decelerated growth fears have caused this fall in entire IT sector.

These are precautions against “what if situations”

Investing in shares has the downside risk, but that is limited. Shares cannot go below zero. You do not loose more than, what you invested.

For every 100% risk of loss, you could end up gaining 1000% returns.

This is because, upside for a share is never capped. While At worst , it can go to zero only.

A fun and painful fact is, our expenses are perpetual. They don’t stop until death. But your salary is limited till retirement. You are responsible towards your own future self aged 70+. These risk are mandatory, if you want to give yourself a comfortable life after age 70.

Also it is a harsh truth that, Most of us are a hospital bill away from being pushed to lower middle class. It takes you back by few years.

What if we are wrong?

In a remote case, wipro management does something erratic and take longer time. Data says, wipro should make a new high in 31 months.

In past 20 years (since 2002) Wipro has corrected more than 40% from its all-time high, 3 occasions.

Since October 2021, it is down by 50%.

Stock price was 740 in October 2021

Bottom was 372 in October 2022.

Historic data is not a complete fact sheet.

However, the management capability, Skills to navigate tough times can be verified from past falls and then the time company took to make an all time high.

On an average,

Wipro makes a new all time high in 31 months, even after worst crash maximum time it took was 42 months during year 2015 fall.

Recovery from 50% drawdown is equivalent to 100% return from current price.

If not 1 year (12 months) , then it should give 100% returns in 3 years (36 months)

I believe you are convinced that we know what we are talking about. We are Regulator licensed Investment Advisors. In India the market regulator is called Securities And Exchange Board of India (SEBI)

So, Before you jump the gun and decide to buy Wipro after reading this post so far… let me tell you why this awesome info is of no use to you, unless someone like me manages your money.

Full form of wipro ? Western India Palm Refined Oil Limited You never knew this before.

Now, if you were going to take the decision to invest your hard earned money, without even knowing the basic name of wipro, that was not commonsense. Right?

Let us assume you are smart enough to do your own due diligence and then decide about investing in Wipro.

Finally the moment of investing arrives.

The question is, can you invest atleast 1 years’s income into wipro …even after all that hard work?

If Wipro doubles as we expect, you will end up earning 1 additional year’s income. But will 1 year’s extra income make any change to your financial needle? I don’t think so.

Is it possible to find another such opportunity like Wipro again at will? I hope you have seen enough life to know, A man gets such jackpots just 4-5 times in entire life.

What we propose is, to hire me. Let me be your licensed investment advisor. We dedicate the needed time and monitor your portfolio with hawk’s eye. You pay us 10 thousand for every 1 lakh you earn. A fair 10% fee structure. You win first, Then we win model.

More about me click quora profile

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Did you know this, Nifty Index can never go to zero. Even if reliance or TCS goes to zero, nifty won’t go to zero. Reliance

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.