What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

There is a boy in the class who performs quite well on internal assessments. During that time his bragging is on the next level. We are happy with his performance for those short term. The only issue is that, he has been studying in the same class for the past 7 years! Confused?

There is a clear explanation, he keeps failing the annual examinations. LOL

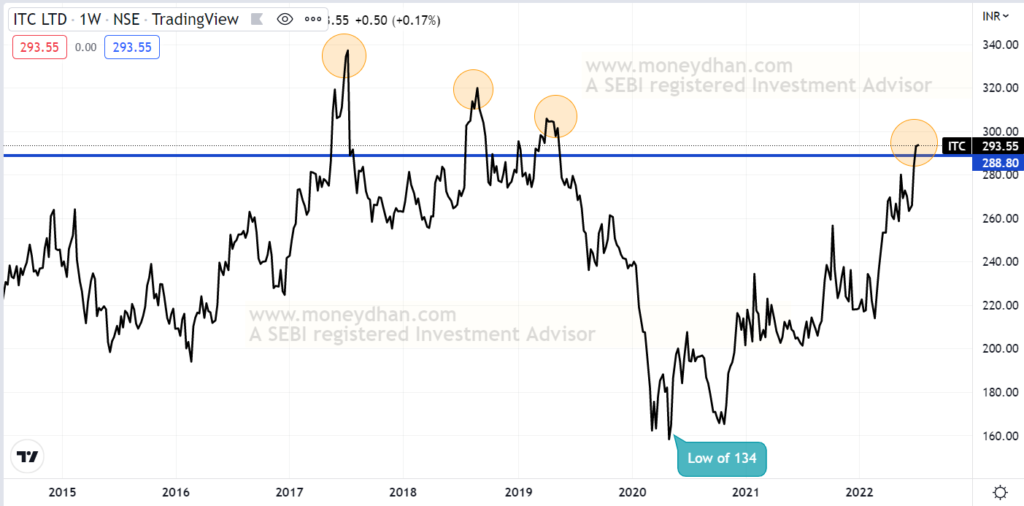

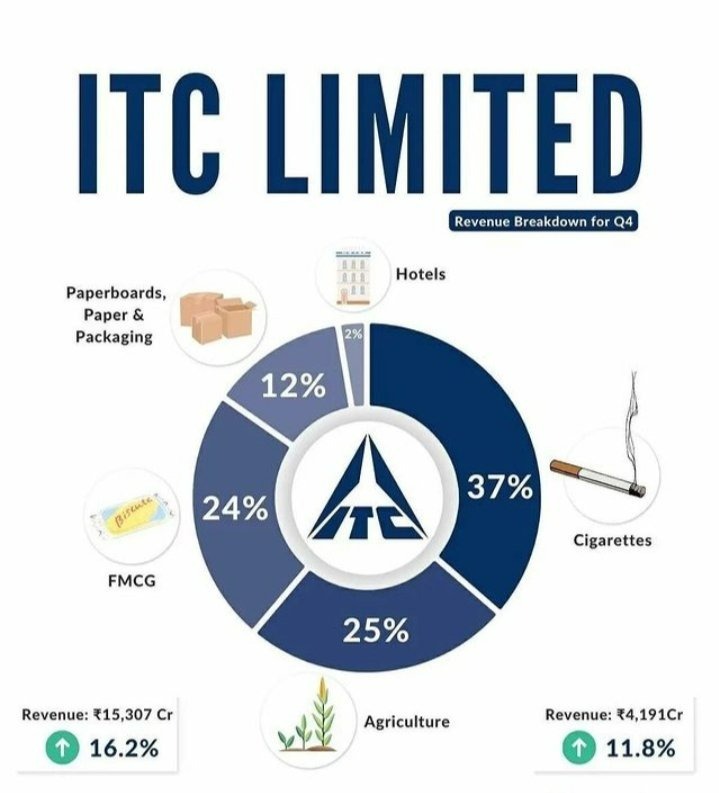

In just 4 months, ITC soars from 210 to 290. It is 4th time now that, ITC has breached this level (2017, 2018, 2019 & 2022}. With good mood of ITC is recovering, investor who bought in 2019 saw 134 i.e. more than 50% of bloodbath. Now he/she is relaxed because loss is recovered.

Let us examine how this increase of more than 35% ( since Feb 2022 till July 2022 , 5 months) still doesn’t convince smart investors, who seek value for money. A typical investor looks at his or her portfolio over a period of 5 to 6 years. The ultimate goal is to obtain an extra pie, more than Bank Fixed Deposit. Since you took risk in stock and not Bank FD, you should ask better returns than Fixed Deposit. right?

Benchmark returns are usually at a CAGR of around 10%. (Bank FD 6% + extra 4 %).

Extra 4% for the risk taken, by ditching Bank FD which gives 6%.

Previously, People expected 12% from nifty (benchmark) when FD was 8% (8+4 = 12%). At present, Now be happy with 10% CAGR since FD returns fell from 8% to 6 %.

With those kind of yields, 100 rupees should become 160, in Nifty after 5 years, at expected 10% CAGR.

Check the below image,

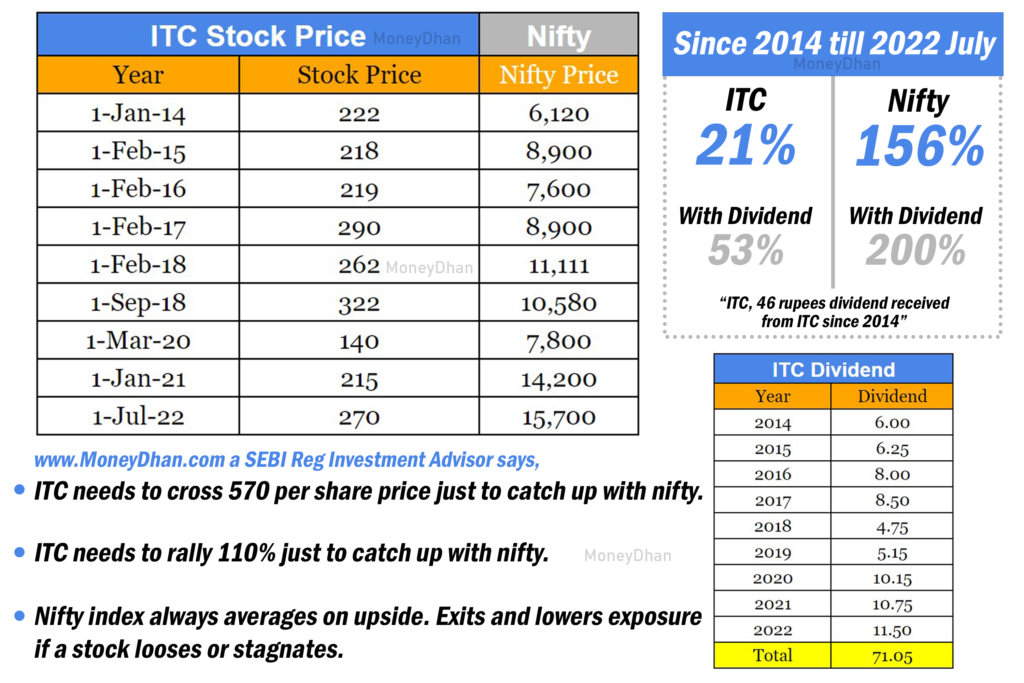

ITC has been able to provide just 21% in absolute terms (not CAGR). Price of 270 today with respect to, price of 222 as on year 2014. Also add, Dividend. This bumps the returns from 21% to 53% (Rs 71 dividend by stock price of 222 per share) returns.

But Nifty, the boring benchmark provided you with a returns of 200% since 2014, including dividends. ( 6000 became 15700). ITC gave just 53%, don’t forget.

If I were to translate this into monetary terms for you; A 1 lakh capital in ITC, in year 2014, became rupees 1,53,000 by 2022. While during same time, 1 lakh in nifty became 3,00,000 Rs.

A single company gave you 53,000 profit while a gang of 50 companies combined gave you 1,56,000 profit. The gang was safer in comparison to single stock. Even if you took higher risk with a single company like ITC, you didn’t earn enough to justify the risk you volunteered. YES?

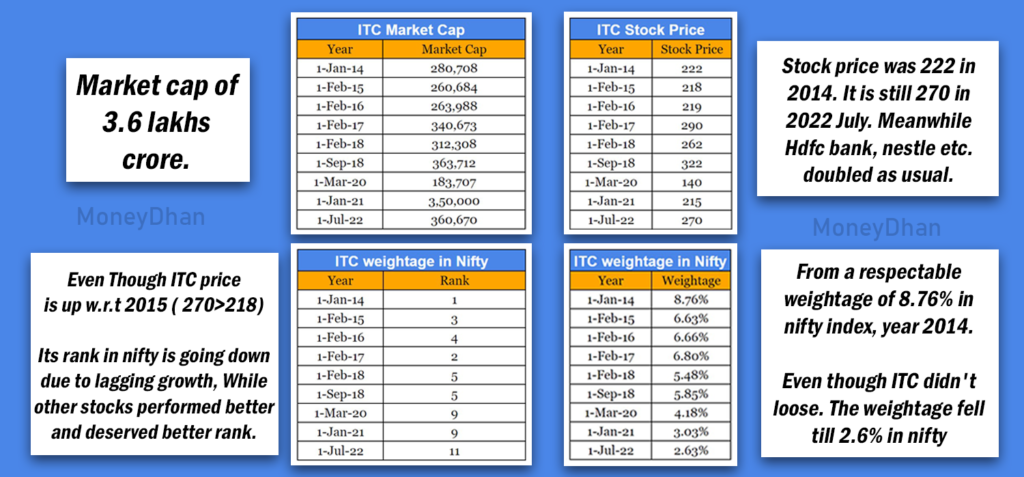

ITC’s appeal in the Nifty constituents is eroding year over year. Nifty is made up of 50 top companies in India. ITC held the top spot in the Nifty constituents for the year 2014. (Rank 1 , in image) By year 2022, ITC is no longer among the top 10 firms.

Nifty has a algorithm where only performing companies gets promoted in weightage and rank. If you are lagging behind, nifty pushes you down the weightage list. Nifty makes sure that, your money chases the best performers and reduces exposure to lagging stocks.

Previously in year 2014, around 9% of nifty’s movement was attributed to ITC. Now in 2022, its just 2.63%

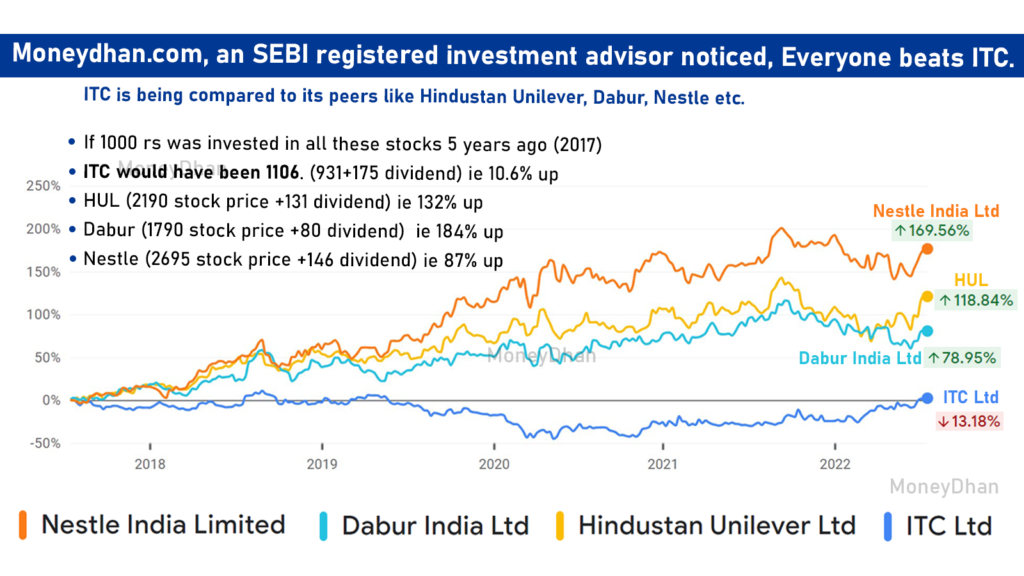

ITC is being compared to its peers like Hindustan Unilever, Dabur, Nestle etc.

If 1000 rs was invested in all these stocks 5 years ago (2017) ITC would have been 1106. (931+175 dividend)

You can argue this as small profit is better than loss, but what was the opportunity cost ? HUL would have become 2180. Dabur would have become 1790. Nestle would have become 2170.

Companies are constantly subject to a changing market, dynamic forces, and competition. It is not worth the risk, if you treat any stock similar to Fixed deposit. Because of huge dividend payout.

Challenge now is that, ITC needs a rally of 110% to catch up with Nifty. ITC will beat Nifty if its share price crosses 540 per share immediately.

Nifty should stand here at 15700, while ITC shoots from 270 till 540 Rs per share, Just to equal with Nifty. This is one hell of a task at hand. Read, Halwa hain kya?

Meanwhile other FMCG peers are not here to sell vadapav. They will compete.

ITC declared in 2016 that it will not rely on the cigarette industry for future expansion. Returning to the FMCG industry means facing up against formidable rivals like Dabur and Nestle. companies that are already market leaders in their niche.

After killing the cash-cow which was unfortunately a “SIN” business. To change the image from a SIN company to ESG compliant company, ITC shot at their own leg. ESG stands for (Environmental Social and Governance).

Investor should question themselves now. Using cripples walking stick, can ITC still run and defeat the nifty. If not other peers who are light years ahead in returns ?

Company’s focus is on gaining goodwill image. Do not assume that a good image company will necessarily add value to stock Value.

At D street, return on investment is king. Goodwill is always secondary.

In defense of ITC, it is a good company with consistent Dividend. Drawdowns are unlikely with no bad news in sight. If anything, only good news can be there when its regarding ITC. You would never loose money with ITC, as long as current scenario.

Sujith ⚡ Investment Advisor SEBI

Whatsapp: http://wa.link/p3d57p

Twitter: @REALmoneydhan

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.