What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

High Inflation has a gruesome potential to hurt the investor’s sentiments.

Macroeconomics phenomena have a direct impact on security markets. High Inflation is one such major macroeconomic phenomenon.

Did you know, that a pharma theme portfolio can be a savior, and can still hold its ground for an equity investor in such uncertain times.

“Aswathama hai a-pun, nahi marega”- well-structured pharma portfolio

Let’s briefly discuss these 3 phenomena and how it affects the pharma sector differently.

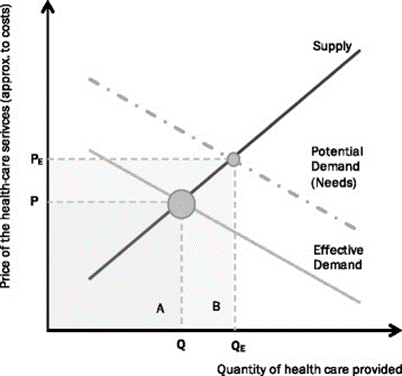

Inflation is a result of fluctuation between the demand and supply curve.

When inflation escalates equity investor gets worried about whether the corporate would be able to pass the cost input to its consumers or not; this inability to pass on will affect the margins.

The answer to this apprehension is that, branded generic medicines manage to transfer the pricing pressure to their consumers.

Pharma company brand protects the pricing level, and acts as a hedge in the long run, unlike the commodity market where low-cost pricing attracts more consumers.

for example, let’s take crocin advanced tablets, fifteen years back one strip cost would 15 rupees and today its market price is 35 rupees.

When you get a fever you would still buy the brand, but you won’t go for unbranded alternatives.

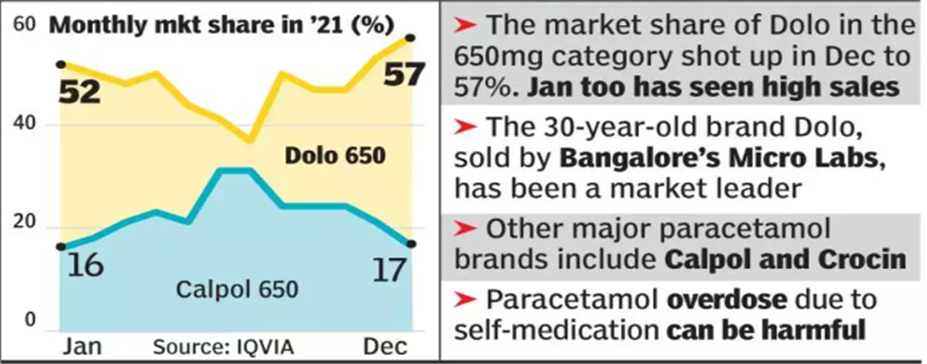

Let’s take paracetamol, as case dolo 65 is 30 rupees per strip while capitol( a paracetamol brand) is 18 rupees per strip despite price difference dolo 65 is the market leader.

This shows us, higher price doesn’t mean lower volume and vice versa in this market. It is all about the brand power and reputation they have gained.

Healthcare in India still comes under price inelastic and non-discretionary consumption. In other words, these are expenses that are not considered a daily necessity but treated as contingency needs.

Another example of understanding this is a hospital, consumers don’t demand medical services because it is cheap but their top priority is undoubtedly the quality of services, quick recovery period, and minimized risk factors.

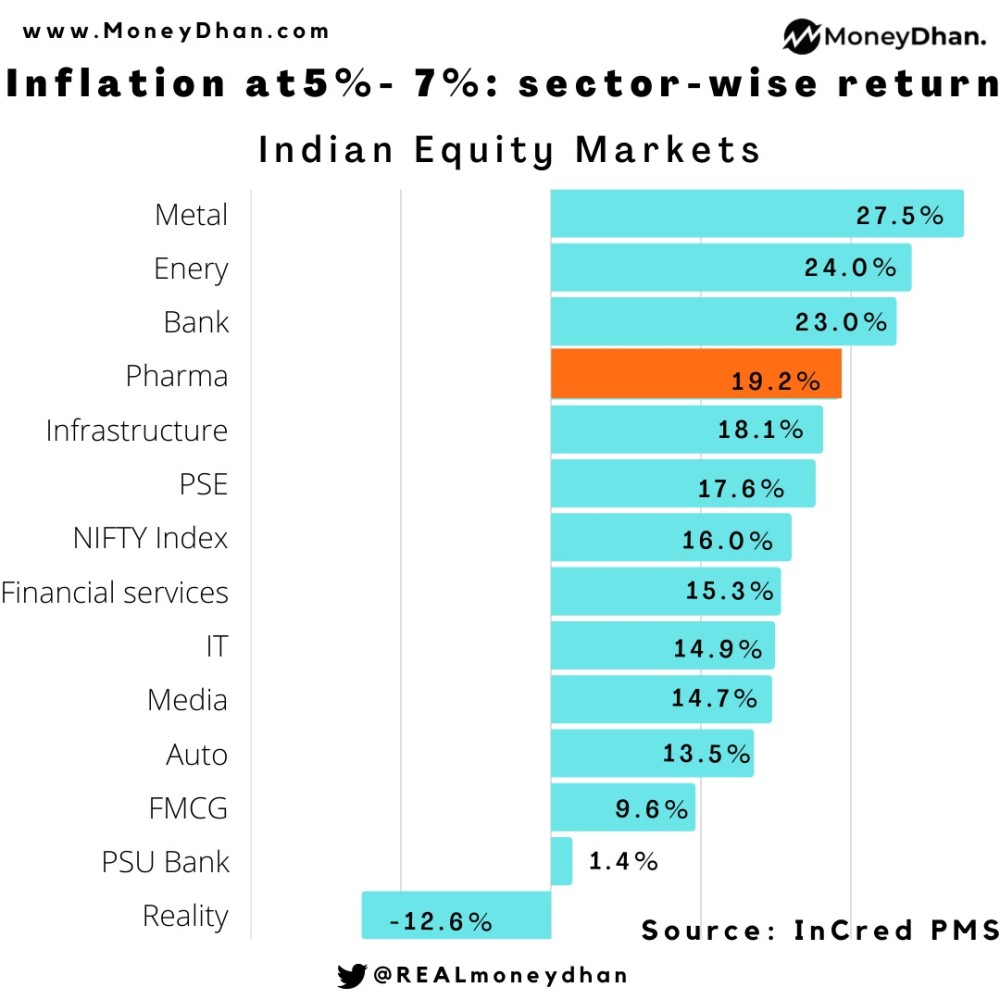

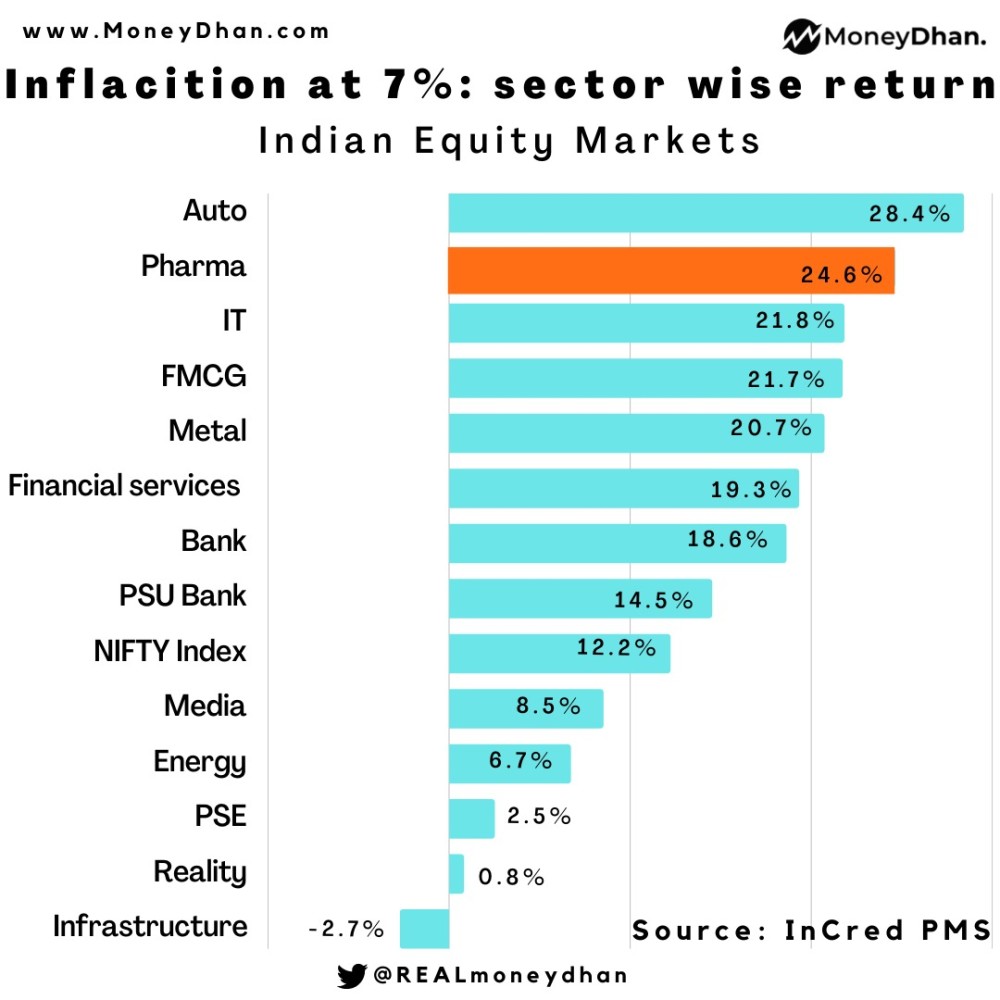

When Inflation was manageable and between 5-7%, Pharma sector gave a positive return of 19%.

But with higher inflation above 7%, when other sectors god weak in performance. Pharma could go to 24% CAGR.

Therefore this sector goes hand in hand with inflation, it sort of works around it and we can pass the prices directly to the consumers with the help of the reputation of the product and its longevity in the market.

when interest rates hikes,

a) the money supply in the market gets tighter,

b) cash flows suffers,

c) balance sheet suffers.

d) the amount of money that consumers can spend decreases.

Hence consumer demand decreases and eventually, businesses’ revenues and profits decrease.

With Higher Interest rate, It becomes more expensive for companies to raise capital.

They have to pay higher interest rates on the bonds they issue, and it becomes quite a difficult task to raise capital for growth prospects.

Profits tend to follow a downward trend ( at high interest rate scenario), businesses are not only impacted by higher borrowing costs but, are also exposed to the adverse effects of lagging consumer demand.

In addition to this due to this macro-economic factor, investment in equities can be viewed as too risky when compared to other investments. FII are selling non-stop for last 9 months in indian markets.

All these factors can weigh on earnings and stock prices.

Moneydhan, sebi RIA did its research to find out a hidden detail.

In the healthcare portfolio, the debt to equity ratio is 0.02 which again insulates the portfolio from the rising cost of debt and hence doesn’t impact the performance

Demand destruction is a sustained decline in demand for a product due to excessively high price or limited supply. Because of persistently high prices, consumers may decide it is not worth purchasing as much of that good or seek out alternatives.

Health is always a priority so no matter what the price it still doesn’t limit the consumer demand as mentioned earlier India is still exposed to non-discretionary consumption, we visit doctors when we fall ill not on the daily basis, and we are still in a reactionary market hence demand destruction doesn’t impact the healthcare portfolio as it does to other stocks.

In the pandemic as well the demand for healthcare facilities was alarmingly high and supply was limited but still it didn’t lead to demand destruction as everyone follows the basic life motto “health is wealth” or “jaan hai toh jaahan hai”

These are the reasons which give the well-made healthcare portfolios an edge compared to other portfolios.

However the question arises; why this analysis and the factors weren’t able to convince the equity investors in recent years, especially in the pre-pandemic timeline?

In the last years, people kept looking at the healthcare index which is dominated by companies that are focused on unbranded generics where cost pressure can’t be passed on as the products can’t be differentiated.

There is no pricing power but the company’s other than these unbranded generics have performed well but went unnoticed

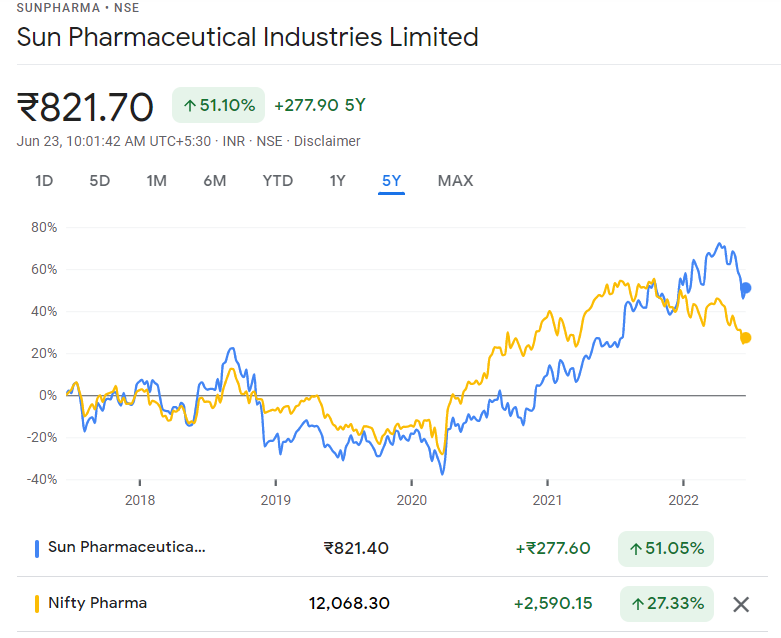

Let’s look at the image above.

Nifty pharma is made up of 20 companies. Only Sun Pharma has a market capitalization of more than one lakh crores, and there are two other companies ( Cipla and Dr. Reddy are above 50k crores).

Other mid-cap and small-cap companies account for the remaining 85 percent of pharma.

During a pandemic, the covid business bubble aided the growth of these small businesses. The returns on such stocks are similar to instant gratification. Pump and dump with ease.

Blue chip companies, on the other hand, require time and patience. When they rise, they stick to that level.

As the hype surrounding the covid business subsided, Sun Pharma began to outperform the index.

Historically also, Sector leaders have provided returns that are twice as high in a five-year time frame.

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.