Comparison with other Investment Options

| Instrument | Principal Protection | Liquidity | Market Risk | Credit Risk | Potential of Maximizing Return |

|---|---|---|---|---|---|

| Recession Beater | Available | Low | Low | Low | High |

| Bank Fixed Deposits | Yes | Medium/High | None | Low | Low |

| Mutual Funds | No | High | Medium/High | None | High |

| Direct Equity | No | High | High | None | High |

| Derivatives | No | High | Very High | None | High |

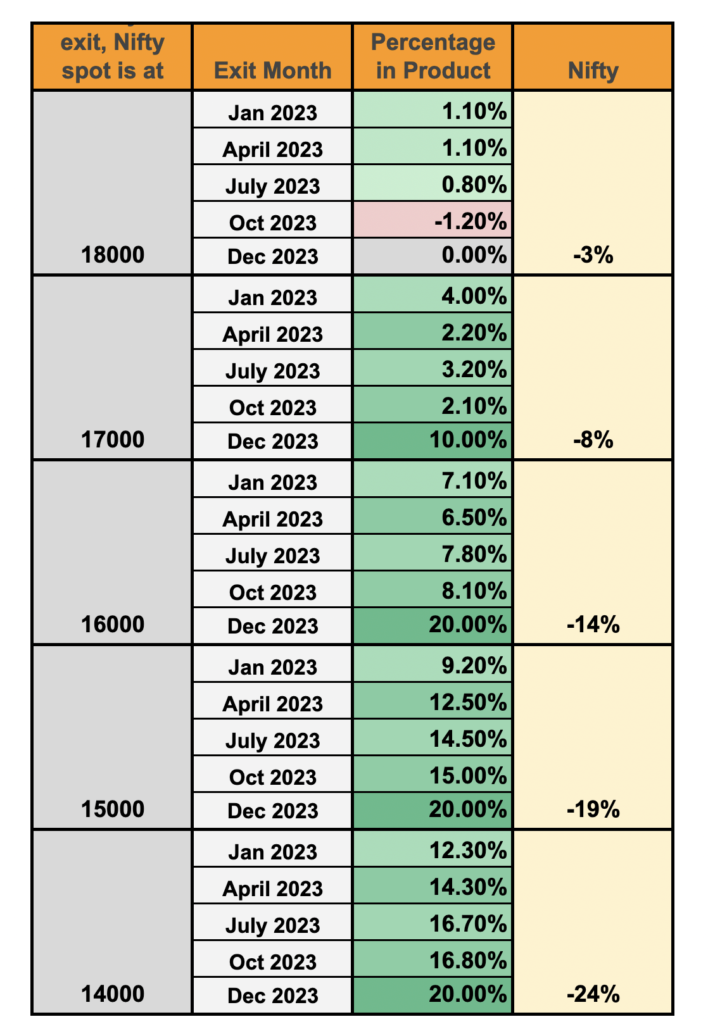

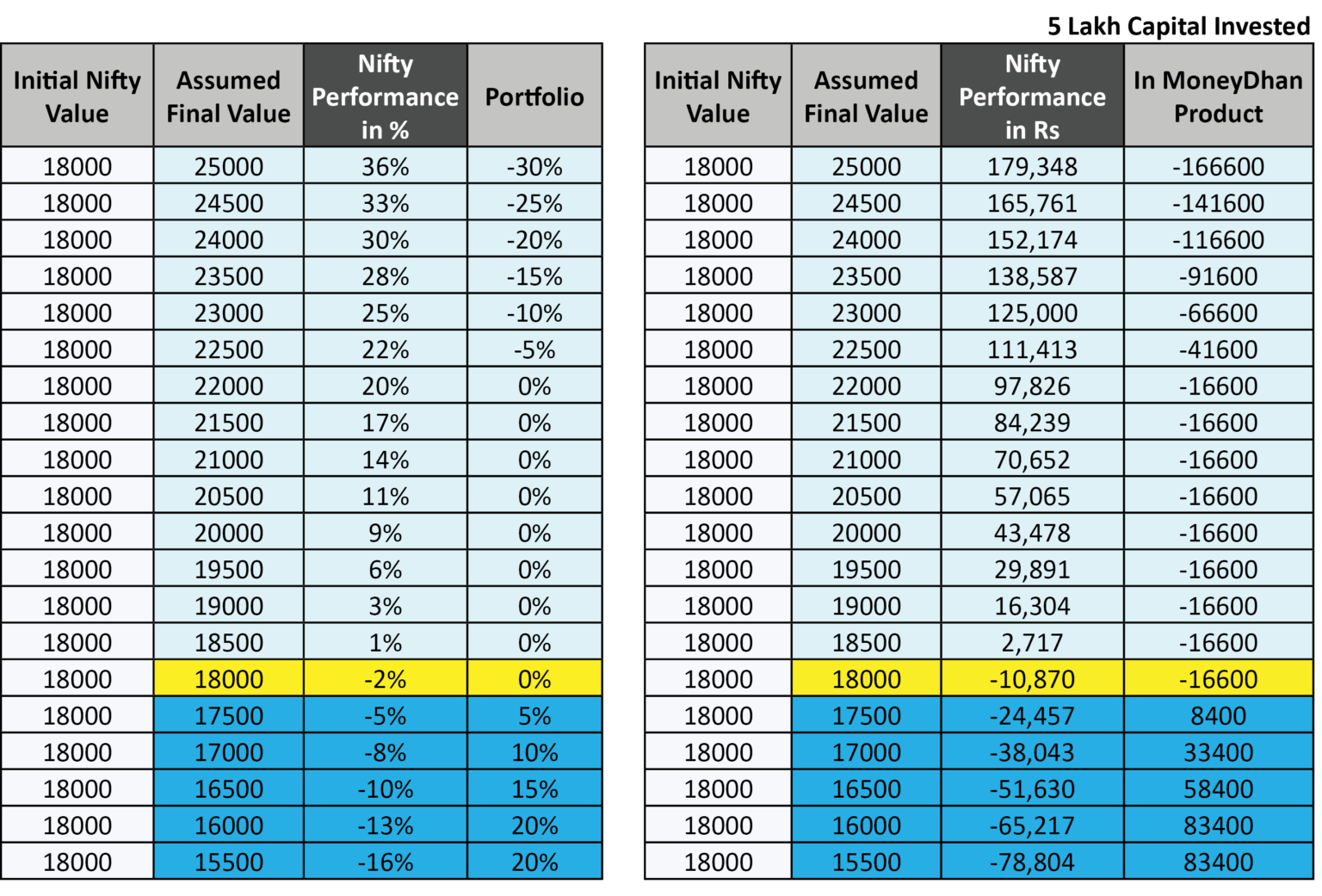

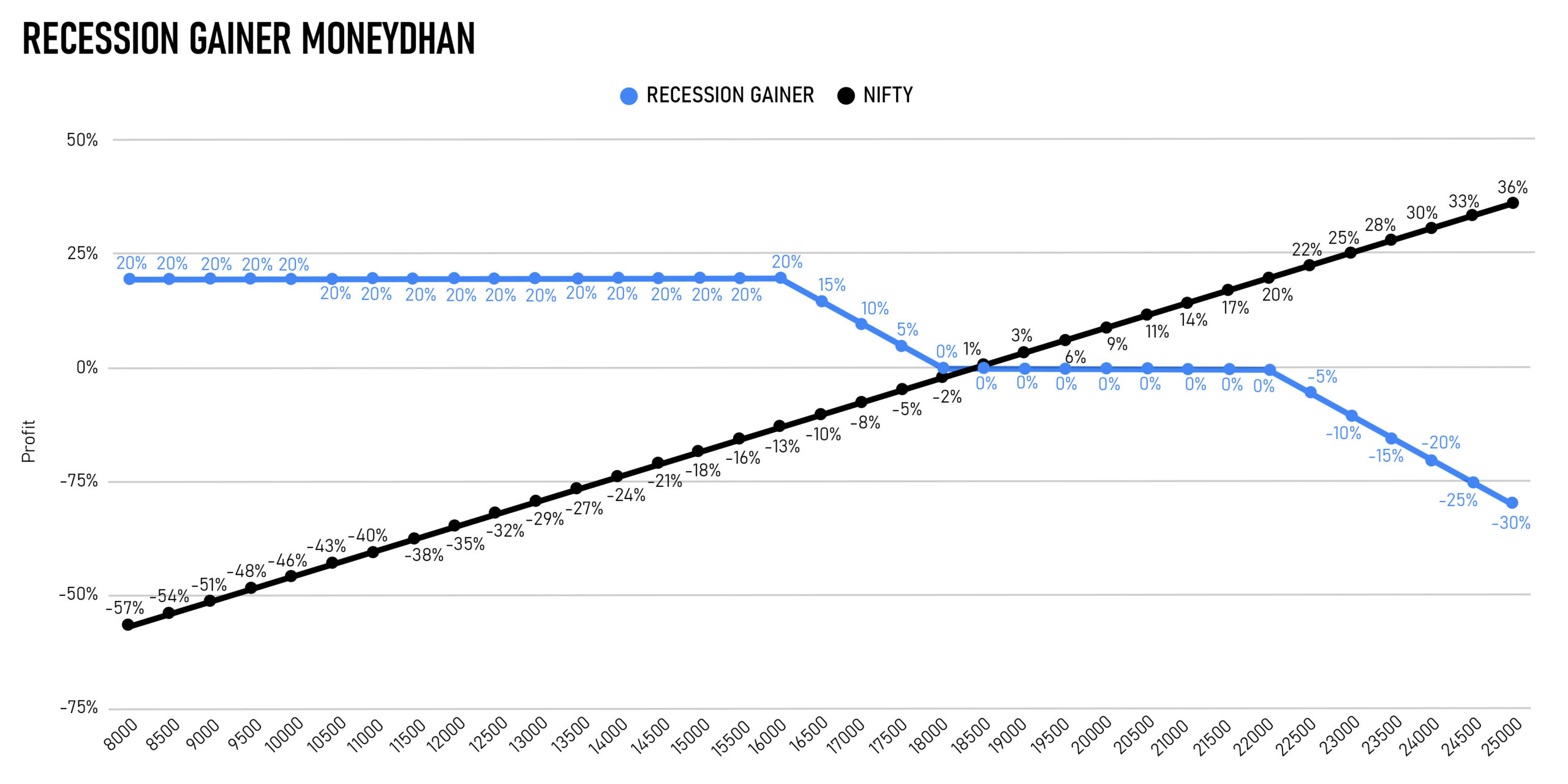

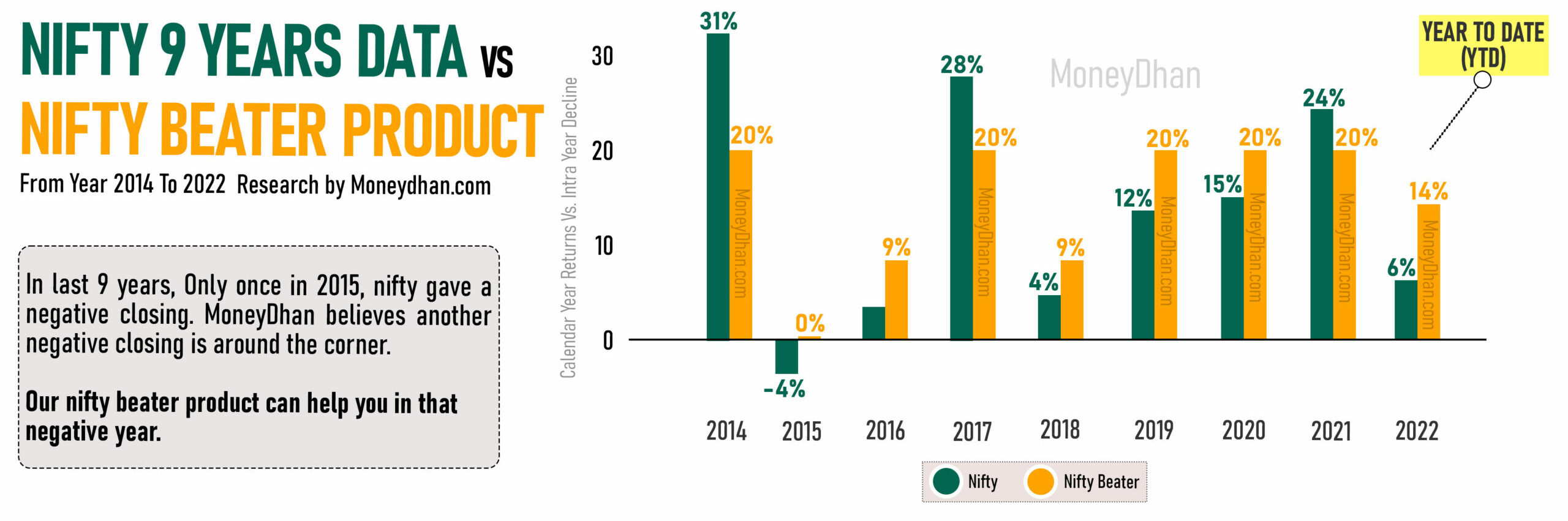

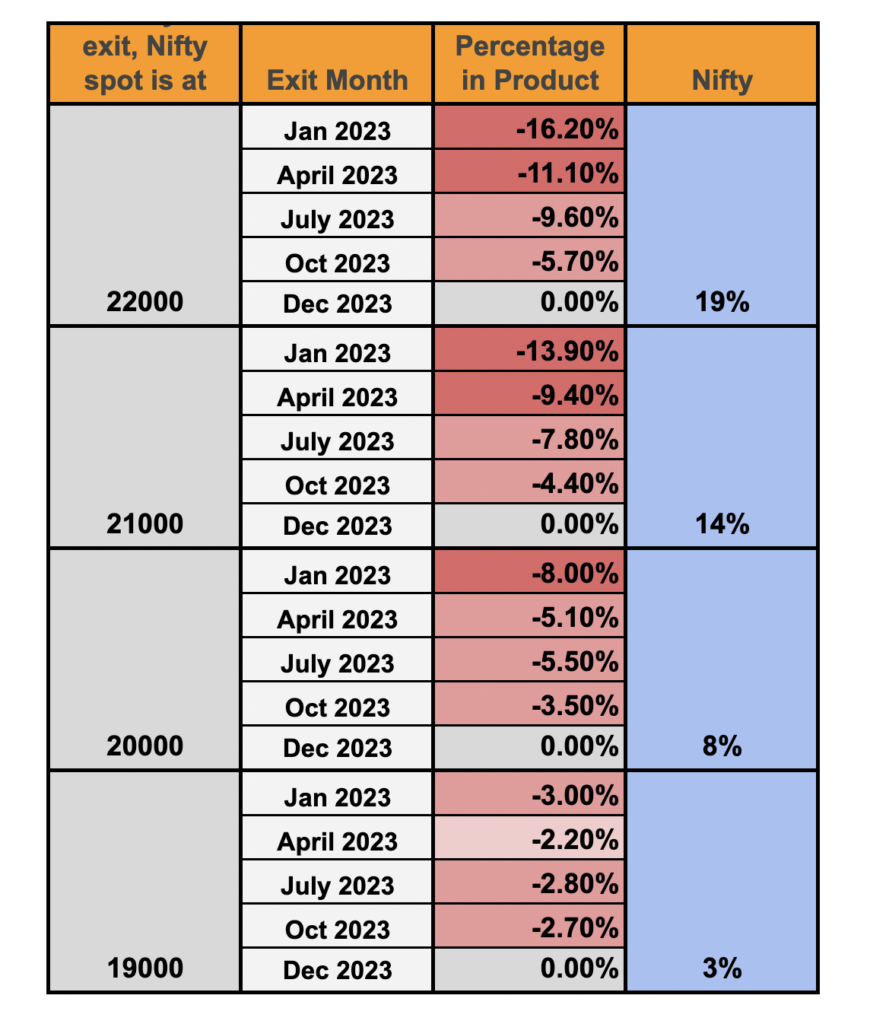

Quarterly profit payout image when nifty goes up and the recession gainer will have loss.

Quarterly profit payout image when nifty goes up and the recession gainer will have loss.