What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.

But inflation was never an issue since past 30 years.

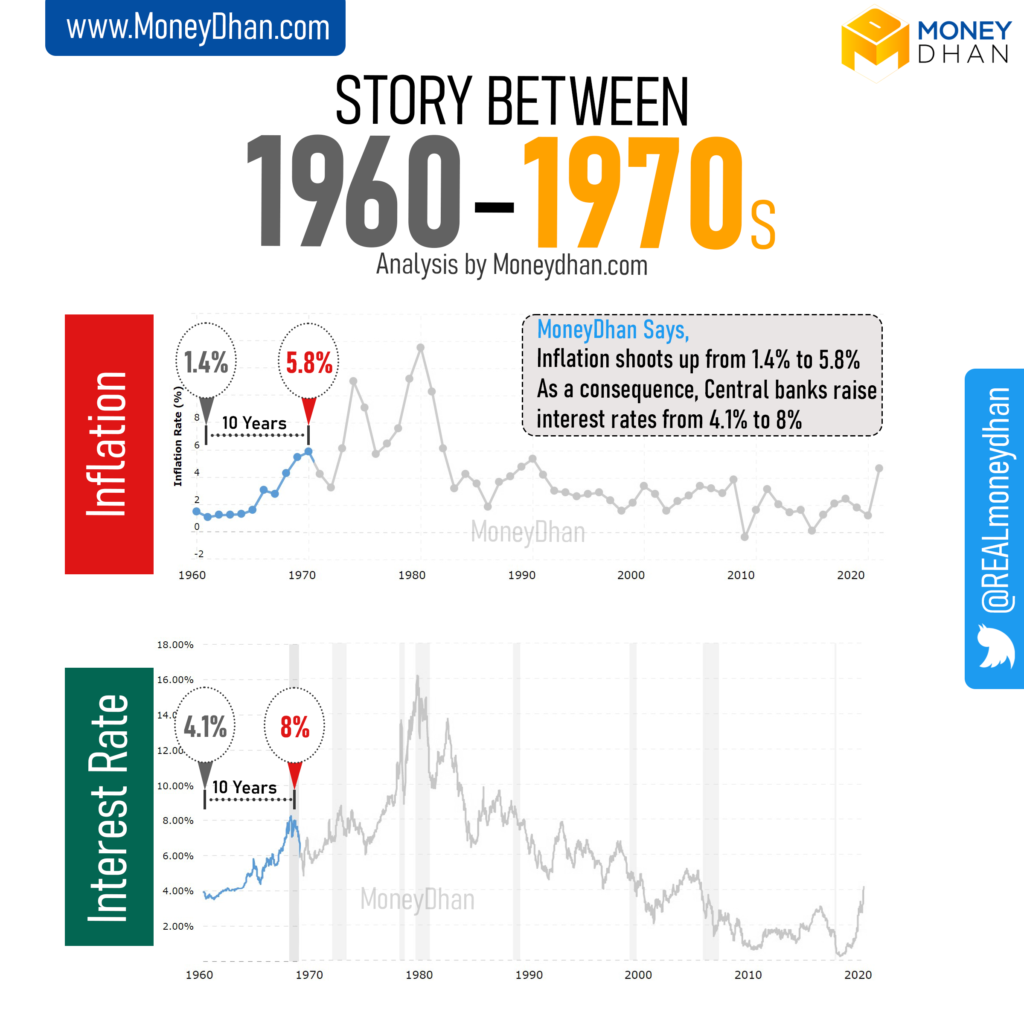

Inflation shoots up from 1.4% to 5.8% As a consequence, Central banks raise interest rates from 4.1% to 8% Inflation is a hint that, there is surplus money in the economy. Due to which, governments have to suck it out of the system. By increasing interest rates, people will bring this surplus money towards Bonds, Bank FDs etc. An stuck money ceases to exist.

Since money circulation reduces in the economy, inflation (rise in cost) gets manageably lower.

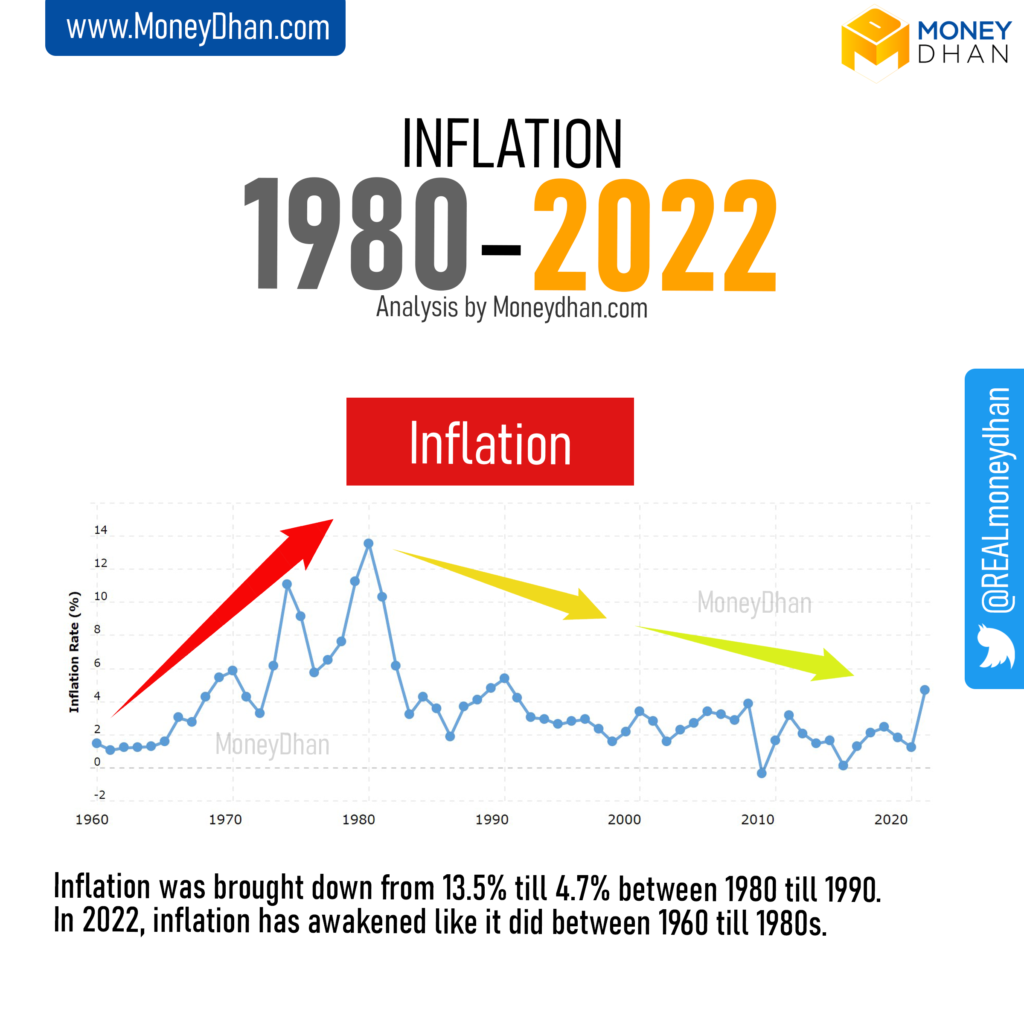

As you can see below, in 10 years, it was quiet tough to reduce inflation.

Did you notice how interest rates must stay above inflation to keep things under control?

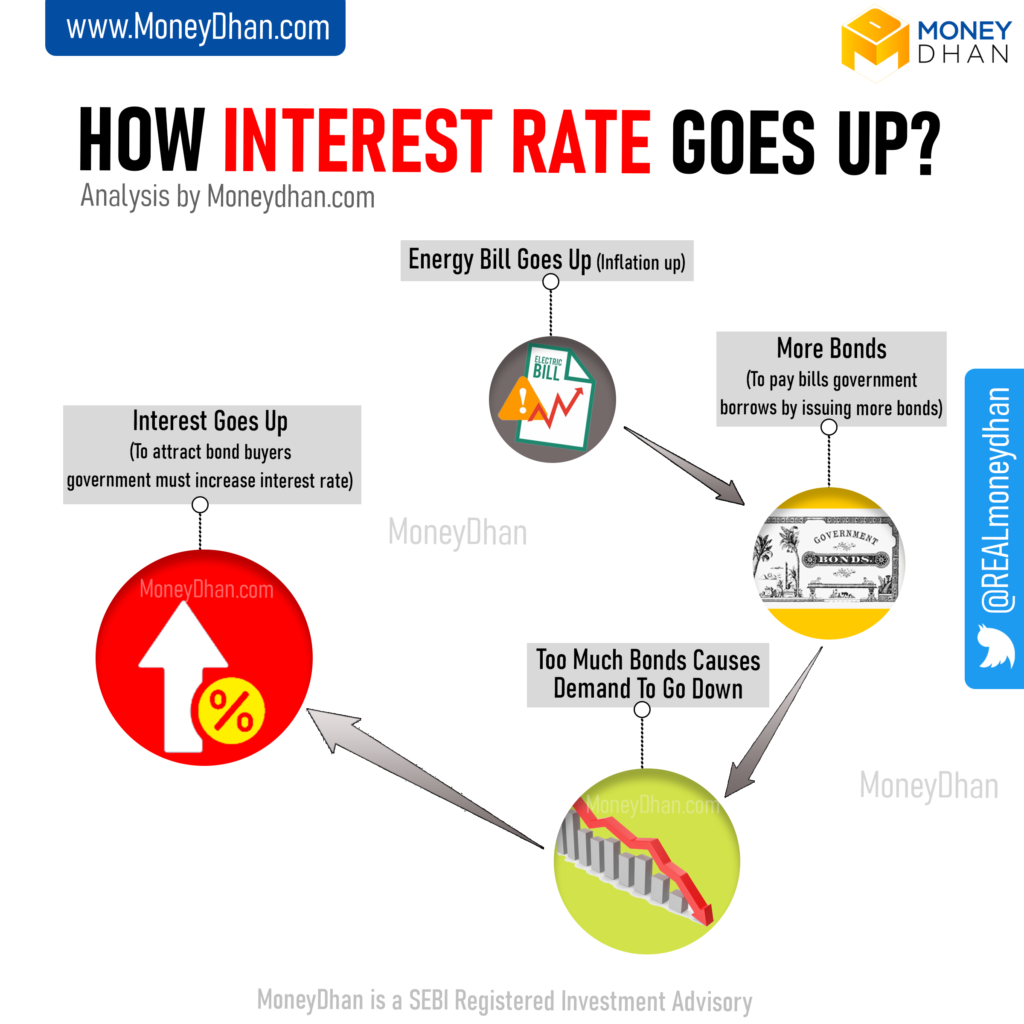

When the interest rate goes up, Bond prices fall. The below image will give a quick explanation.

Thanks to Russia, the energy bill is soaring in UK. This time inflation is in the form of energy bills. (Energy bills = Inflation)

Government is forced to pay huge premium for the usage of energy. To compensate for the increasing expenses, Government is in-turn forced to borrow more via bonds.

When you flood market with more bonds, the demand for government bonds go down. People hesitate to lend to government. When demand for bond goes down, in order to attract the investor, government has to raise interest rate. Make the deal sweeter. This is the cycle of direct cause and effect between Inflation & Interest rate.

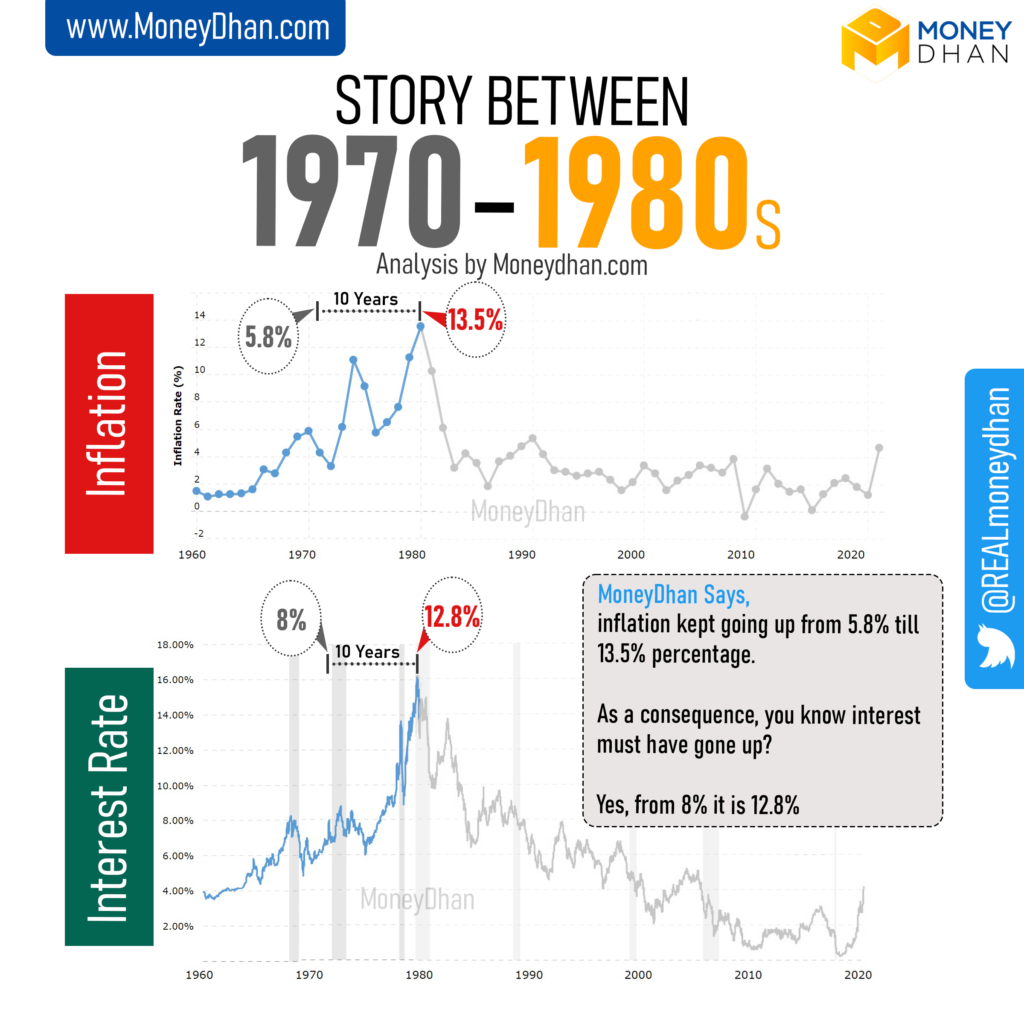

Inflation kept going up from 5.8% till 13.5% percentage.

As a consequence, you know interest must have gone up?

YES, from 8% it is 12.8%

Basically if you know your countries inflation, you can predict its interest rate.

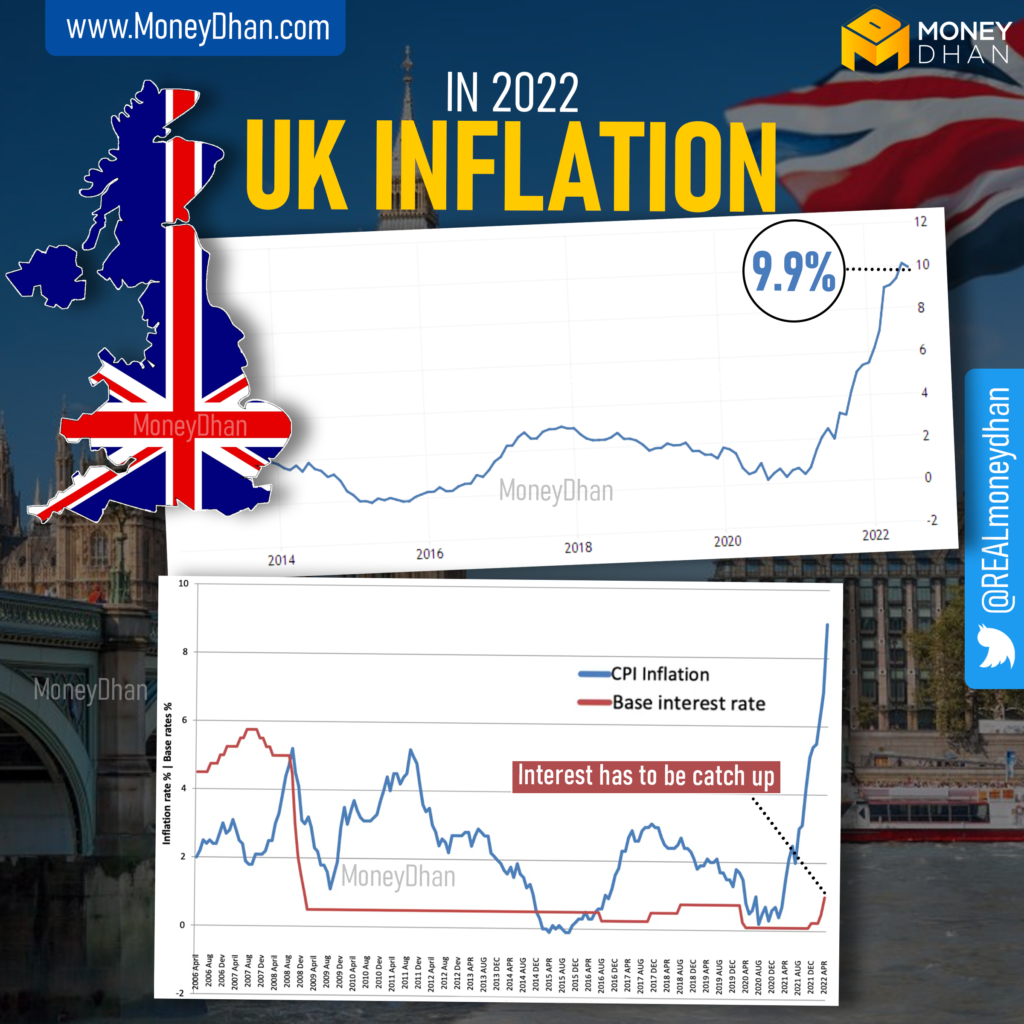

In 2022, Uk inflation is 9.9%

Now since you posses the ability to guess the interest rate in UK.

If inflation is 9.9%, interest should be 10% or above. But no, the interest rate is 2.5% and will be raised to 5% before December 2022.

In the above chart, the red line should be above blue line. If the red lines shoots up like the blue line, UK is pushed into a severe recession!

With higher interest, will any business grow in country?

Companies with loan must pay more as interest from their profit. This shrinks their profit margin. To protect this profits, can company raise price of products?

Probably no. Increased prices will push customers away and the sales volume will plummet.

It is a catch 22 situation for companies. Growing interest rate is an assurance of fall in profits.

Moreover, think about the customer who spends?

His home loan EMI is shooting up, Energy bills, food bills gone up. Budget is out of whack. Suddenly alot of middle class people are pushed to lower class. People drive less and take public transport more.

Eating out is limited to occasions. Vacation trip becomes luxury. Jobs are lost to recession too.

Inflation was brought down from 13.5% till 4.7% between 1980 till 1990. Since 1980, for past 40 years, inflation was a sleeping giant. It never bothers us.

An entire generation has grown up, without hearing what inflation is about. It is dangerous and how it can spoil decades of wealth creation.

Central banks did what they pleased with interest rate. And now, the inflation giant has awakened.

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Did you know this, Nifty Index can never go to zero. Even if reliance or TCS goes to zero, nifty won’t go to zero. Reliance

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.