What is the rich people’s investment strategy?

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Nifty50 (NSE index) is a bag that holds within the top 50 stocks of india, in terms of market capitalization (value of company) and liquidity (ease of buying or selling at will)

Once i told my friend that “ Nifty, it makes a new high every 3 years”

He was impressed and consequently he said, “Lets buy nifty then“

Now, i had to correct him. “ You cannot buy Nifty buddy. You can buy a ETF or Index MF to track it”

He stared at me for a while. He was a IT engineer. Out of no where, he asked, “ is it a good time to buy gold?”

I was like, “ yes ofcourse it always rises.”

He responded decisively,” okay then, i can buy gold, i will buy gold tomorrow.”

This, was a revelation for me. We all track sensex & nifty. News channels make a big news when there is a 1000 points fall or rally in sensex.

However in reao there is no “ sensex” or “nifty” which a common man can own. You need a ETF or MF ! Now good luck in explaining ETF or MF to a IT guy.

Nifty makes a new high every 3 years

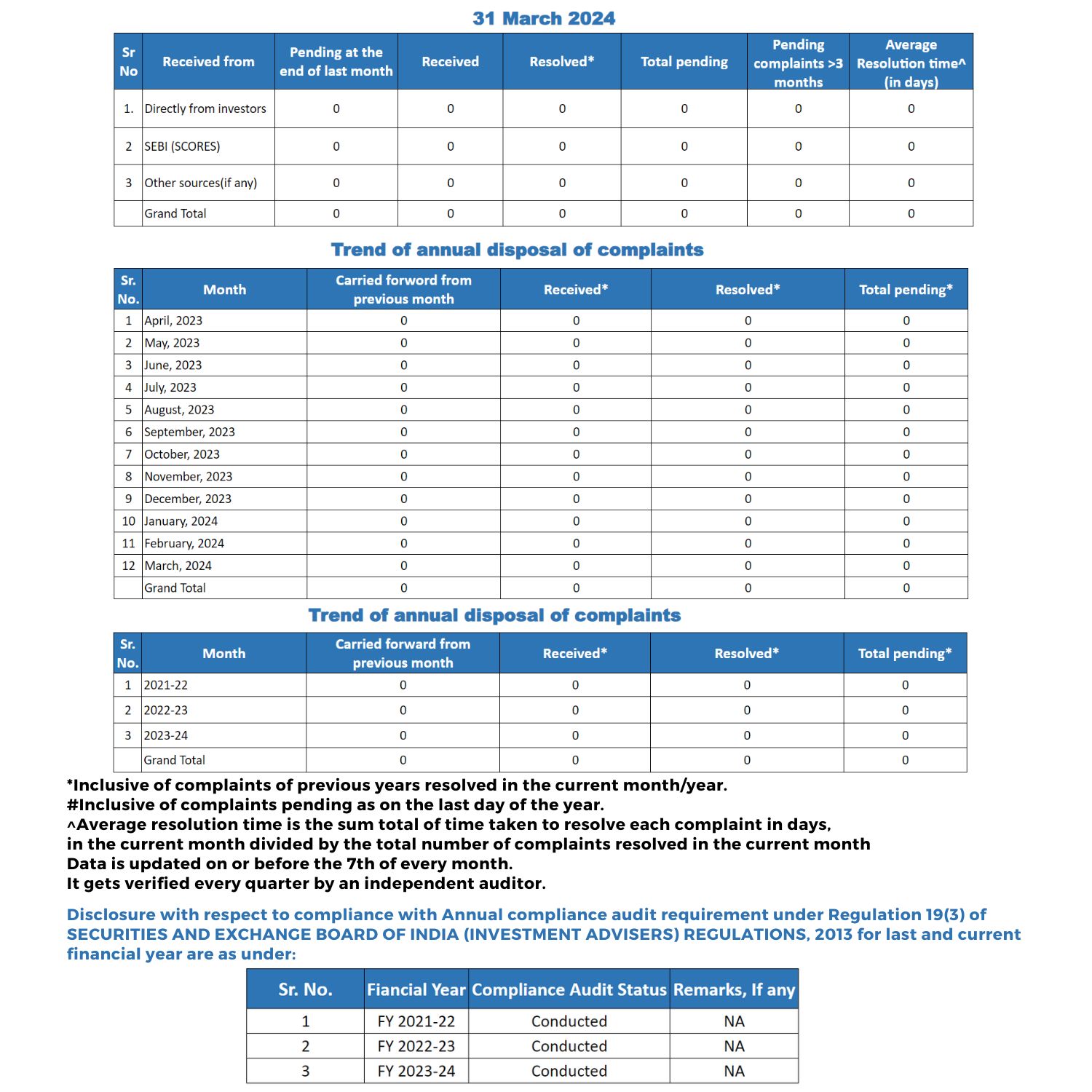

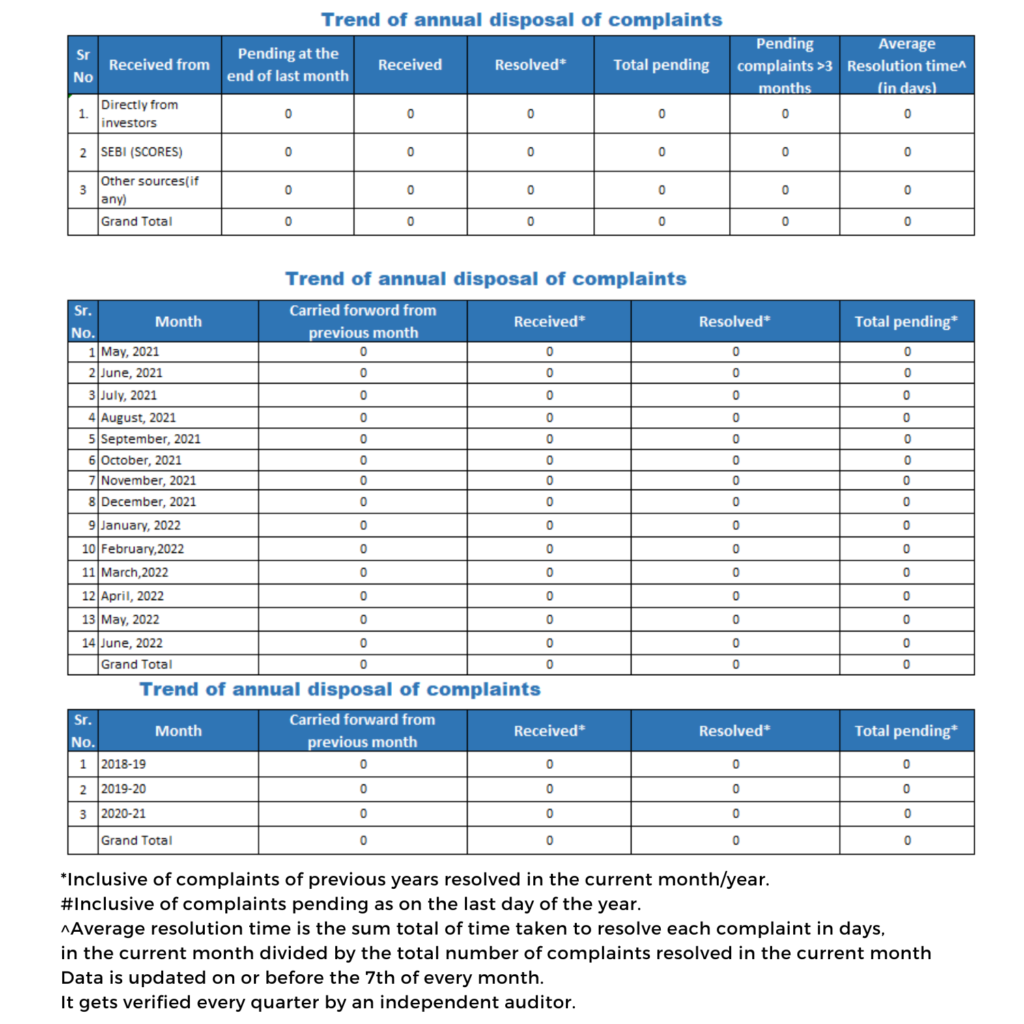

What are the idea from above data?

What is the best strategy for nifty?

In 2019 at the time of this answer, Nifty’s all time high is 12100.

At present, October 2019, Nifty is at 11100.

(12100–11100)/11100 = 9 % far from all time high.

Since we know by 2022, nifty will be atleast 12100 even in worst case. You can buy and accumulate nifty for this 10% gap covering.

Since we now know the appropriate approach and expected return from Large cap Nifty Index. Next would be to choose the vehicle in which, you would park the capital.

Active Management by a Fund manager has majorly under performed ETF which is not actively managed.

Active manager tries to outsmart the existing benchmark index. But this smart approach comes at a cost of higher Expense ratio. Every exit and re-purchase increases the transnational cost. The Tax gain factor rubs off the alpha advantage many a times.

When we invest with a actively Managed Mutual fund, we pay higher expense ratio. We hope for a good fund manager to beat the benchmark.

Surprisingly, in last 10 years, Just 43% of ELSS Tax saver MF has been able to beats it’s benchmark.

You have a large cap Mutual Fund?

Just 6 out of every 10 MF out performed its index.

In US, over past 35 years, the number of Actively Managed Mutual Funds that beat their respective Benchmark has dwindled even more. Learning from them, it;s highly possible that in next years your present MF under-performs the benchmarks.

You have a mid/small cap Mutual Fund?

Just 50% of the entire Mutual Funds that survive till date has beaten benchmark. Now that is a pure 50–50 chance when you pick a Mid cap MF scheme out so so many schemes.

Does this means ETF is better than Active Managed MF?

Answer is yes. ETF has outperformed Actively Managed MF just because of its low cost expenses. It has very less turn over of stocks which reduces the tax gains and the aligned brokerage costs etc.

Its like that fat guy who just ate and didn’t do much. Ultimately he over powered others.

Below is the list of ETFs available for nifty50.

National Stock Exchange of India Ltd. entire list of ETFs .

Out of this, UTI AMC ( the last one) has highest Asset Under Management. It manages 1500 crores. Expense ratio is 0.10% (direct) & 0.17% (regular)

So once again this ETF (red line) under-performs the black line (Benchmark) !

In nutshell both Actively Managed Index funds or ETFs under perfrom a becnhmark due to various add-on costs.

ETF under-performs less in comparison with Mutual funds. But then, some actively Managed MF beats the benchmarks big time.

ETF wont beat its own benchmark by big margin, unlike actively manage MF, if you happen to invest with the right Fund manager.

Bechmark beats both MF & ETF usually.

ETF beats MF when , active MF gets the move wrong.

Active MF outperforms Benchmark, when their move clicks as hoped by the fund manager.

Buy ETF & MF. Add more of those units whomever outperformes the other.

What would i do , with nifty?

Some day when 11000 nifty touches 12000, my 1000 points gains reflects as 75,000 rupees. This profit is against my down payment capital of 3 Lac. Say i spld that 8 Lac worth flat for 8.75 Lac at a gain of 75,000.

This 75,000/3,00,000 = 25 % returns while nifty went up just 10 %. Now you do know the importance of 25 % Don’t you !

Btech in Information Technology followed by an PG in Financial engineering & Risk Management from National Institute of Securities Markets. Certified Investment Advisor XB, FRM (USGARP) .

The nutshell of investment is how fast doubled your money and, what was the initial investment? A rich Guy before making any investment looks at

Introduction Let me give it straight to you. Today is October 2022. Wipro is 40% down from its all time high. I am going to

Inflation going up forces banks to raise interest rates. Higher interest rates causes bond prices to fall.But inflation was never an issue since past 30

It is not hidden from anyone that the IT sector is one of the most crucial sectors of the Indian industry as well as one

Post expense ratio and churning, Mutual Fund cannot achieve your financial goal.

60% of entire Mutual Fund Industry money is invested in just top 9 Nifty stocks. 10% goes to HDFC twins.

MF Direct Plan against expensive regular way

We are Zero Fixed fee. Buying Direct equity is close to zero cost nowadays. You can mimic MF via equity, for free.

50 Lakhs to Portfolio Management Service (PMS)

No minimum Balance with us. We can mimic the best PMS in market.

Giving Power of Attorney (POA) to anyone

Execute Yourself. We just provide you with advise and guidelines. No POA involved.

Every person is different. Let us not dis-respect your hard earned money with senseless automation.

We personalise our service for you.

We guide you via email. You can get the investment executed form your broker.

We do not touch your capital.

Moneydhan Investment Advisory India LLP

SEBI Registered Investment Advisers Registration No. INA200016193 (Type of Registration- Non-Individual, Validity of Registration- Perpetual)

7/433, Alumavunchodu, Thankalam, kothamangalam, kochi, Ernakulam, KERALA, INDIA – 686691

Contact No: 91 8480005564,

Email: sujith@moneydhan.com

Principal Officer: Mr. Hardeep Shantaram Korde, Contact No: 91 8480005564, Email: moneydhanadvisor@gmail.com

Warning: Investments in the securities market are subjected to market risks. Read all the related documents carefully before investing.

Disclaimer: Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.