What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

In year 2012 , while reading a Facebook comment intrigued me. The person made a statement, HDFCBANK doubles every 4 years.

Well, India lost in the semi finals of the 2019 world-cup. No matter what actions you take, one must wait until 2023 for another chance to claim the world-cup.

My profile would hint that we are in the profession of wealth creation, for Demat account holders. We buy HDFCBANK like crazy for all our investors in their own Demat account. Then, unlike mutual funds , an demat account owner can collateralize this equity holding inorder to generate 20 % additional return per annum, from derivatives strategy.

If you invest a certain capital today and exit the investment during next world cup?

4 years down the lane, HDFCBANK has been giving more than 100% returns since 1999 world cup.

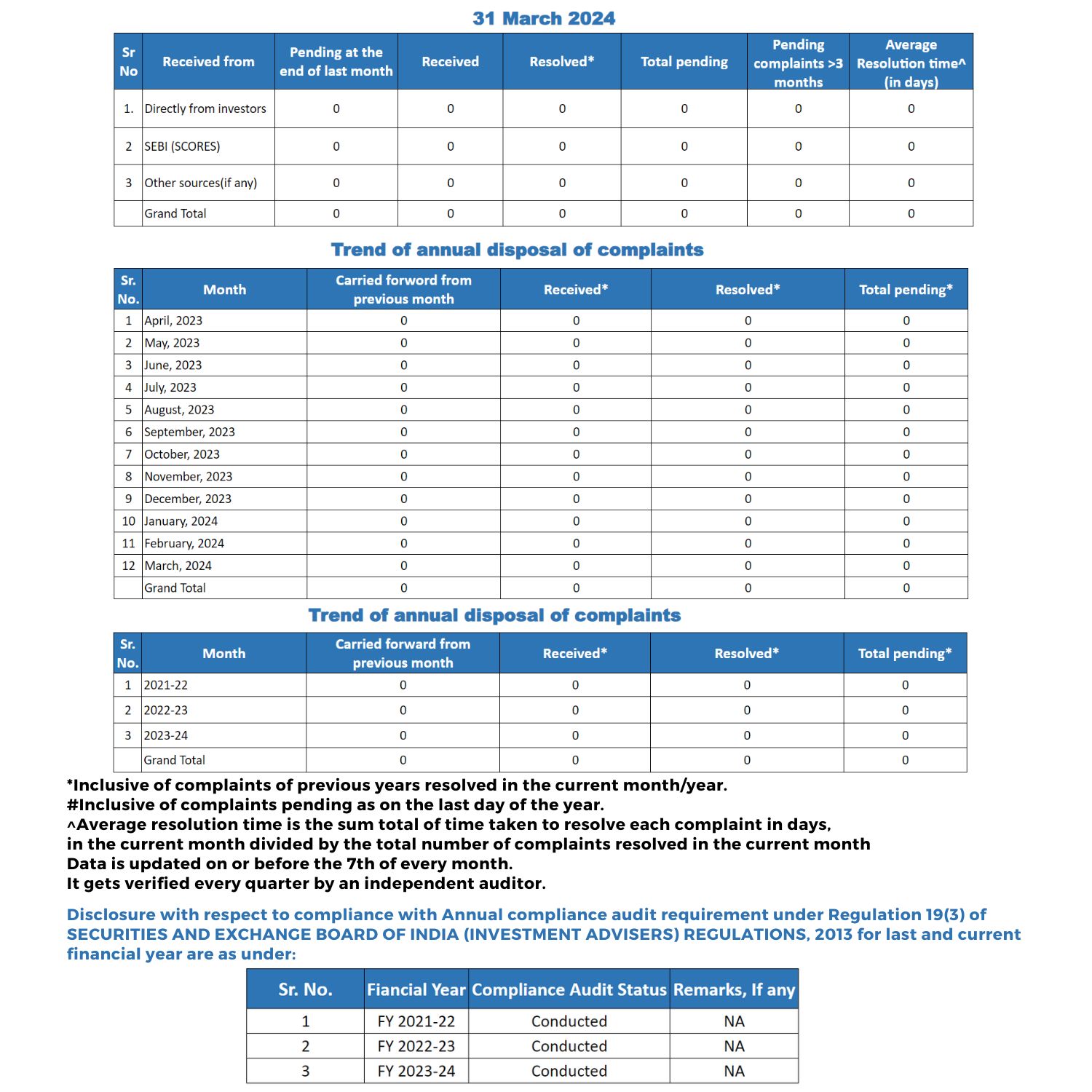

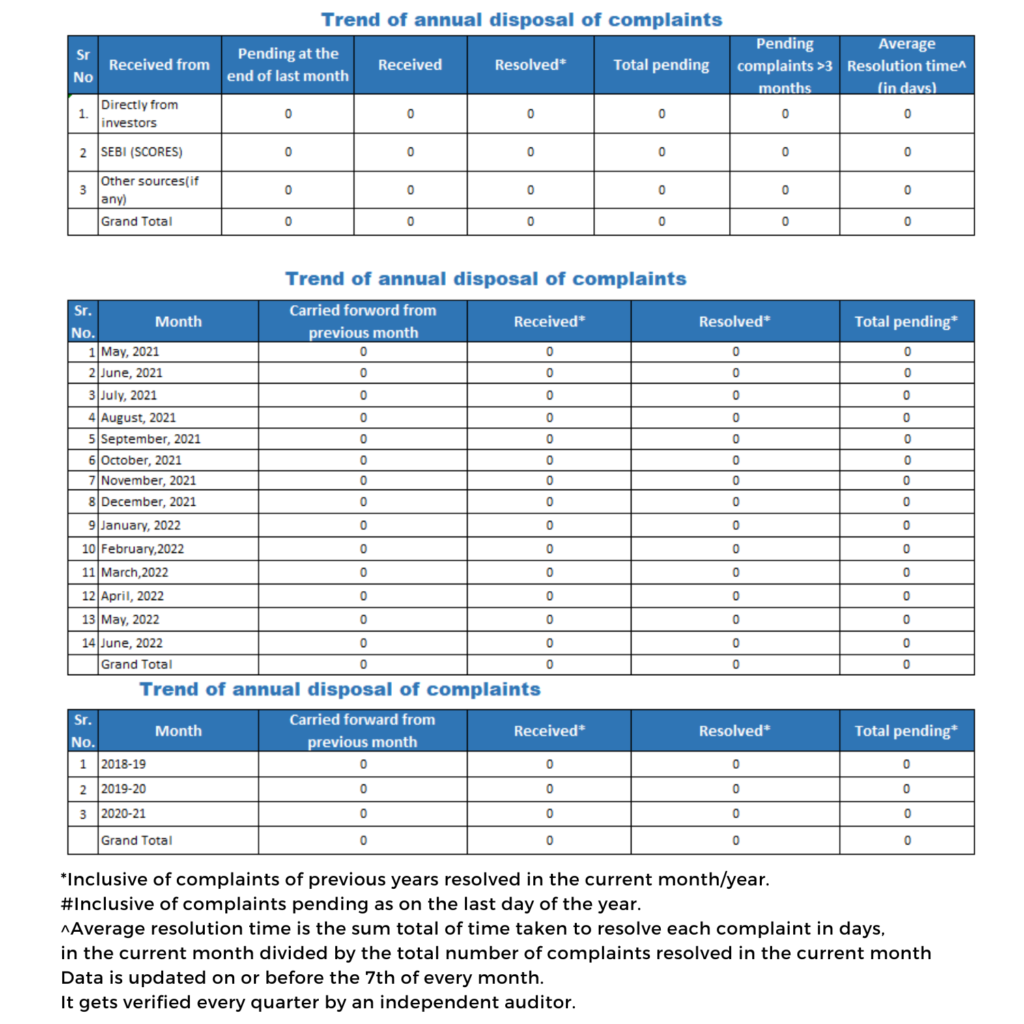

The above table shows ; what was the stock price of HDFCBANK as on January 1st of each year when world cup was conducted.

Evidently, every 4 years, HDFCBANK is a doubler of wealth. To grasp the seriousness of this , lets talk this in terms of rupees.

Lets assume your Dad invested 1 lac in HDFCBANK in year 1999.

Its been 5 world cups & 20 years since 1999.

That 1 lac invested in 1999 is worth 1.92 crore today.

Am in this journey of investment in HDFCBANK since 2013 .Accumulating & Parking alot of my own capital into HDFCBANK.

We all are aware , investing in stocks is not a game of guarantee. Forecasting price action usually seems like an act of foolishness. However, against the odds, we would like to make a forecast for next world cup of 2023.

HDFCBANK is worth 6.52 Lac crore as on date of this post. If we are right, in next 4 years, HDFCBANK will be worth 13 Lac crore.

If you are upset that India lost 2019 world cup. I am sure our players cannot do anything but wait next 4 years for another chance.

Meanwhile why don’t you ensure your Networth is double of what it is today?

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.